Axie Infinity price upside potential limited as AXS struggles to tackle tough hurdles

- Axie Infinity price could see its rally hindered by various headwinds ahead.

- There are two key hurdles for AXS to overcome to target higher prices and revisit its all-time high.

- A major decline could be on the radar if Axie Infinity falls below $122

Axie Infinity price sees little hope of trending higher as a few obstacles emerged, prohibiting AXS from targeting bigger aspirations. The gaming token must hold above $122 to prevent a massive sell-off.

Axie Infinity price to confront key obstacles

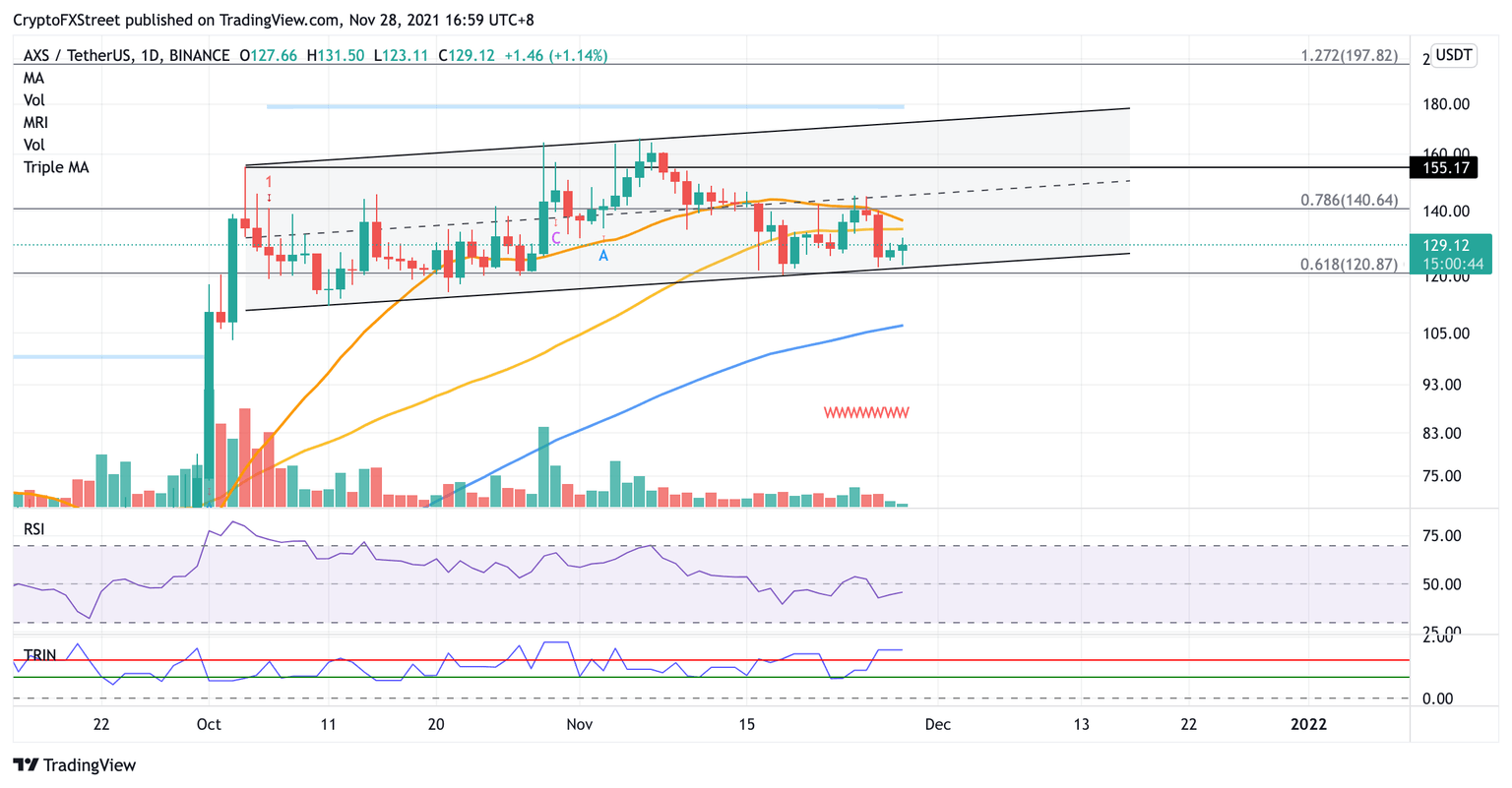

Axie Infinity price has formed a parallel channel on the daily chart, as it continued to consolidate since October 4. After AXS reached its all-time high at $165 on November 6, trading activity waned as the token tests the reliability of the lower boundary of the governing technical pattern.

The fact that Axie Infinity price has been able to hold above the downside trend line of the parallel channel as support at $122 suggests that AXS is unlikely to fall further, unless a catastrophic sell-off takes place. However, the token’s upside potential is severely limited unless it tackles several obstacles ahead.

Axie Infinity price sliced below the 21-day Simple Moving Average (SMA) on November 16 and the 50-day SMA on November 18, as AXS momentum weakened. The 50-day SMA at $133, and the 21-day SMA at $136 currently act as stiff resistance for the gaming token.

Another hurdle for Axie Infinity price may appear at the 78.6% Fibonacci retracement level at $140. Only if AXS is able to overcome the aforementioned challenges will the see token a rise toward the middle boundary of the prevailing chart pattern at $145.

An increase in buying pressure may push Axie Infinity price higher toward the October 4 high at $155.

AXS/USDT daily chart

If the bears continue to control the market, Axie Infinity price may discover its first line of defense at the lower boundary of the chart pattern at $122. Additional support may appear at the 61.8% Fibonacci retracement level at $120.

Although the two aforementioned support levels will act as meaning footholds for Axie Infinity price, a significant increase in sell orders may see AXS slide toward the 100-day SMA at $106.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.