Axie Infinity price to steepen its downtrend as AXS eyes 20% correction

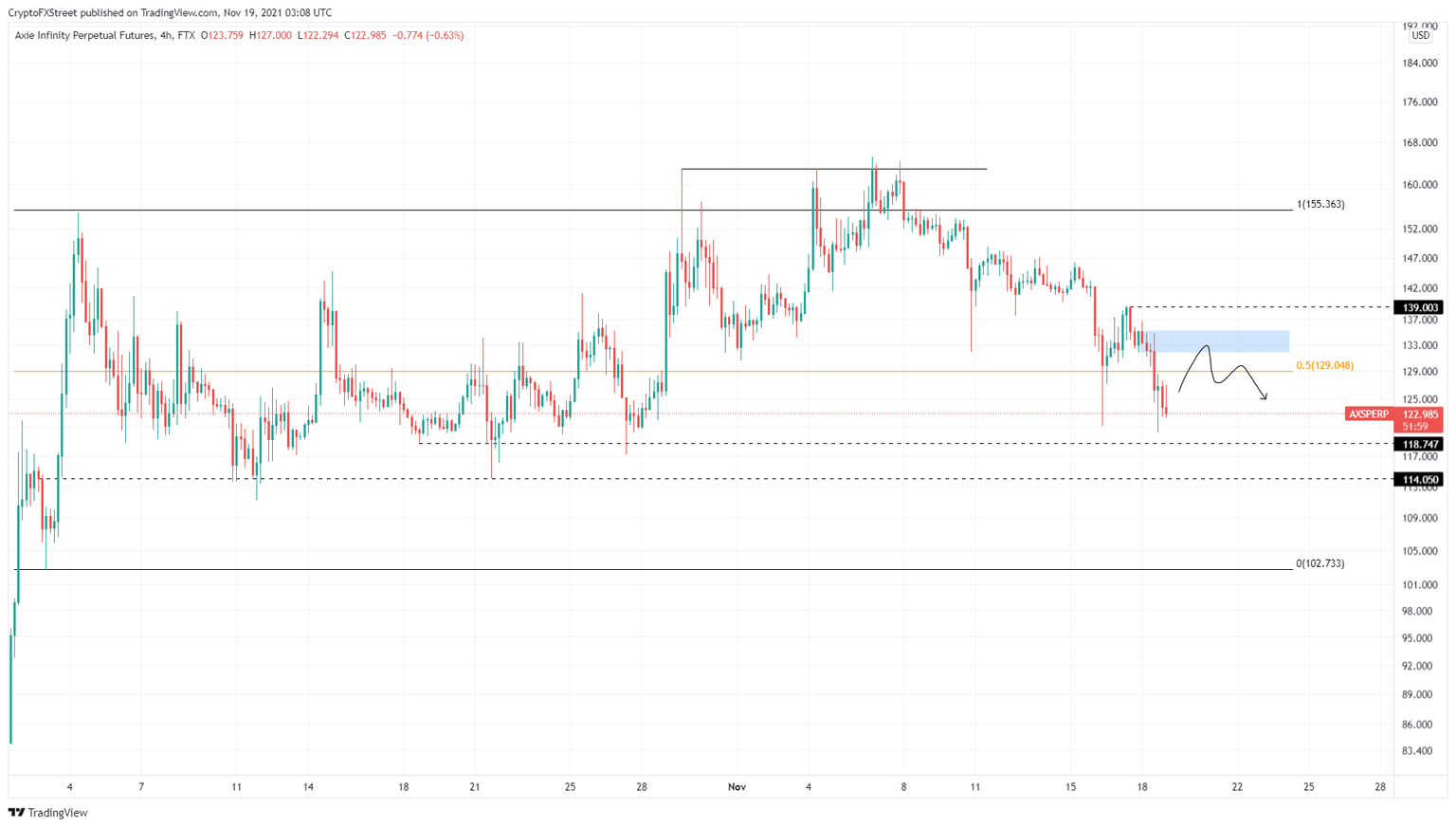

- Axie Infinity price has sliced through the 50% retracement level at $129, suggesting a further downswing is likely.

- A rejection at the $131 to $135 supply zone will confirm the bearish outlook and kick-start a 20% correction to $102.

- A daily close above $139 will invalidate the bearish thesis.

Axie Infinity price has been on a steady downtrend since November 6 after multiple failed attempts to rally higher. This correction has pushed AXS below a crucial level and hints that a further downswing is likely.

Axie Infinity price to be available at discount

Axie Infinity price set up a swing high at $163 on October 29 and consolidated for a while. However, multiple attempts to breach past this barrier have failed, suggesting that the liquidity resting above these barriers was collected.

As a result, AXS has dropped 24% to where it currently trades, at $125. In doing so, Axie Infinity price has shattered the 50% retracement level at $129 and has ventured lower. However, investors can expect a relief bounce that either gets rejected at $129 or the $131 to $135 supply zone.

This inability to cross higher will be the final nail in Axie Infinity’s coffin, suggesting that AXS price will kick-start a 20% downswing to the range low at $102.

While this correction might seem straightforward, it is not. The support levels at $118 and $114 have been extremely resilient in the past and have supported the upswing. Therefore, market participants can expect Axie Infinity price to witness buying interests around these levels.

AXS/USDT 4-hour chart

While things are looking rough for Axie Infinity price, a daily close above the $131 to $135 supply zone will indicate a willingness to move higher. While this move is bullish, an invalidation of the bearish thesis will arrive only if AXS price produces a daily close above $139.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.