- Axie Infinity price is in the process of filling a fair value gap, extending from $102.62 to $79.20.

- On-chain metrics support the 15% crash forecast from a technical perspective.

- A swing high above $116.22 will indicate a potential shift in the trend and invalidate the bullish thesis.

Axie Infinity price is contemplating a deep correction. AXS is likely to witness a minor bump in its market value before it triggers a crash.

Axie Infinity price to fill inefficiencies

Axie Infinity price rose 33% from $79.20 to $106.01 quickly without leaving any room for correction. This sudden upswing created a price inefficiency referred to as the fair value gap (FVG).

More often than not, these gaps are filled as price trades back into the range and that is what Axie Infinity price is currently doing. So far, AXS has dipped almost halfway into the FVG but going forward, investors can expect it to go all the way.

From its current position at $93.50, market participants can expect Axie Infinity price to drop another 15% to $79.20. In some cases, AXS could retest the $71.59 barrier, bringing the total drop to 23%.

AXS/USDT 6-hour chart

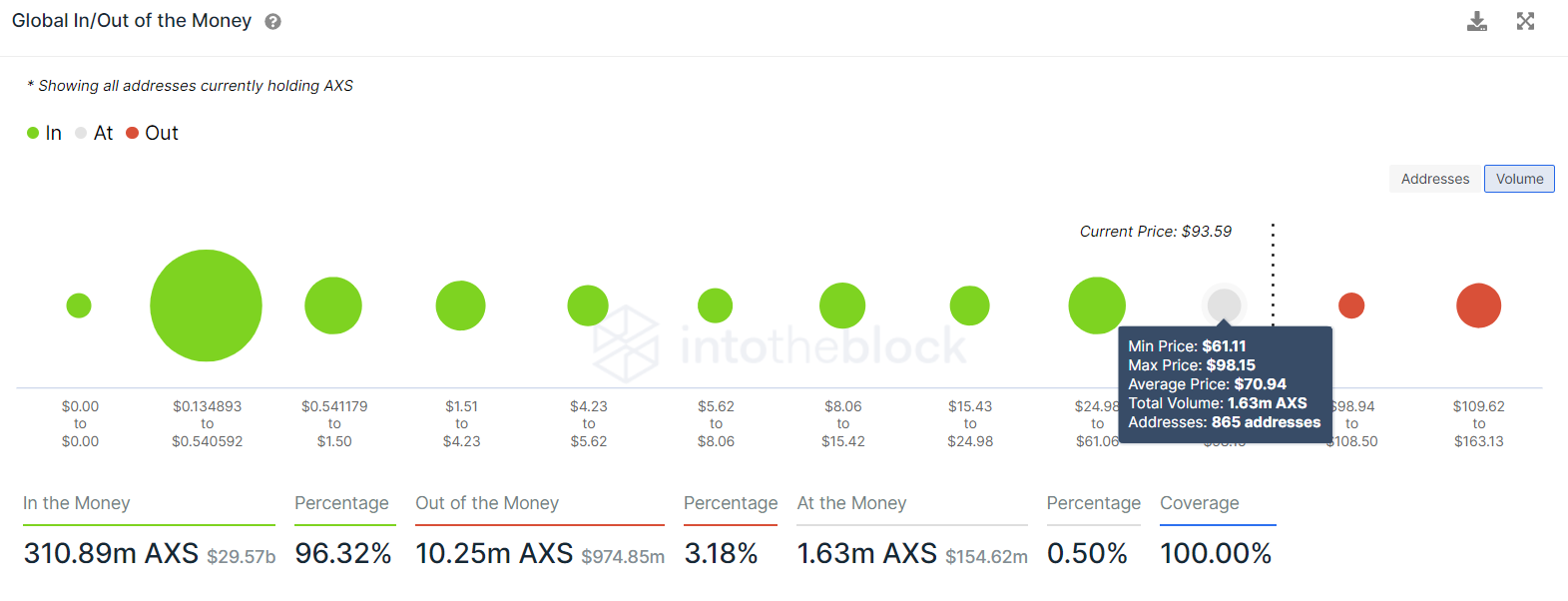

Supporting this drop to $79.20 or $71.59 is IntoTheBlock’s Global In/Out of the Money (GIOM) model, which shows the immediate support level is around $70.94. Here, roughly 865 addresses purchased 1.63 million AXS.

Therefore, market participants can expect the gaming token to see substantial losses in the near future.

AXS GIOM

Moreover, the number of daily active addresses joining the Axie Infinity blockchain has dropped considerably over the past three months from 6,263 to 746. This 88% decline indicates

Investors are done investing in AXS and not are interested in Axie Infinity price at the current levels.

AXS DAA

On the other hand, if Axie Infinity price sees a potential increase in buying pressure, leading to a six-hour candlestick close above $106.47, it will indicate that the market makers are collecting liquidity before triggering a crash.

However, if AXS sets up a swing high above $116.22, it will invalidate the bullish thesis.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EOS 22% pump steals the show unveiling Vaulta’s web3 banking ecosystem

EOS, the token behind the recently rebranded Vaulta network, has increased by a staggering 22% in the last 24 hours.

Curve DAO Price Forecast: CRV bulls could aim for double-digit gains above key resistance

Curve DAO (CRV) price is in the green, up 8%, trading above $0.53 on Thursday after rallying nearly 15% so far this week.

Bitcoin price reacts as Gold sets fresh record highs after Trump’s reciprocal tariffs announcement

Bitcoin price plunges towards $82,000 as Gold soars past $3,150 after US President Donald Trump imposed new tariffs on Israel and UK, triggering global markets turbulence.

Bitcoin and top altcoins slide as Trump kicks off reciprocal tariffs

Bitcoin (BTC) and the entire crypto market saw a quick correction on Wednesday following President Donald Trump's reciprocal tariff announcements based on half of each country's respective rates.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

[07.29.26, 14 Dec, 2021]-637750546986134018.png)