Axie Infinity price fails to regain support, increasing risk of 18% pullback

- Axie Infinity price rose roughly 30% on September 4 and set a new all-time high at $94.85.

- AXS could pull back 18% since it failed to close above the 161.8% Fibonacci extension level at $85.23.

- A decisive daily candlestick close above $85.23 will invalidate the bearish thesis.

Axie Infinity price showed incredible bullish momentum during July and August. Although September started out on a good note, things might be coming to an end for AXS.

Axie Infinity price looks to take a break

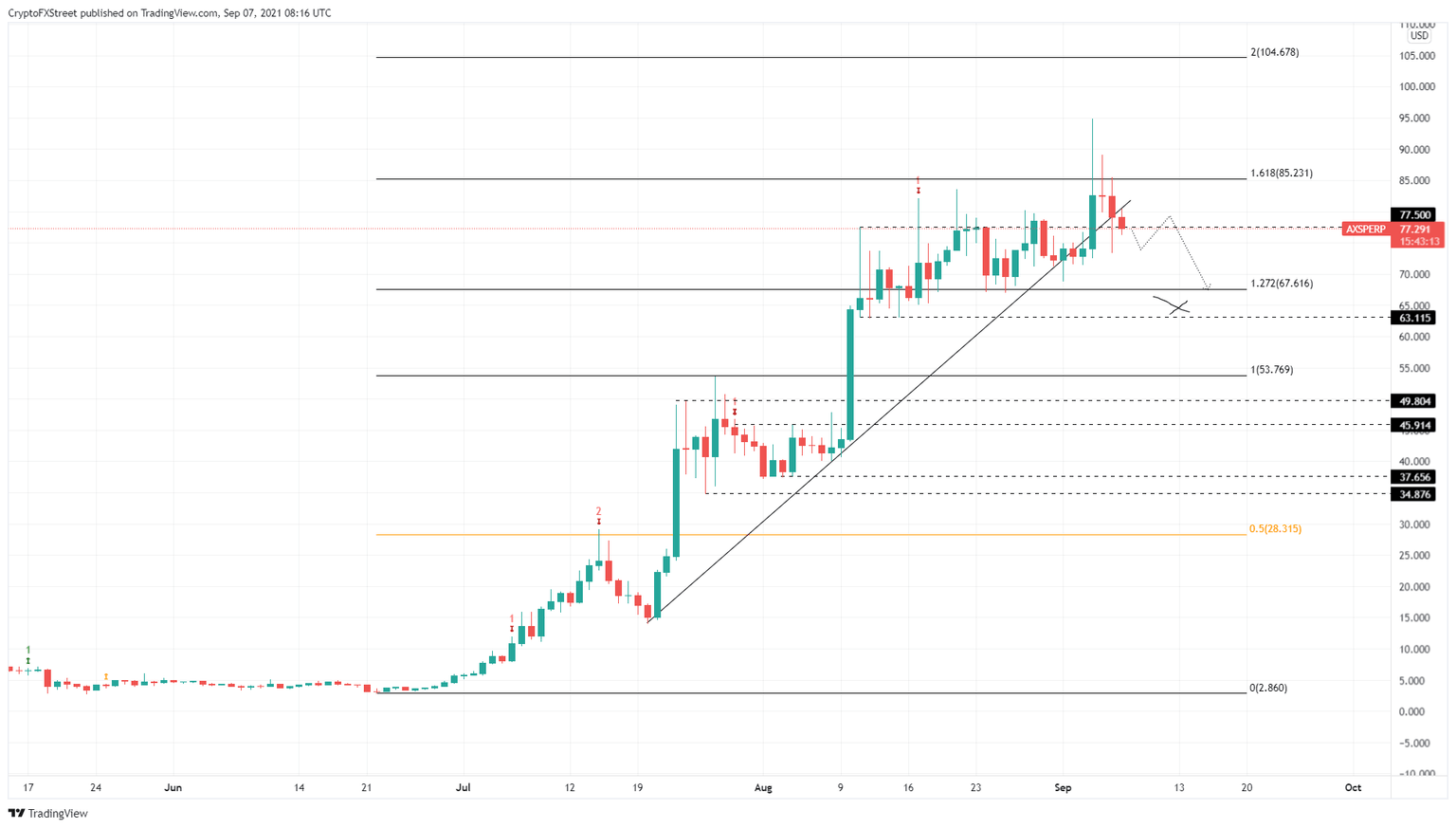

Axie Infinity price rallied 30% on September 4 as it pierced the 161.8% Fibonacci extension level at $85.23. However, the inability to produce a decisive daily candlestick close above this barrier indicated a lack of buying pressure and that investors were eager to book profits.

This move has opened up a weakness that has pushed AXS to shatter the support level at $77.50 and could even drag Axie Infinity price to the 127.2% Fibonacci extension level at $67.61, which would constitute a 13% sell-off.

However, the crash could be exacerbated if AXS breaks below $67.61 and heads to the next barrier at $63.12, an 18% retracement from $77.50.

AXS/USDT 1-day chart

While things seem to be looking grim for Axie Infinity price, a decisive close above $77.50 will be the first sign of a recovery. However, it is not a confirmation of a trend reversal.

Investors need to wait for a convincing daily close above the 161.8% Fibonacci extension level at $85.23. Such a climb will invalidate the bearish thesis.

If the buying pressure continues to pour in, the climb could extend 23% until AXS retests the 200% Fibonacci extension level at $104.68.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.