Axie Infinity Price Prediction: AXS contemplates new all-time high at $95

- Axie Infinity price is consolidating inside an ascending triangle pattern, expecting a bullish breakout.

- A decisive close above $80.10 will confirm a breakout and trigger a 20% upswing.

- If AXS bulls fail to hold above $64.74, it will put an end to the bullish outlook.

Axie Infinity price has been on an exponential run since July and shows no sign of stopping or major corrections. Now, AXS is consolidating in a pattern with a bullish bias and hopes to set up new all-time highs.

Axie Infinity price yet to explore new highs

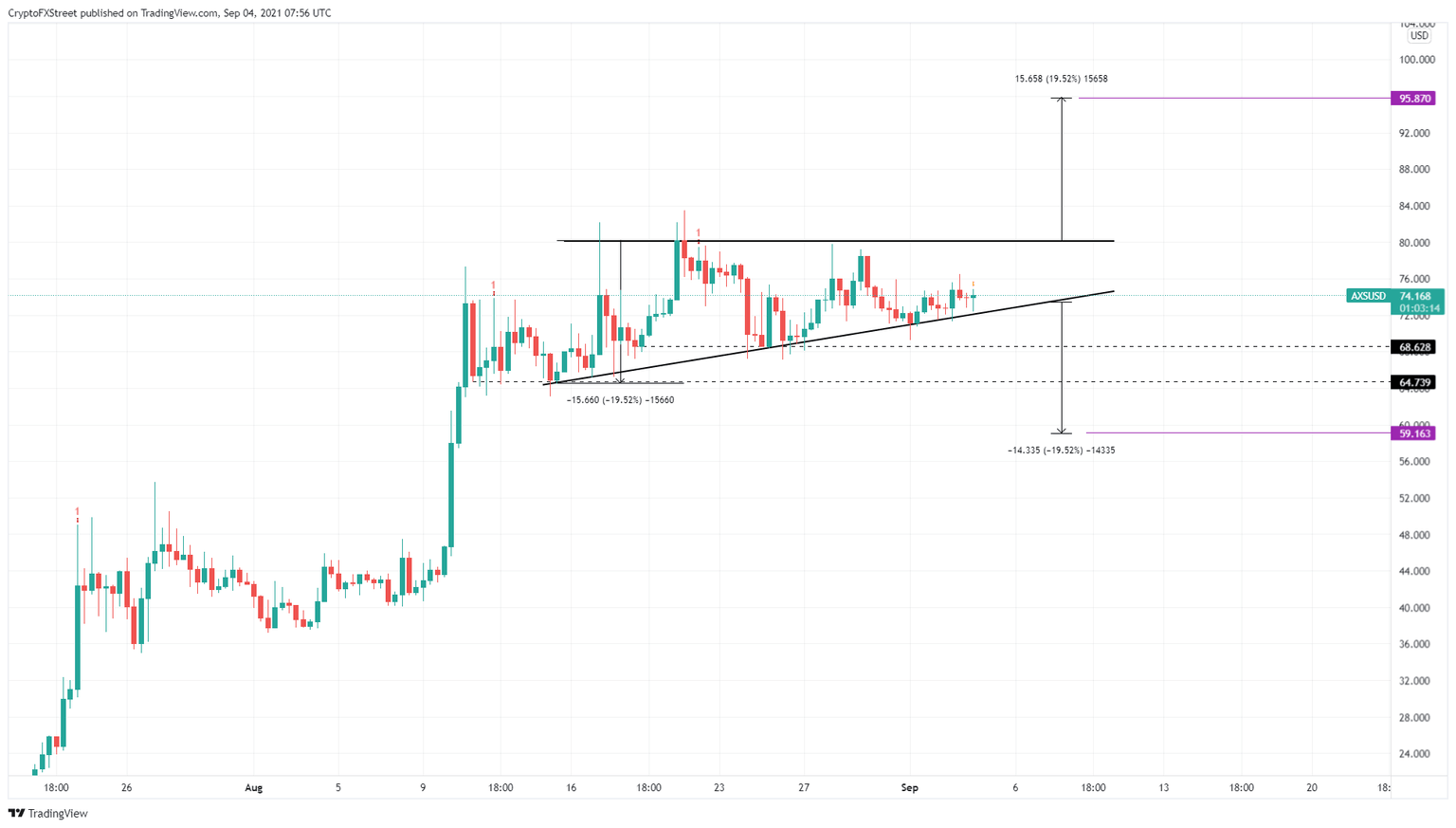

Axie Infinity price roughly set up three swing highs and multiple higher lows since August 15. Connecting these swing points using trend lines reveals the formation of an ascending triangle pattern.

This technical setup forecasts a roughly 20% upswing, determined by measuring the distance between the first swing high and low. Adding this distance to the breakout point at $80.10 reveals the target at $95.87.

Therefore, it is crucial for the bulls to produce a decisive close above the horizontal resistance level at $80.10 to have any chance of trending higher. Any move beyond the all-time high at $83.47 is a price discovery mode and has no resistance whatsoever, which indicates that the climb to $95.87 will be swift.

AXS/USD 9-hour chart

On the other hand, it is possible for the bulls to fail to shatter the horizontal resistance at $80.10, leading to a retest of the lower trend line.

If Axie Infinity price creates a lower low below $73.42, which coincides with the ascending triangle’s lower trend line, it will indicate a bearish breakout and likely trigger a crash to the subsequent demand barrier at $68.63.

While this move might appear bearish, a breakdown of the $64.74 support floor will invalidate the bullish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.