Axie Infinity Price Prediction: AXS coils up for 25% move

- Axie Infinity price is consolidating inside a symmetrical triangle pattern with no directional bias.

- A breakdown of the inclined trend line could lead to a 25% move to $96.54 or $52.72.

- AXS is likely to break to the upside if the big crypto turns bullish.

Axie Infinity price is traversing a symmetrical triangle pattern, which has no inherent bias. Therefore, a breakout could head in either direction, depending on the trend line it breaches. However, the probability of a bullish breakout seems likely considering the recent upswing seen in the big crypto and the altcoin ecosystem.

Axie Infinity price awaits a trigger

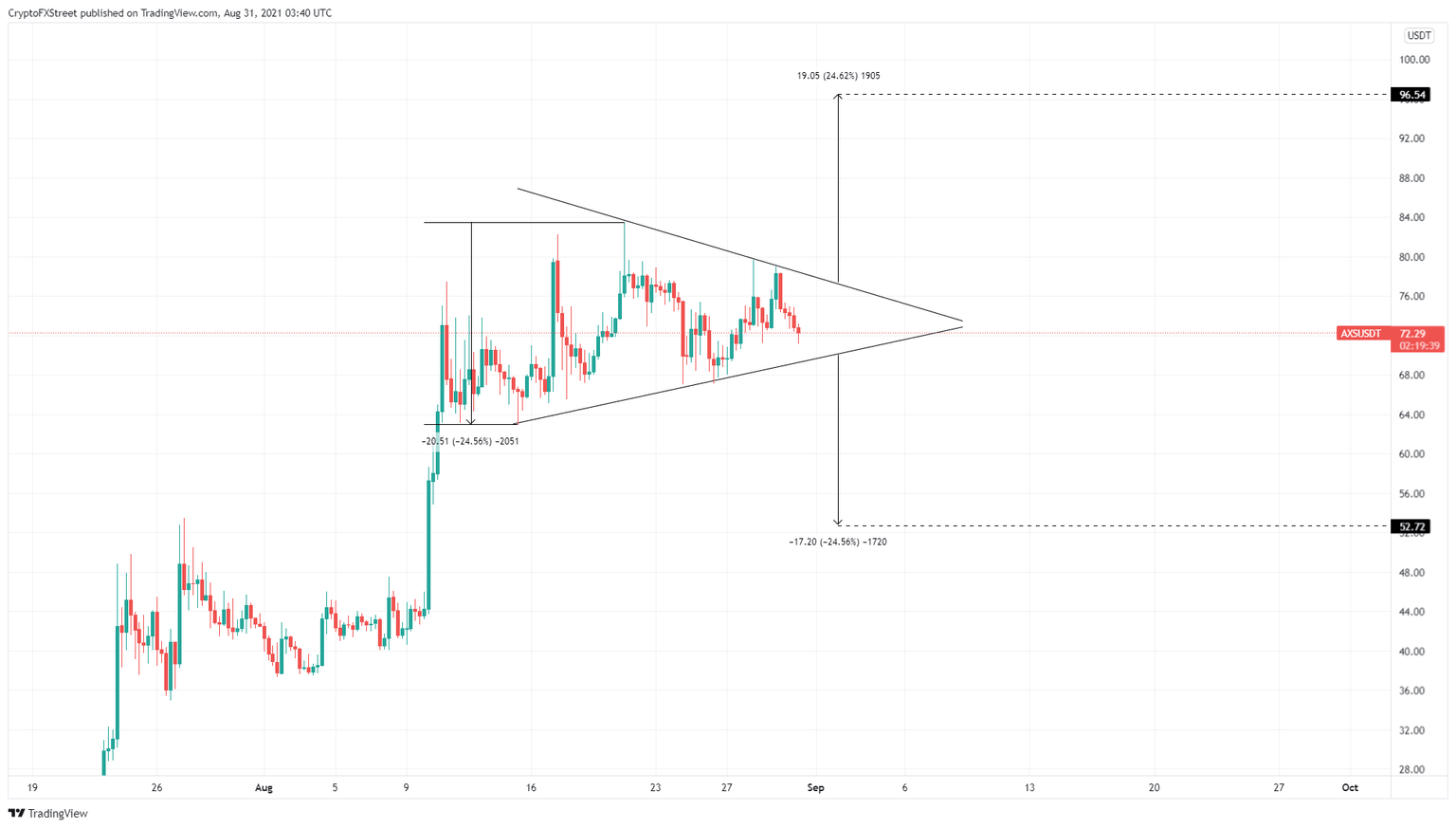

Axie Infinity price slid into consolidation after a 79% upswing from August 10 and August 11. Since this point, AXS has set up higher lows but started creating lower highs beginning August 21. Drawing trend lines connecting these swing points results in the formation of a symmetrical triangle.

This technical pattern has no inherent bias and could head in either direction, but a breakout will be confirmed after it breaches the upper or the lower trend lines. Currently, Axie Infinity price is heading toward the lower boundary of the setup and could result in a resurgence of buying pressure.

An upswing that originates here should rally at least 10% to retest the upper trend line. Only a flip of the trend line into a support barrier at $77.38 will confirm a successful breakout and the start of a new uptrend.

In such a case, the symmetrical triangle pattern forecasts a 24% upswing to $96.43, determined by measuring the distance between the August 15 and August 21 swing points and adding it to the breakout point at $77.38.

AXS/USDT 6-hour chart

On the other hand, if the buying pressure fails to manifest around the lower trend line, it will indicate a weakness among the bulls and suggest a further decline in Axie Infinity price.

A decisive 6-hour candlestick close below $70.02 will indicate a bearish breakout and trigger a 24% downswing to $52.72.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.