Axie Infinity Price Prediction: AXS begins consolidation, could see 17% upswing

- Axie Infinity price managed to stay above the inclined trend line despite the recent downswing.

- AXS might bounce off the $67.20 support level and rise 16% to retest the August 17 swing high at $82.18.

- A breakdown of the $63.11 demand barrier will invalidate the bullish structure.

Axie Infinity price is holding up better than most altcoins and shows resilience despite the recent sell-off. AXS is currently holding above a crucial support level and shows signs of a momentary upswing.

Axie Infinity price eyes minor upswing

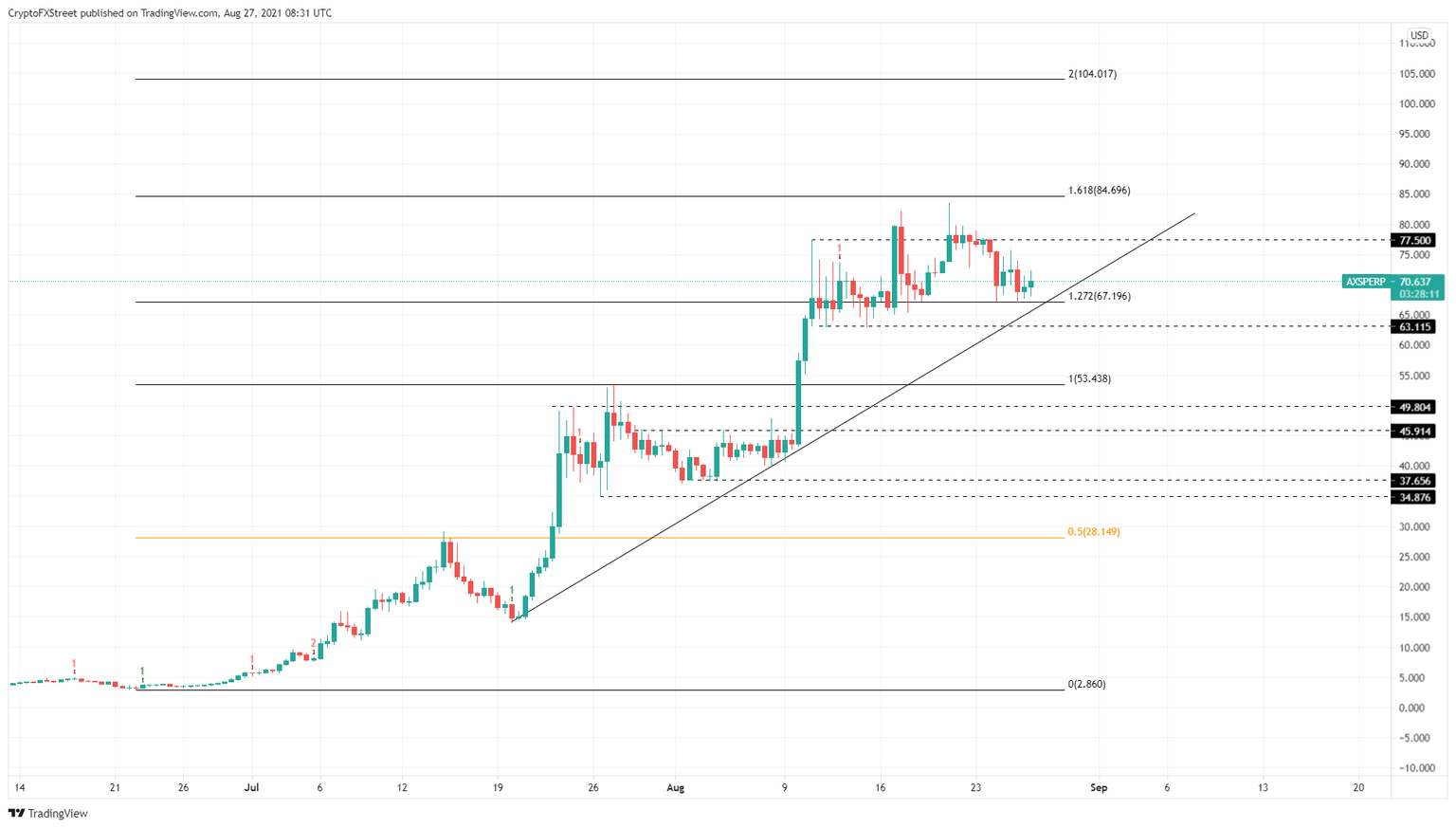

Axie Infinity price performance saw a massive bump since July 21, pushing it from $14.75 to an all-time high at $83.58 on August 21. Despite the recent market crash, AXS dropped only 19% but found support around the 127.2% Fibonacci extension level at $67.20.

So far, Axie Infinity price has managed to consolidate above it and might head higher if the buyers make a comeback.

The $77.50 level will be the first barrier that AXS needs to shatter. Beyond this level, Axie Infinity price might make a run at the August 17 swing high at $82.18 and, in a highly bullish case, retest the all-time high at $85.58.

In some cases, AXS might tag the 161.8% Fibonacci extension level at $84.70 and set up a new all-time high or head higher to tag the 200% Fibonacci extension level at $104.07.

AXS/USDT 12-hour chart

On the other hand, if Axie Infinity price fails to hold above the $67.20 support level, it will indicate weakness among buyers. This move could push AXS to the subsequent foothold at $63.11, a breakdown of which will set up a lower low, invalidating the bullish thesis.

In that case, AXS might crash another 16% to tag $53.44.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.