Axie Infinity price hints at 30% breakout rally if AXS can overcome two hurdles

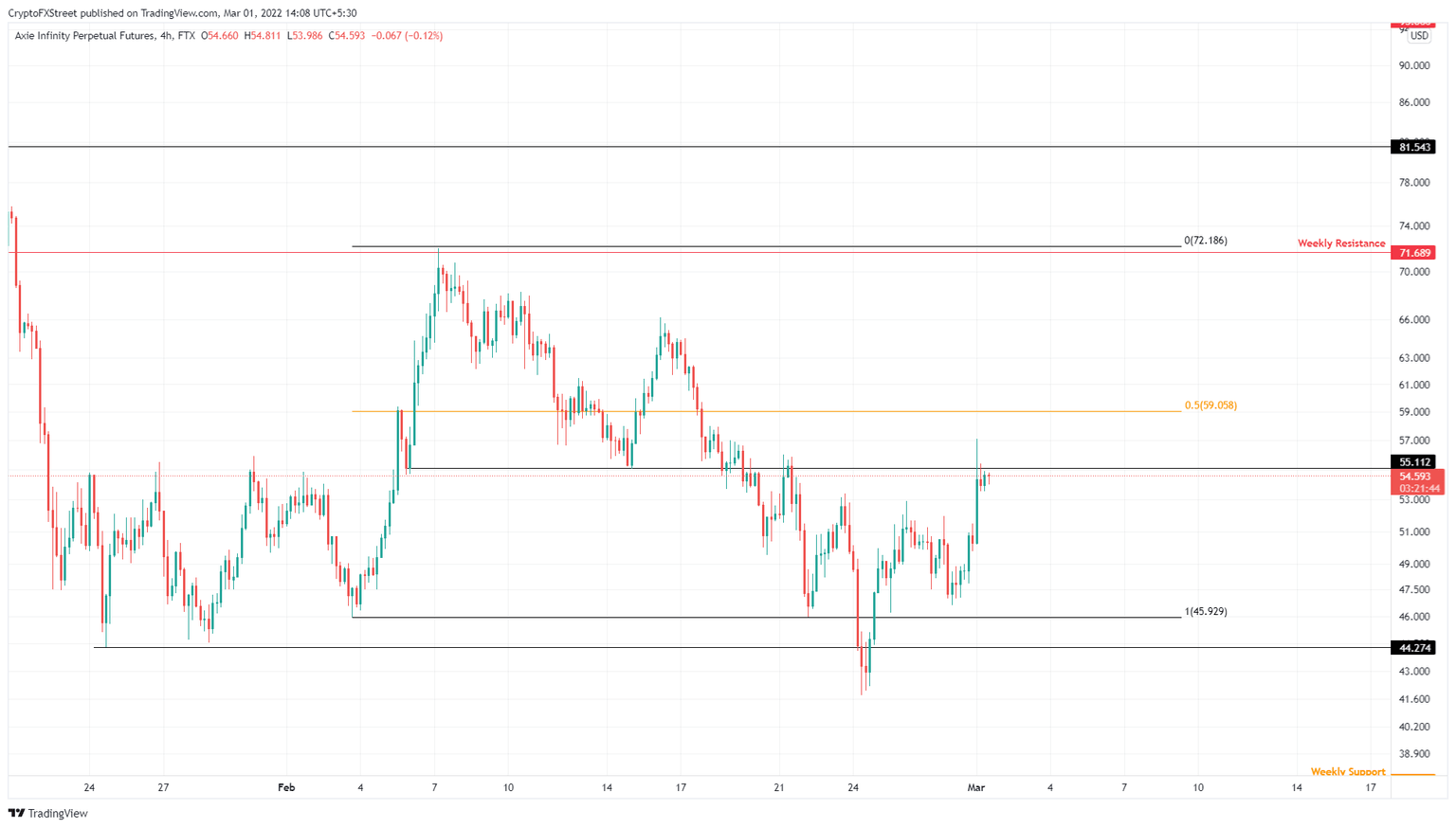

- Axie Infinity price upside is being limited by two hurdles at $55.11 and $59.06.

- Clearing these blockades will result in a run-up to the range high at $72.19, coinciding with a weekly resistance barrier.

- A four-hour candlestick close below the range low at $45.93 will invalidate the bullish thesis for AXS.

Axie Infinity price is at an inflection point in its journey to the top as it faces two stiff hurdles in its path. A breach of these blockades is crucial for AXS to reach its destination, but failure could have unwarranted repercussions.

Axie Infinity price at make or break point

Axie Infinity price has swept below the range low at $45.93 and recovered swiftly, leading to a 36% ascent in the last four days. Although for a brief moment, AXS sliced through the $55.11 resistance barrier, it failed to hold above it and is currently grappling with it.

Assuming buyers band together, Axie Infinity price will likely continue its uptrend to the next barrier at $59.06 aka the 50% retracement level. Here, bulls’ strength will be tested. While this outlook might seem bullish, a better alternative will be for AXS to retrace lower and find a stable support floor at $51.49 for buyers to recuperate and step up.

A bounce off this barrier is where interested investors can enter long position and expect AXS to shatter through the immediate barriers at $55.12 and $59.06. Clearing these blockades will open the path for Axie Infinity price to make a run for the range high at $72.19, coinciding roughly with the weekly resistance barrier.

In total, this run-up would constitute a 40% ascent and is a point where market participants can book profits

AXS/USDT 4-hour chart

On the other hand, if Axie Infinity price fails to hold above $51.48, it will indicate a weakness among buyers. In the event of a decline, Axie Infinity price has a last chance to recover around the range low at $45.93.

However, a breakdown of this level would create a lower low, shifting the odds in bears’ favor and invalidating the bullish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.