Axie Infinity price guided by the power of round numbers, as AXS targets $100

- Axie Infinity price emerges from the consolidation with a conclusive 47.62% gain on August 10.

- The topside trend line from November 2000 at $148.00 is now a potential price target.

- AXS intra-day and daily Relative Strength Indexes (RSI) do not present a bearish momentum divergence.

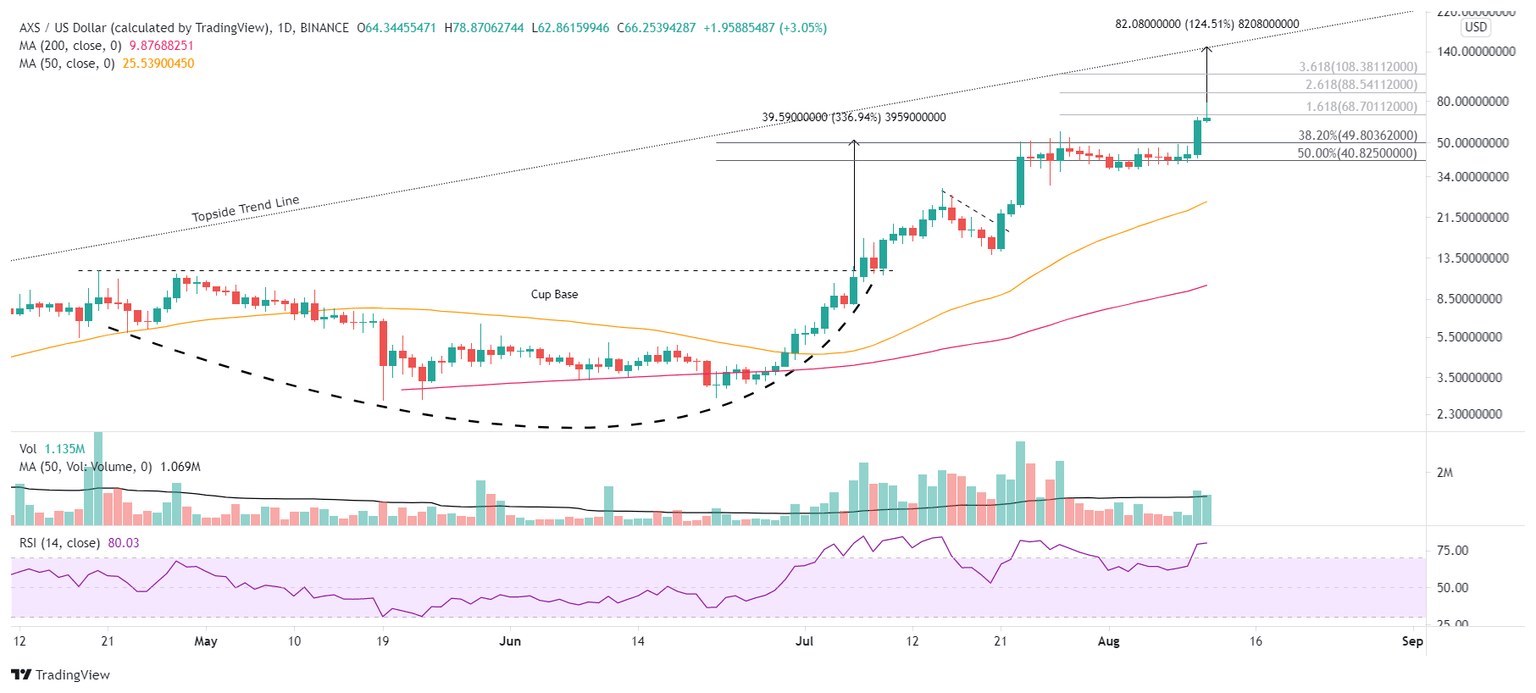

Axie Infinity price concluded a two-week consolidation above the 38.2% Fibonacci retracement with an impressive 47.62% gain, overcoming the resistance established by the measured move price target of the prior cup base at $51.34. AXS is now has a shot of reaching the topside trend line at $148.00, but $100 is more likely.

Axie Infinity continues the trend of big, positive sessions

Axie Infinity price consolidation was defined by many doji candlestick patterns, expressing the investor uncertainty for higher AXS prices and a reluctance to capture the sizeable profits generated since the June 21 low. The patient holders were rewarded yesterday with a 47.62% gain and a decisive breakout from the sideways price action that had defined Axie Infinity price since late July.

With Axie Infinity price realizing the cup pattern’s measured move of 337%, the attention turns to new points of resistance, such as the 161.8% Fibonacci extension of the recent consolidation at $68.70, the 261.8% extension at $88.54, the 361.8% extension at $108.38 and then the topside trend line at $148.00.

Today’s early rally eclipsed the 161.8% extension and carried Axie Infinity price within ten points of the 261.8% extension at $88.54. The lack of a bearish momentum divergence at today’s high suggested that the earlier gains of today will be revisited soon, preparing AXS to reach at least the psychologically important $100.00 or the 361.8% extension at $108.38, benefitting AXS speculators with a 64% return from the current price.

Axie Infinity price has established a precedent of substantial gains in a short period, so there is the potential for AXS to test the topside trend line at $148.00 and record a 124% profit from the price at the time of writing.

AXS/USD daily chart

A daily close below the July 27 high of $56.44 would be a warning signal that Axie Infinity price may have reached a significant top, and AXS investors should consider capturing profits.

AXS support begins with the 38.2% Fibonacci retracement of the rally from the cup base formed during April-July at $49.80, followed by the 50% retracement at $40.82 and the Axie Infinity price lows of the recent consolidation around $37.00.

Axie Infinity price has recorded a dominant performance since the June low and is still displaying the same impulsiveness. The momentum holds the potential to carry AXS to at least the psychologically important $100.00 before coming to a halt. In the book New Market Wizards, Monroe Trout called the power of big round numbers like $100.00 the ‘magnet effect.’

I believe markets almost always get to the round number. Therefore, the best place to get in is before that number is reached and play what I call the magnet effect.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.