Axie Infinity price fractal shows high probability AXS will reach $100

- Axie Infinity is surfing on the favorable sentiment abounding throughout the cryptocurrency market.

- Some short-term profit-taking should be no worry for investors as fundamentals are still solid.

- Pattern repetition can lift AXS toward $100.

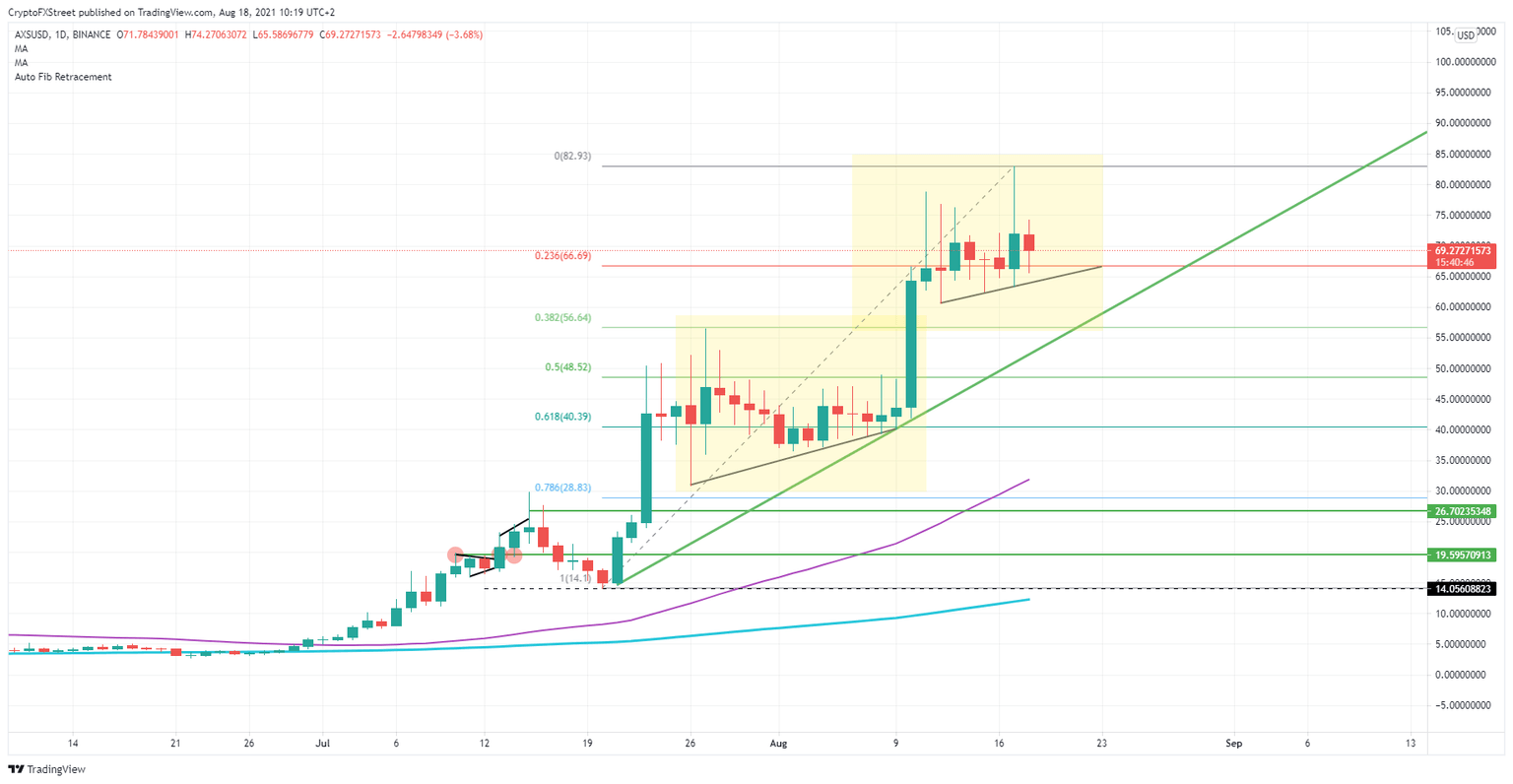

Axie Infinity has had a smooth run higher, coming from $14.05 on July 21 toward $82.93 yesterday. In the rally upwards, AXS has shown two consecutive repetitions of the same trade setup. Each time – on July 23 and August 10 – Axie Infinity price produced a large green candle with a thick body. Next, price consolidated, and short-term profit was taken by buyers in the first two or three days that followed. A tilted ascending floor is created as a reference point for buyers to add long positions. At the end of the cycle, the price will shoot higher again, repeating a large green candle with a thick body.

Axie Infinity’s fractal could have $100 in reach

Short-term selling is of no worry for the trade as there are still many support levels in place. The green ascending trend line originating from July 21 is still intact and has only had one retest, proving its importance as that test was the prelude for the next leg up.

The Fibonacci retracement coincides with our pattern analyses. In the first pattern (lower yellow rectangle), the price hovered between four Fibo levels before breaking the $56.64 Fibo level. The pattern shows a similar move between the $56.64 and the $82.93 Fibo levels in the current yellow rectangle. The tilted ascending floor is also being formed, so more upside potential is there.

Should the supporting short-term ascending trend line break, even then buyers will still be quite interested in looking for entries for a long in AXS. There is the green ascending trend line that has hardly been tested before but is of great importance. The $56.64 Fibo level needs to show its support, and that level has not been retested yet since the break higher on August 10.

If market sentiment sours and cryptocurrency positions are being slashed across the board, expect a break of the green trend line and look for support around $50, which will be there as a psychological pivot. AXS has the 55-day Simple Moving Average (SMA) around $30 and the $28.83 Fibo level as support even further below.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.