- Axie Infinity price may buck the trend of any broad recovery and continue to move lower.

- On the weekly and daily charts, extreme oversold levels warn of a relief rally.

- On the weekly chart, bulls need a 100% gain to return AXS to bullish conditions.

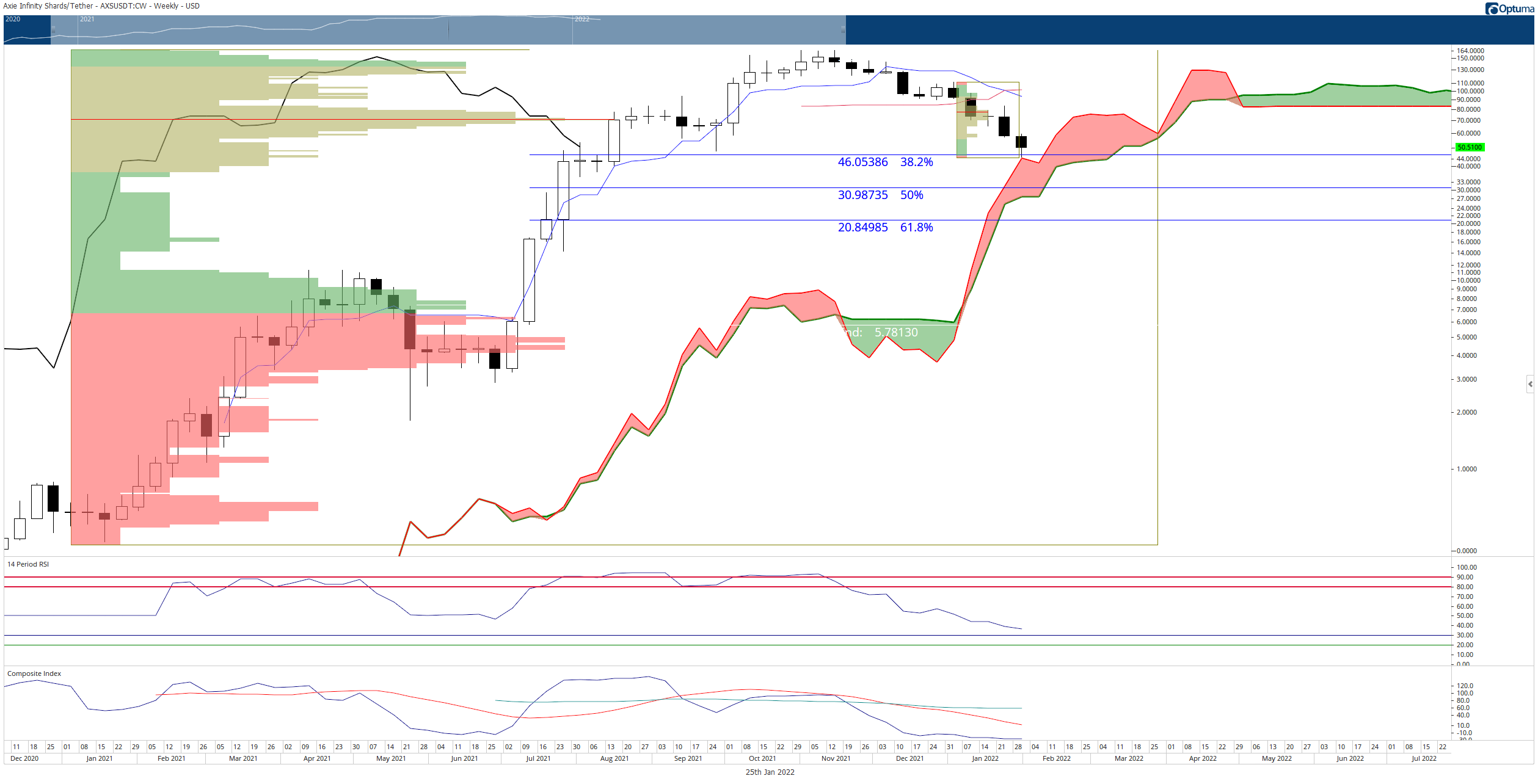

Axie Infinity price has been hammered since the beginning of 2022. It has fallen more than 52% this year and is down over 73% from the all-time high made in November 2021. Despite the 73% loss, a 50% logarithmic Fibonacci retracement has yet to trigger.

Axie Infinity may bounce and retest $90, but a drop to $31 is also likely

Axie Infinity price has found some support against the top of the weekly Cloud (Senkou Span B) at $44.25 and the 38.2% Fibonacci retracement at $46. A bounce from these lows should be expected, especially given the extreme oversold conditions on the weekly chart.

The Relative Strength Index remains in bear market territory and is slightly above the first oversold level at 30. More importantly, however, is the Composite Index. The Composite Index has essentially flat-lined and created new all-time lows, pursuing lower lows every other week. Combining these major oversold oscillator levels and the price support levels indicates a bounce to the Tenkan-Sen at $90 this week or, roughly, the $70 zone next week.

However, Axie Infinity price could move lower. Amongst its peers, AXS is the only remaining primary crypto in its peer group that has yet to make a 50% retracement based on a logarithmic Fibonacci measurement. GALA, MANA, ENJIN, and others have all completed their deep retracements, except AXS.

AXS/USDT Weekly Ichimoku Kinko Hyo Chart

The downside target for Axie Infinity price is $46. If AXS bulls want to invalidate any further bearish outlook, then they have the difficult task of pushing Axie Infinity to a weekly close above the Kijun-Sen, currently at $104.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.