Axie Infinity bulls attempt to regain control as AXS moves toward $80

- Axie Infinity price continues to slide south.

- Early signs of support and a pullback are now evident.

- Bulls could create a higher low pivot, staving off further selling.

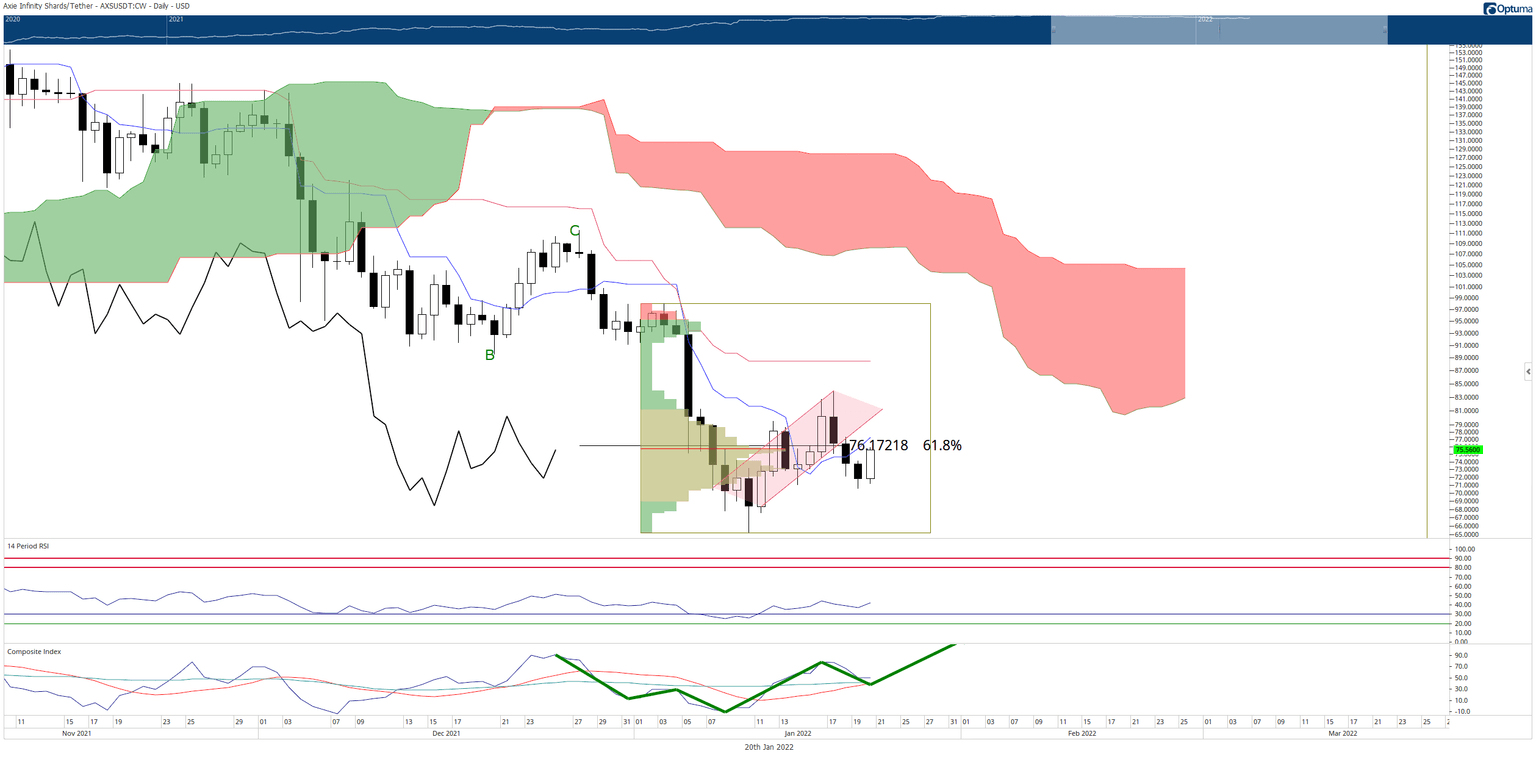

Axie Infinity price has dropped more than 10% since Monday and is nearly 57% lower than its all-time high. A bearish continuation pattern points to another leg south before buyers step in.

Axie Infinity price at risk of another 16% drop to the $60 value area

Axie Infinity price action has been a source of frustration for bulls. After gaining 23% between January 10 and January 17, AXS has dropped 16% from the January 17 swing high. The selling pressure looks like it may continue.

Two bearish events coincided on the close of this Tuesday’s daily candlestick. First, Axie Infinity price closed below the bear flag, and second, it closed below the Tenkan-Sen. The return below the Tenkan-Sen, in particular, is the most prominent warning that further downside pressure is likely to continue.

The projected support zone is the 100% Fibonacci expansion at $60. The $60 mark is also where the final sliver of support in the Volume Profile exists; a level that must hold or a much deeper capitulation move into the $40 area is highly probable. The Volume Profile is extremely thin between $60 and $45, indicating an easy move lower if $60 fails.

AXS/USDT

However, bulls are not entirely without some hope. Structurally, Axie Infinity price has developed a higher low precisely where the current 2022 Volume Point Of Control is. Therefore, if buyers can return AXS to a close above the Tenkan-Sen currently at $77, then enough momentum may return to end the current corrective move.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.