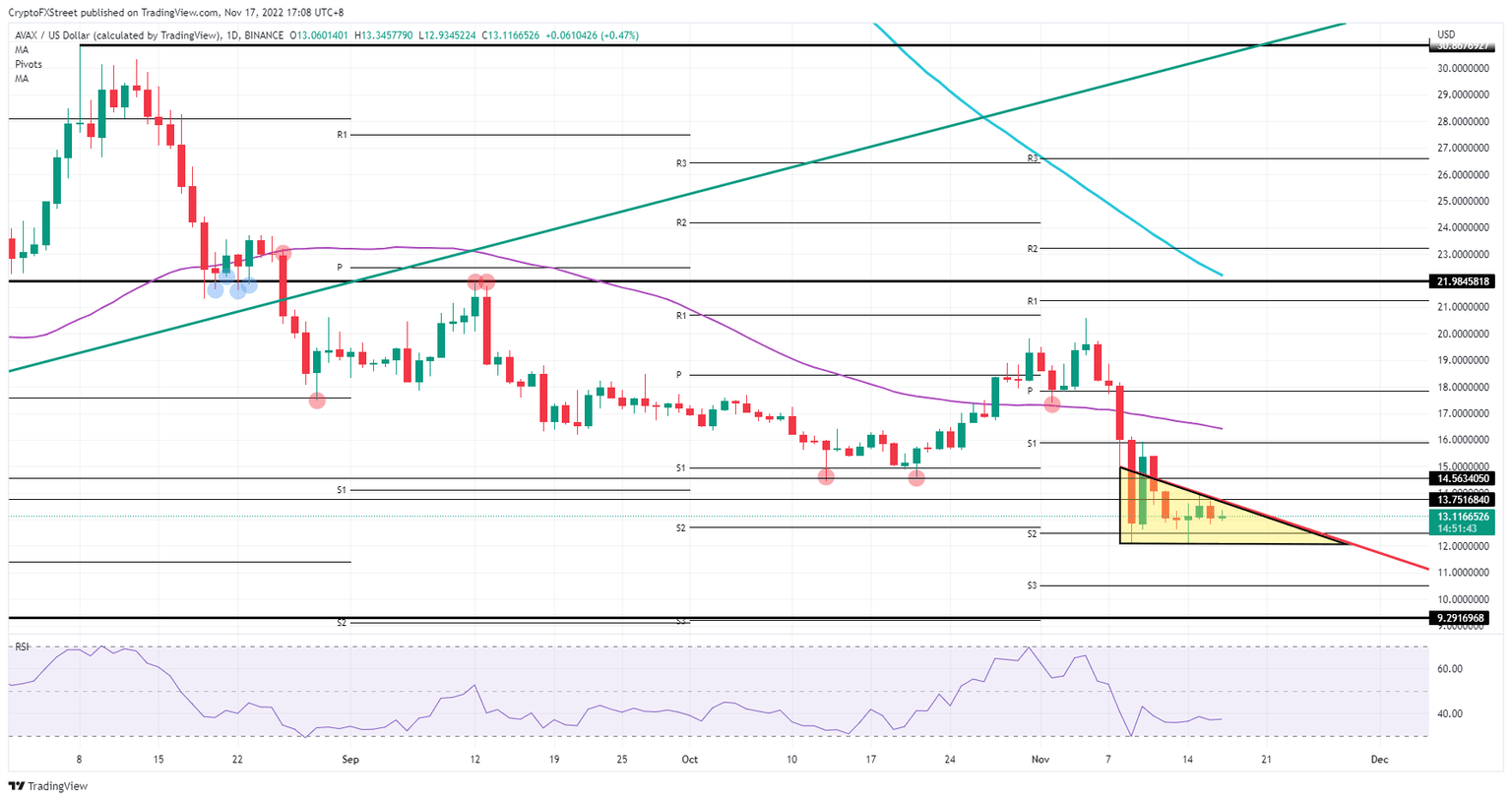

AVAX price stuck in bearish triangle that could bring $11 into view

- Avalanche price sees Tuesday and Wednesday bouncing off the sloping side.

- AVAX already confirmed the base of the triangle twice.

- Expect to see a bearish breakout that could lead AVAX price to print below $11.

Avalanche (AVAX) sees traders licking their wounds after the alt-currency fulfilled its name by sliding over 30% last week. Although the price action might be trading in more calm waters, the prospect does not look too tempting for any upswings or recoveries. While markets are focused on Genesis as the next casualty in the FTX debacle, technically, AVAX is stuck in a pattern that can only point to more losses in the near future.

AVAX is ready for the next step lower

Avalanche price action is currently keeping its head above water, although dark clouds are forming again above cryptocurrencies. The next casualty set to file for bankruptcy is the crypto service provider Genesis, which has halted withdrawals. The event is keeping the current debate going as to whether crypto holders can file for reclaiming some funds or legally have lost their investments.

As Capitol Hill is looking at more regulatory crackdowns and Treasury Secretary Yellen loudly advocating for more controls, cryptocurrencies are still in an identity crisis that puts big question marks on which direction this industry will evolve.

AVAX price action is caught in a bearish triangle with two confirmed tests against the sloping side. On the base of the triangle, support held around $12.08, and the pattern already had one downside test. Expect to see the triangle completed by next week, with price action breaking below the base and looking for room near $11, with the monthly S3 support coming in at $10.51.

AVAX/USD daily chart

The fact that the bearish triangle has had only one firm test on its base level could point to a sharp bounce on the second test. That could even result in a breakout above the red descending trend line and that same tilted side of the bearish triangle. In that breakout, a short squeeze could unfold where bears are being stopped out of their positions, with bulls trying to hit $16 at the monthly S1 support level.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.