AVAX price sets up a new bull rally to $115

- AVAX price is coiling into a triangle formation.

- The token remains stagnant while the volume remains stagnant.

- Confirmation on a bullish impulse would happen above $90.

AVAX price, like many digital assets in the crypto space, is currently consolidating into what appears to be a contracting triangle. Avalanche’s native token has yet to make a significant move above support or resistance to confirm where it is heading next.

AVAX price awaits a major move

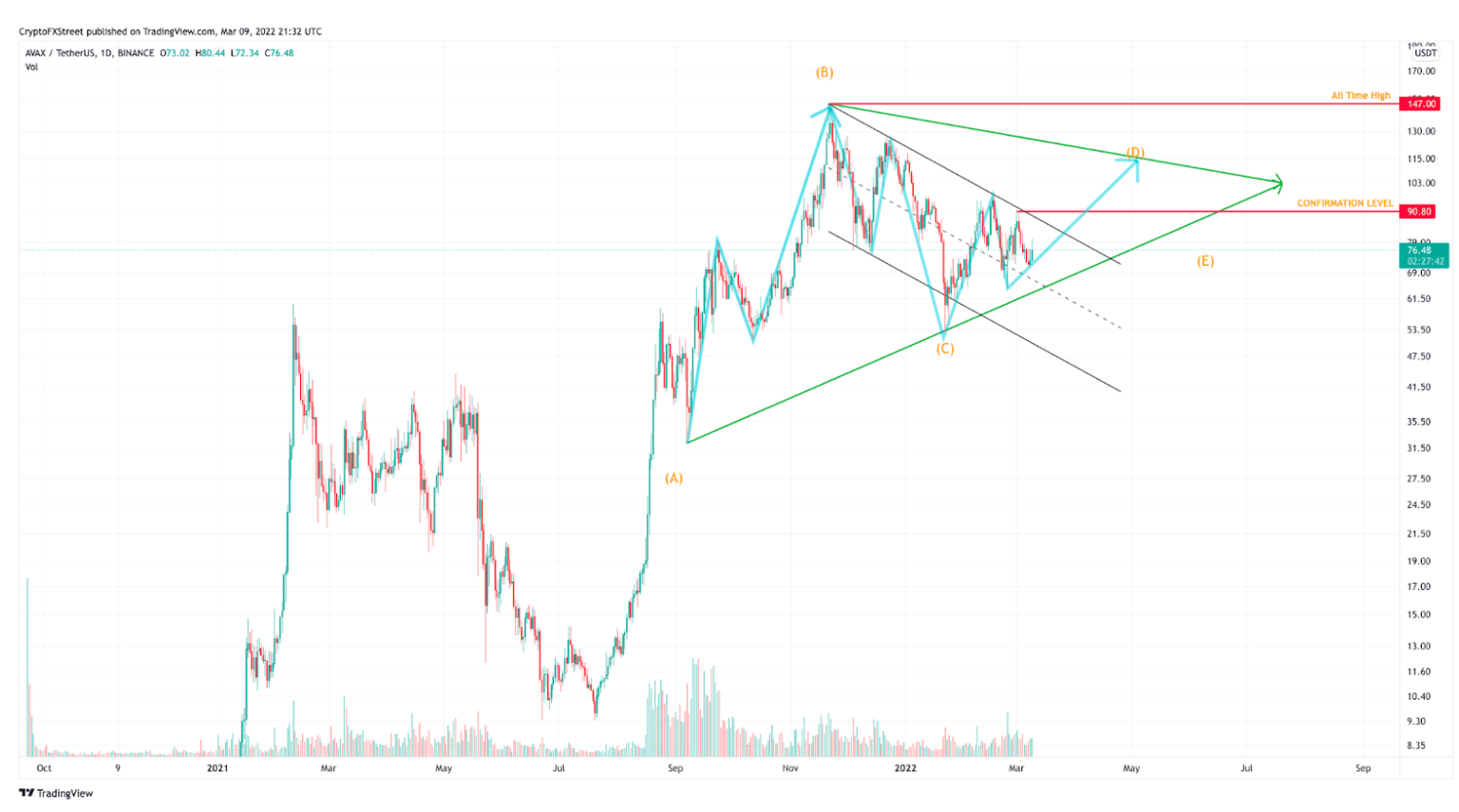

AVAX price had a tremendous 350% run-up from September 8, 2021, to November 22, 2021, printing a new all-time high at $147. As we look at the price action, it is worth noting that the structure does not look impulsive.

Elliot Wave states that impulse waves must contain five separate swings where 1, 3 and 5 all contain five impulse waves. September 2021's 350% bull rally into the all-time high has only three swings. The lack of clear impulse waves constitutes September 2021's bull run as a corrective rally.

The sell-off from the all-time high into January 24, 2022, low at $55.14 is also very similar in terms of structure. There are only three large swings that can be accounted for AVAX's 60% price drop from the all-time high.

AVAX/USD 1-day chart

AVAX is currently displaying bullish behavior as it consolidates above the daily trend channel median line. One more leg is needed to validate the D wave of this unfolding triangle which would send AVAX price as high as $115, representing a 50% upswing from today's current price of $77.00.

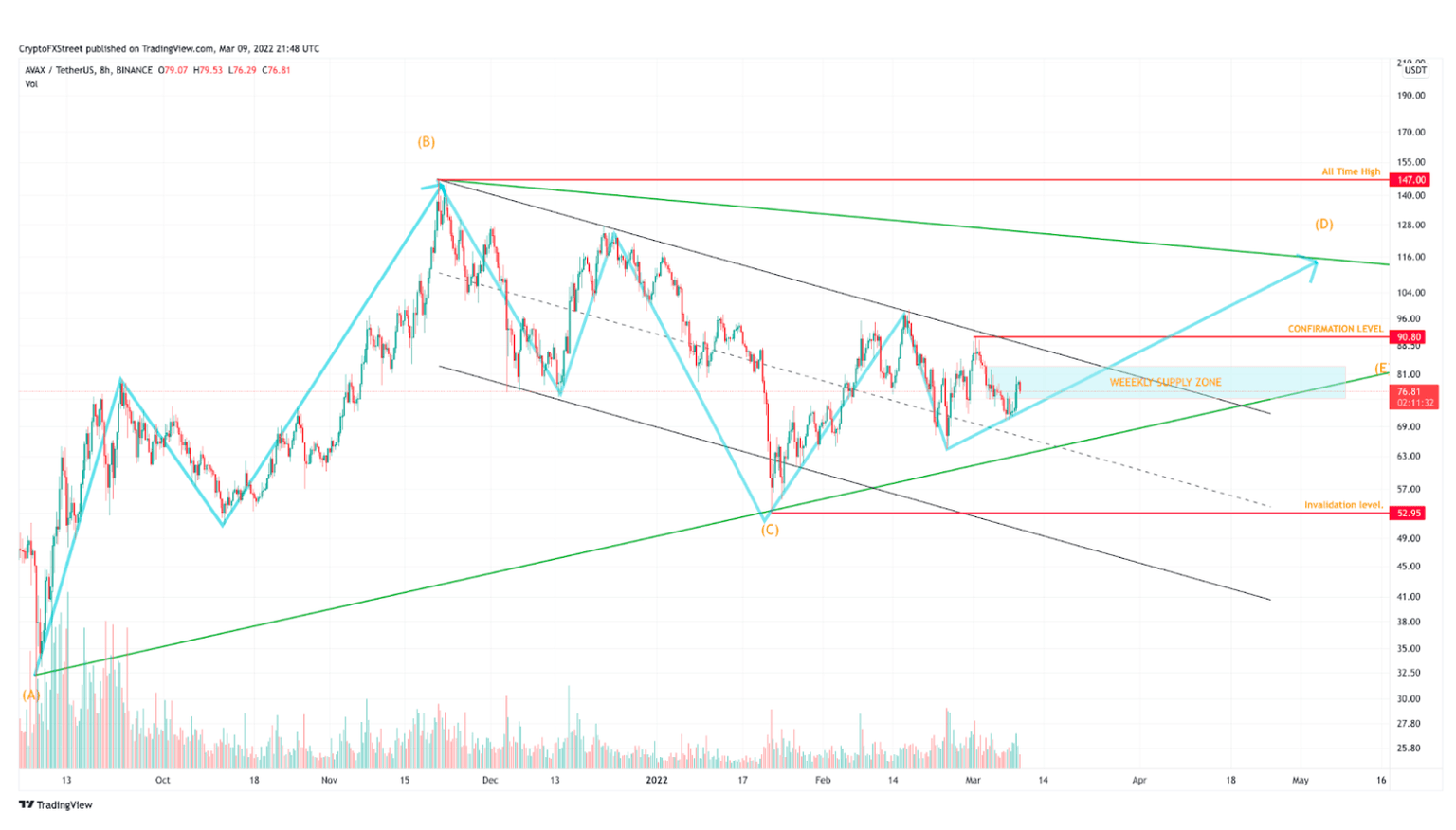

Despite the bullish pattern formation, finding an entry will be the real challenge for AVAX enthusiasts. On smaller time frames, AVAX price is being suppressed right in the middle of this week's supply zone. The safest way to join the bulls would be to wait for the confirmation level to get broken at $90.80.

AVAX/USD 8-hour chart

Bears will likely take control and challenge liquidity levels beneath the median line if the bulls cannot push past the weekly supply zone. A break below $52.95 will invalidate the bullish triangle idea which would give AVAX bears complete control to send prices into the low $40s, a 45% correction from the current price.

Author

FXStreet Team

FXStreet