AVAX price ready to shed some weight before the next 40% run-up

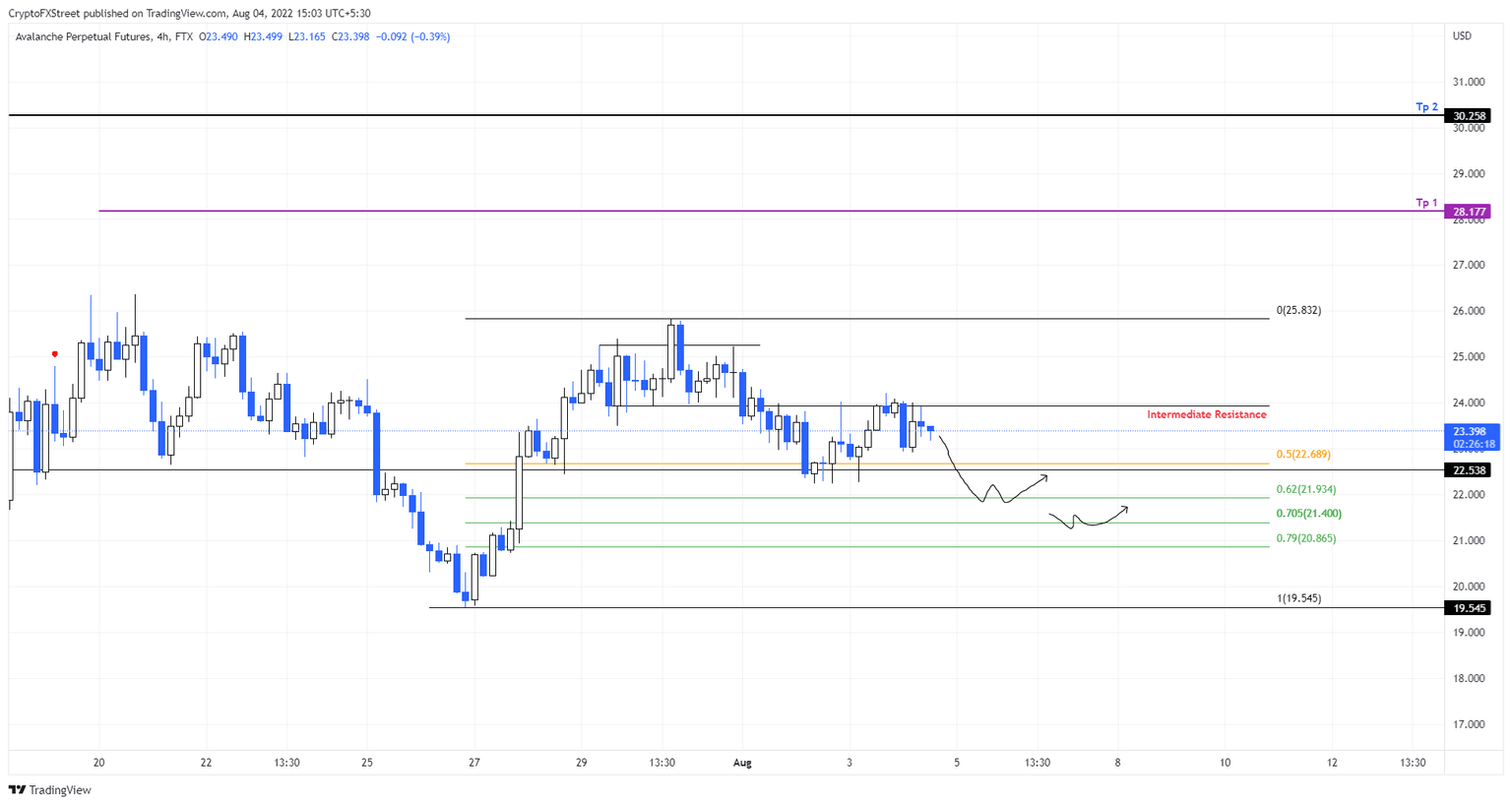

- AVAX price shows a retracement after setting up a swing high at $25.83.

- The downswing will likely shed 8% before triggering the next move to $28.17 and $30.25.

- A daily candlestick close below $19.54 will invalidate the bullish thesis.

AVAX price is correcting after an impressive run-up seen over the last two weeks. This move is likely driven by investors booking profits after the aforementioned upswing.

Avalanche bulls are likely to come to the rescue around a stable support level, triggering a new run-up that pushes past the previously set local top.

AVAX price sets the journey for a higher high

AVAX price rallied 32% between July 27 and July 30 as it moved from a swing low of $19.54 to a local top at $25.83. As a result of this bullish upthrust, buyers could be booking profits, driving the price lower.

Sidelined investors, however, are likely to come in at around the 62% or 70.5% retracement level at $21.93 and $21.40 to add more to their holdings. This development could trigger a new rally for AVAX price.

As for the targets, investors can expect a retest of the local top at $25.83 as the first hurdle. But flipping this level into a support floor will allow Avalanche bulls to make a run for the $28.17 blockade.

If buyers exercise patience with respect to booking profits, AVAX price might extend its run-up to $30.25. In total, this move would constitute a 41% ascent from $21.40.

AVAX/USDT 4-hour chart

While this bullish outlook makes logical sense, investors need to pay close attention to Bitcoin price, as a sell-off in the big crypto could affect AVAX price and all altcoins equally. In such a case if AVAX price produces a daily candlestick close below $19.54, it will invalidate the bullish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.