AVAX Price Prediction: Avalanche bears target $47

- AVAX price remains a significant outperformer, continues to trade near all-time highs.

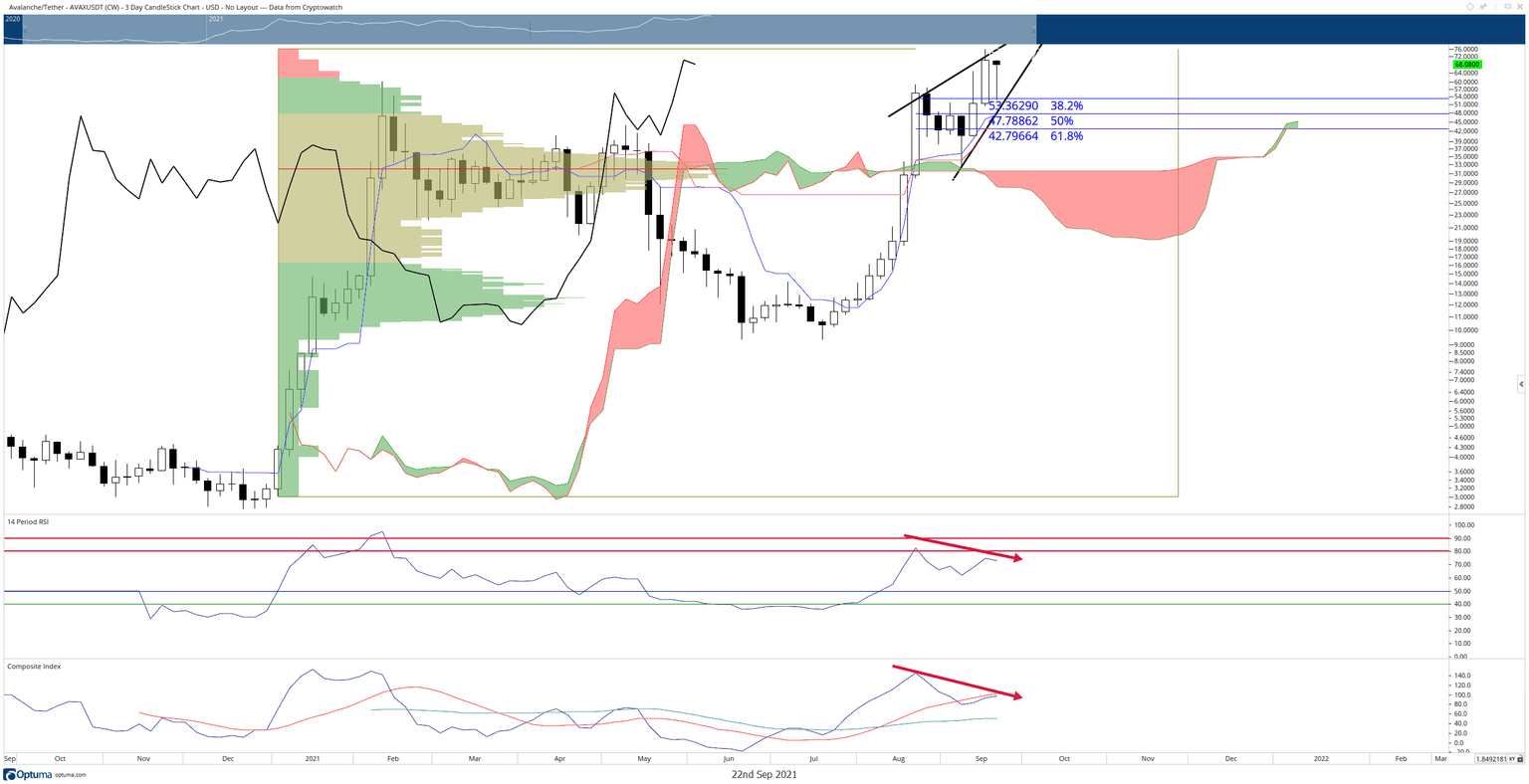

- Several bearish warning signs indicate future weakness between the Relative Strength Index and the Composite Index against AVAX price exit.

- A large gap between price and the Tenkan-Sen points to a mean reversion setup.

AVAX price continues to outperform the majority of the market in its performance. It also has the distinction of being one of a few high market cap cryptocurrencies that remains near its all-time highs. However, that might change soon.

AVAX price may print a bearish hammer candlestick pattern, pointing to solid downside pressure ahead

AVAX price is threatened by some term bearish pressure if it prints a bearish hammer on the three-day chart. The hammer pattern is one of the most sought out candlestick patterns because it often forms at the end of a swing. Moreover, the probability of the hammer pattern forming is enhanced by the be bearish conditions of the Relative Strength Index and Composite Index.

The Tenkan-Sen currently sits right on top of the 50% Fibonacci retracement at $47.78. However, because of the enormous gap between the AVAX price and the Tenkan-Sen, a mean reversion sell-off is expected to be coming soon. Massive gaps between the close and the Tenkan-Sen do not last long Ichimoku Kinko Hyo system and correct extremely fast.

A look at the Relative Strength Index and Composite Index oscillators shows two red lines sloping down. Those red lines point to lower highs in their respective windows while AVAX price shows higher highs. This condition is known as regular bearish divergence: a warning that the current upswing could be nearing a reversal.

AVAX/USDT 3-day Ichimoku Chart

While the projected target for bears is at $47, it is entirely probable that $47 could be just the beginning of an even deeper move south. This is due to AVAX price inside a rising wedge pattern – an extremely bearish pattern that often precedes violent reversals and trend changes.

For bulls to maintain these extremes and invalidate any near-term bearish pressure, AVAX price needs to perform a rare feat by moving above the rising wedge and then closing above that wedge.

Like this article? Help us with some feedback by answering this survey:

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.