AVAX price needs to rally 27% to prevent spiraling lower

- AVAX price is currently trading at $15.60 after registering a 6.6% decline on Wednesday.

- The altcoin is looking at a bounce back from the critical support at $14.91 to chart a 27% rally potentially.

- The bullish thesis would be invalidated if the critical support level is lost and Avalanche slips below $13.78.

AVAX price slid back to mid-January levels after a disappointing end to February. This continued into March as well, and the altcoin is now nearing the critical support level, which will require the bulls to support the cryptocurrency. Avalanche will, at the least, need to rally up to this price point in order to secure a sustained recovery.

AVAX price bounces back

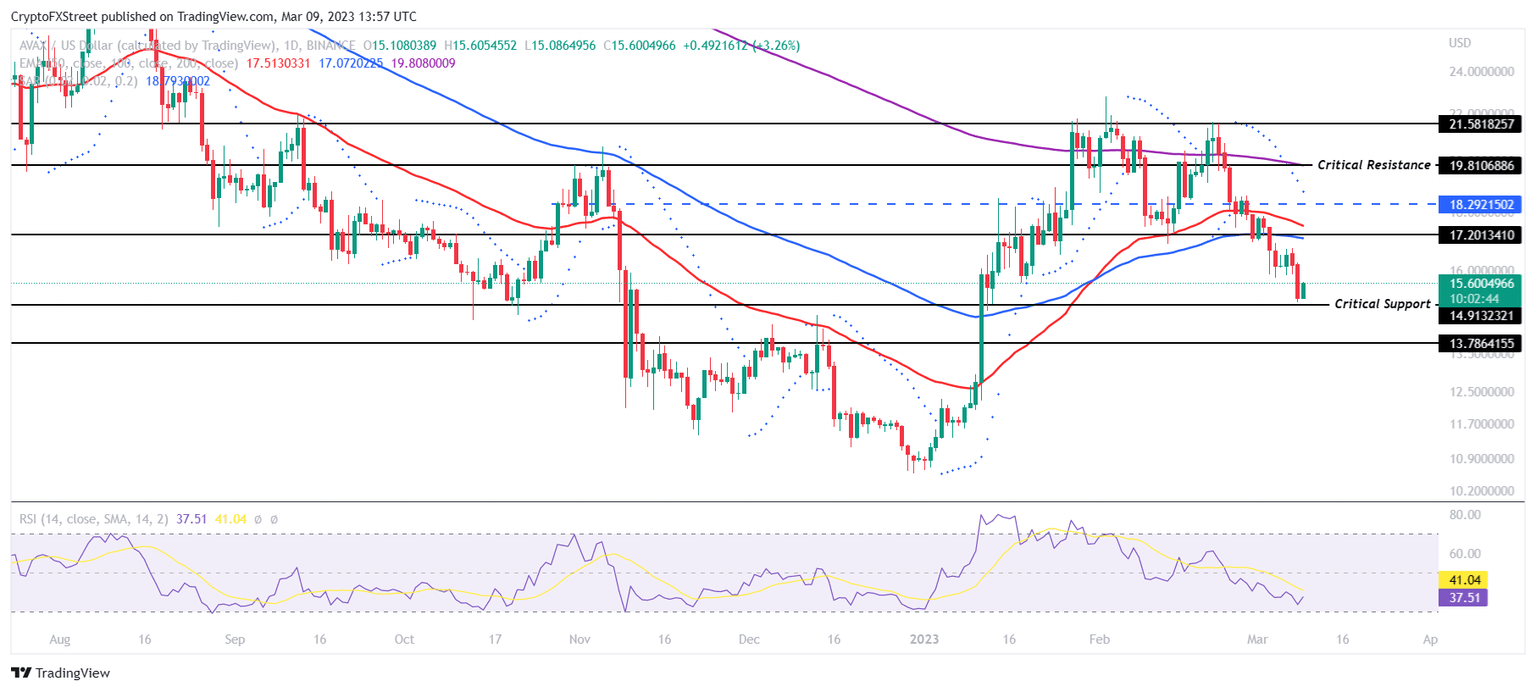

AVAX price could be seen trading at $15.60 after marking a red candle on Wednesday. The 6.6% decline pushed the cryptocurrency closer to testing critical support at $14.91. Bouncing off it, Avalanche today registered a 3.42% rise, signaling a potential recovery rally, provided it finds some support from the buyers.

The uptick noted on the Relative Strength Index (RSI) hints at a similar outcome. If the indicator bounces off the 30.0 mark without slipping into the oversold zone, it would be able to prevent declining below the critical support and continue rising towards its immediate resistance at $17.20.

Traders must watch this level as flipping it into a support level would allow AVAX price to rally by 27% and breach the critical resistance at $19.81. Those looking to long the altcoin can consider placing their bets once this barrier is crossed, as it would also flip the 50,100 and 200-day Exponential Moving Averages (EMAs) into support.

AVAX/USD 1-day chart

But investors and traders must refrain from making a move immediately, as the altcoin is still observing a downtrend. Parabolic Stop and Reverse (SAR) indicator’s blue dots’ presence above the candlestick is evidence of the same.

Thus if AVAX price falls through the critical support level and loses the support of $14.00, it could be looking at falling to test the support at $13.78. This would invalidate the bullish thesis and also mark a 12% crash for the altcoin, leaving it vulnerable to further decline.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.