AVAX price is at an inflection point as Avalanche fills three-day FVG

- Avalanche price is up around 355% since the cryptocurrency market turned bullish on October 18.

- With AVAX price testing the three-day FVG, the odds favor the downside with a 25% slump likely underway.

- The bearish thesis will be invalidated once the price breaks and closes above the midline of the FVG at $39.62.

Avalanche (AVAX) price has recorded one of the most striking performances in 2023, outperforming most tokens in the crypto top 100 by market capitalization (including the top three, Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP), which are up 58%, 53%, and 27%, respectively).

Also Read: Avalanche bulls might step away as AVAX eyes 30% correction

Avalanche price fills three-day FVG

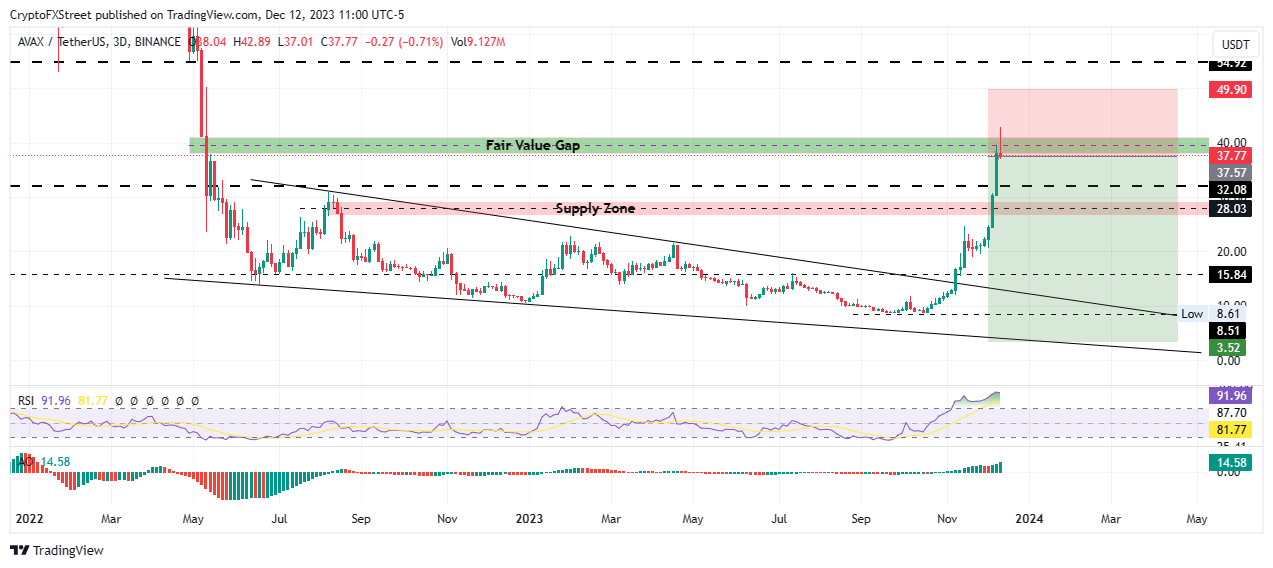

Avalanche (AVAX) price uptrend has seen the market value of the decentralized, open-source, proof-of-stake (PoS), blockchain-native token fill the three-day Fair Value Gap (FVG) stretching from $38.12 to $41.07. This is an area that offers price inefficiencies, and AVAX features an imbalance in the market here.

An asset’s price will always retrace these areas with the intention of filling the gap with some more trades, effectively restoring balance in the market. Once the price tags this zone, it could either continue the upward trend or witness a pullback, with the latter option being more common.

Avalanche price outlook as AVAX fills the inefficiency

Avalanche price is likely to fall, with analysts anticipating a 30% drop as there is no longer an effective upward pull on the price. If the FVG holds as a resistance block, AVAX price could extend south, potentially tagging the $32.08 support level.

An extended fall could plunge the smart contract token’s price into the three-day supply zone extending from $26.56 to $29.34. A break and close below the midline of this order block at $28.03 would not only invalidate the current bullish outlook but would also confirm the continuation of the downtrend. The move would denote a 25% drop below current levels.

Such a move could push AVAX price to the cliff where it could find the next logical support around the $20.00 psychological level.

The Relative Strength Index (RSI) at 91 shows AVAX is already massively overbought, suggesting a pullback may be underway. Broadly, this momentum indicator has already deviated from its previous northbound move as the bulls show exhaustion. This accentuates the bullish thesis.

AVAX/USDT 3-day chart

On the other hand, the bulls maintain a strong presence in the AVAX market, indicated by the presence of large volumes of green histogram bars on the Awesome Oscillator. Increased buying pressure from this cohort of traders could see Avalanche price extend the gains, overcoming the midline of the FVG with the potential to extend past the $49.90 high.

In a highly bullish case, the gains could extend further, tagging the $54.92 resistance level, last tested in May 2022.

Also Read: Avalanche Price Prediction: AVAX could rally 40% if it overcomes this barrier

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.