AVAX Price Forecast: Avalanche bulls might step away as AVAX eyes 30% correction

- AVAX price has rallied 103% in the last two weeks and two days, showcasing the bullish momentum.

- But this rally could be briefly paused, resulting in a 33% correction to $27.90 support level.

- Invalidation of this short-term pullback thesis will occur if Avalanche bulls flip the $50 psychological level into a support floor.

Avalanche (AVAX) price has shown incredible bullishness in the last few weeks, which has resulted in massive gains for the holders. Going forward, token owners need to be cautious as profit-taking and capital rotation could trigger a double-digit correction for AVAX.

Read more: Avalanche price faces selling pressure from $213 million AVAX unlock

AVAX price could slide lower

AVAX price more than doubled between November 27 and December 11. This massive bullish momentum comes as a result of the alt season, where altcoins register explosive gains. But along with the egregious moves, there are equally steep corrections that occur due to investors booking profits and rotating their capital to the next shiny altcoin.

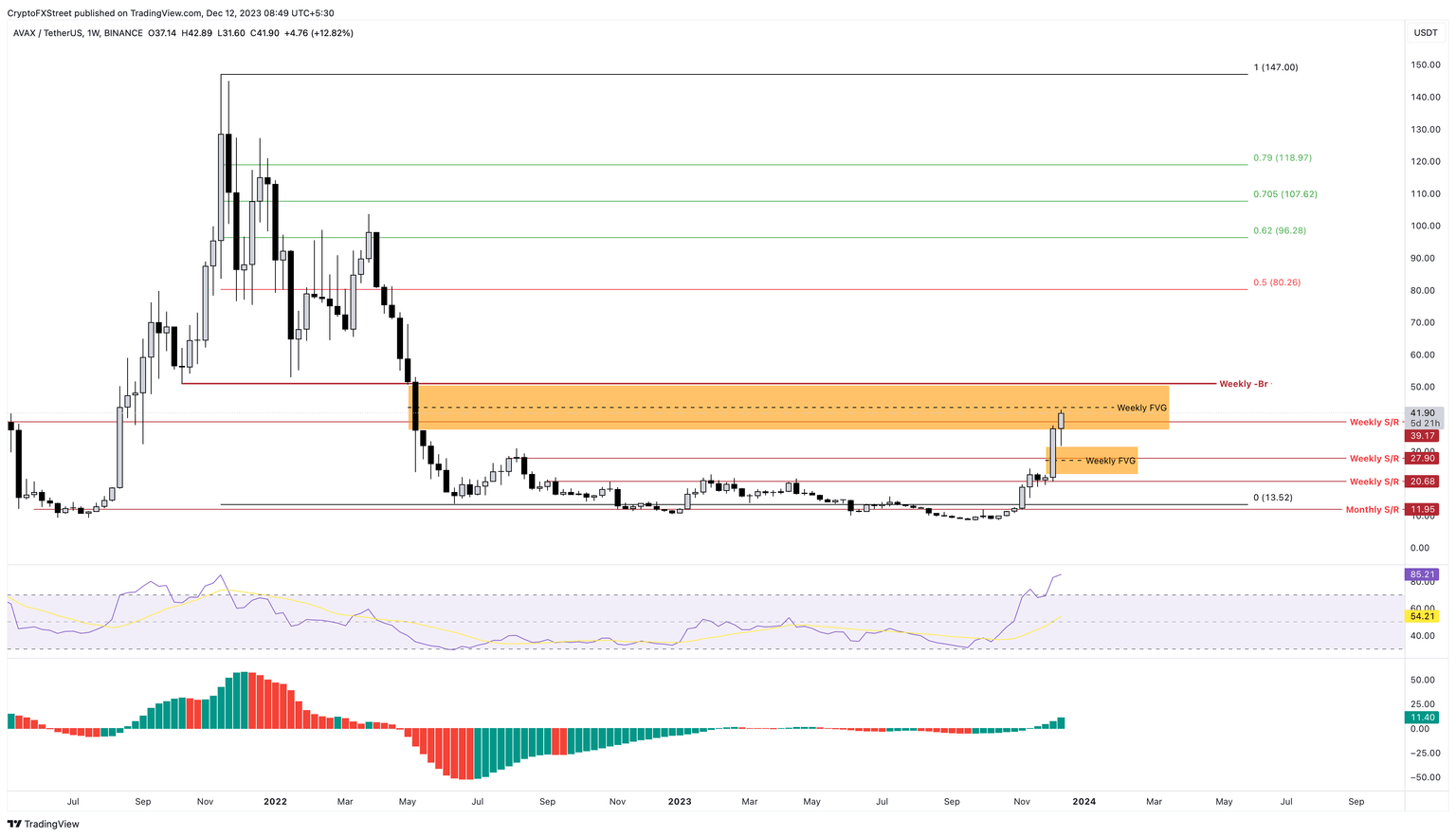

AVAX price currently sits inside a weekly imbalance, extending from $36.56 to $50.63, created in early May 2022 when sellers dominated the market. Hence, as Avalanche bulls push the altcoin higher, this seller-dominated area will be balanced by buyers.

The recent flip of the $40 psychological level and the move toward the midpoint of this imbalance at $43.61, could see a heavy sell-off from investors looking to book profits. Moreover, the Relative Strength Index (RSI) has been in the overbought territory for the third-consecutive week, which adds to the correction scenario.

The immediate weekly support level at $39.17 is roughly 7% away from the current price of $42. A breakdown of this barrier could send AVAX price down by nearly 30% to retest the $27.90 support floor. In total, this move would constitute a 33% correction.

Since the $27.90 level closely coincides with the recently created imbalance’s midpoint of $27.19, it is a good level to consider buying the dips.

AVAX/USDT 1-week chart

While the short-term correction in AVAX price is healthy for the big picture outlook, this retracement might not occur, especially if Bitcoin price continues its ascent toward $50,000. In such a case, if AVAX price flips the $50 psychological level into a support floor, it would invalidate the bearish outlook. This development will set the stage for Avalanche price to attempt a rally toward the $55 level.

Read more: Avalanche Price Prediction: AVAX could rally 40% if it overcomes this barrier

(This story was corrected on December 13 at 06:47 GMT to say that Bitcoin could continue its ascent toward $50,000, not $50,0000.)

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.