AVAX price could rally another 20% before it overheats

- AVAX price trades around $45.14 after registering a 411% rally in 70 days.

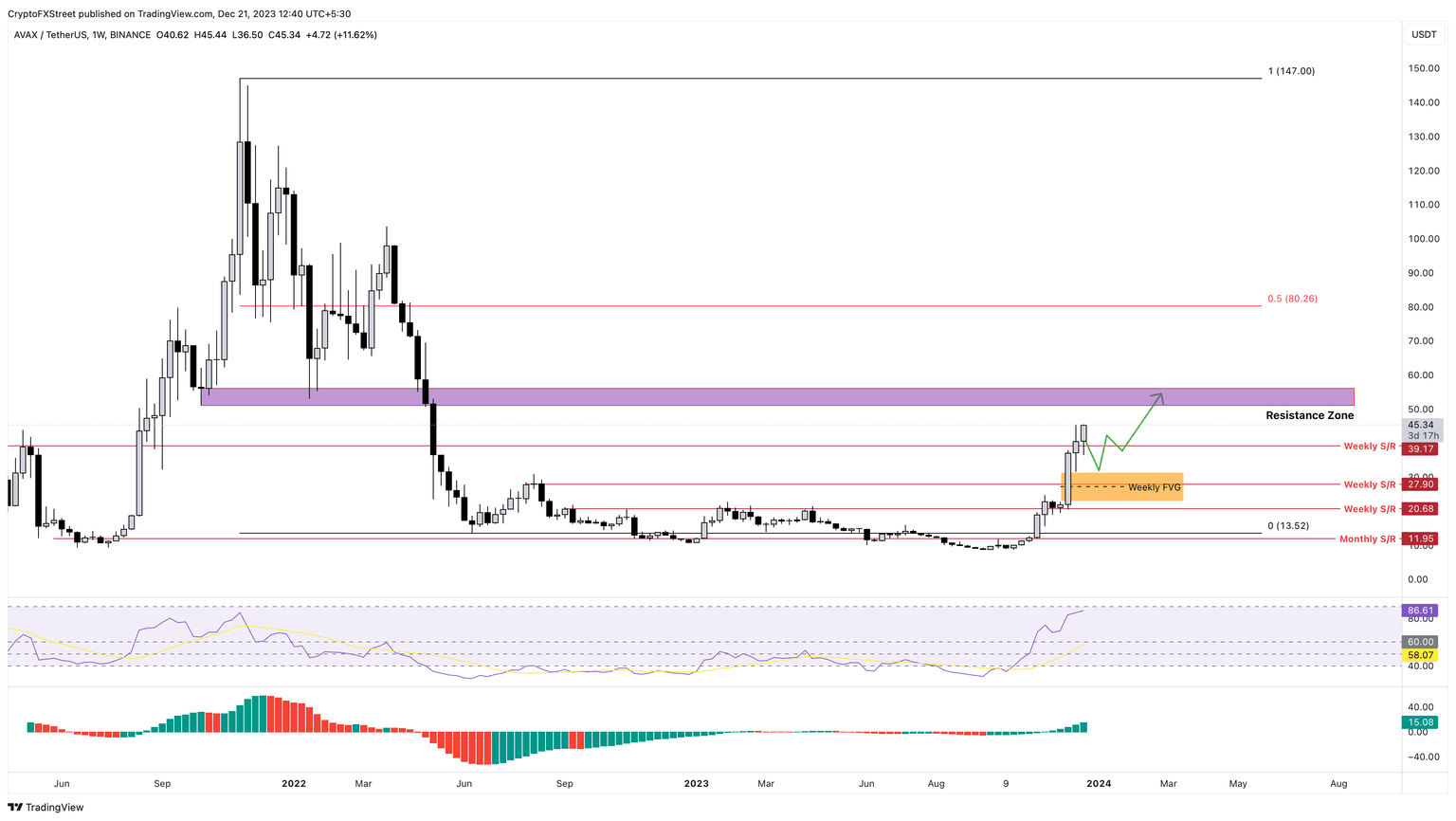

- The altcoin could rally another 20% before it encounters the resistance zone, which extends from $51.04 to $56.10.

- The RSI is still under the overbought conditions, which adds credence to the extension of the ongoing uptrend.

- A breakdown of the $20.68 support level will invalidate the bullish thesis for Avalanche.

Avalanche (AVAX) price has been on a non-stop uptrend and has produced only one weekly red candlestick since October 16. As a result, the altcoin has more than quintupled in less roughly ten weeks. Regardless, AVAX price still has more steam left in the tank as opposed to Solana (SOL), which has registered 296% gains in the same period.

Read more: AVAX price could present another buying opportunity despite 424% gains in under two months

AVAX price likely to continue its ascent

AVAX price has a higher chance of continuing the bull rally due to two critical reasons – overcoming a key weekly hurdle at $78.69 and the Relative Strength Index’s (RSI) position.

Despite rallying a mind-melting 411% in just 70 days, the RSI hovers around 82, just below the overbought level of 90. In bull markets, it is common practice to adjust the overbought and oversold conditions from 70 to 90 and 30 to 40, respectively. The mean level of RSI becomes a zone, extending from 50 to 60.

With this in mind, AVAX price still has more room to the upside before any signs of trouble. Regardless, there are two scenarios heading into the holiday season:

- AVAX price holds above the weekly support level of $39.17 and makes a run for the resistance zone, extending from $51.04 to $56.10. This move would roughly constitute a 20% gain from the current price level of $45.

- However, if AVAX price fails to hold above $39.17, it could retrace 19% and tag $31.60, which is the upper limit of the imbalance formed as Avalanche price rallied 69% in early December. This imbalance stretches from $22.74 to $31.60 and is a good place for accumulation before the altcoin retests the aforementioned resistance zone.

Due to the holiday season’s low liquidity levels, altcoins are likely subject to even higher volatility. So, investors need to exercise caution.

AVAX/USDT 1-day chart

While the bull run of AVAX price is impressive, it is still influenced by Bitcoin’s price movements. Should BTC tank for any reason, Avalanche price is likely to follow its lead.

Regardless, the 411% rally witnessed by AVAX price will face invalidation if it produces a weekly candlestick close below $20.68. This move would produce a lower low and signal that the uptrend is over and reversal has kick-started. In such a case, Avalanche's price could crash 40% and tag the next key support level at $11.95.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.