Avalanche price selling pressure subsides, prompting numerous buy signals

- Avalanche price faces one stumbling block at $24.00 in its quest to recapture $30.00.

- A buy signal from the TD Sequential indicator is a relief gesture in the wake of recent losses to $21.00.

- AVAX must close the day above the supply area at $24.00 to avoid wiping out the progress made from mid-June.

Avalanche price appears focused on reconquering key levels lost when it met the butcher’s knife last week. The smart contracts token built momentum from support it embraced in June at around $14.00 before plunging from $30.00 to $21.00. Despite this considerable drop, AVAX looks poised for a sharp move back to $30.00.

Avalanche price initiates recovery

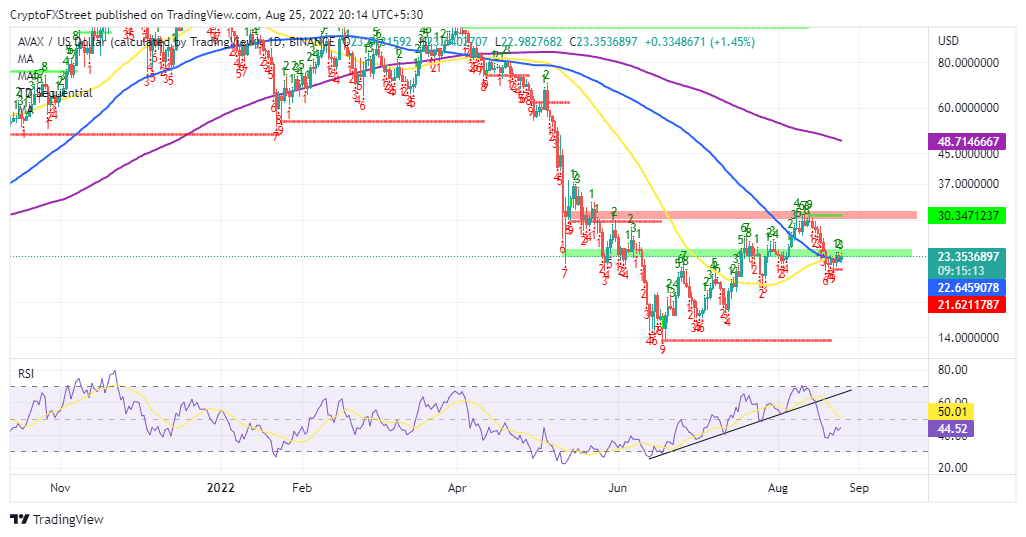

Avalanche price faces acute resistance at $24.00 after bouncing off last week’s support near $21.00. A positive outcome will likely emanate from the ongoing tug of war if the confluence support formed by the 50-day Simple Moving Average (SMA) and the 100-day SMA on the daily chart remain intact.

The anticipated move to $30.00 will greatly depend on the Avalanche price ability to slice through the above seller congestion zone. A buy signal from the TD Sequential indicator reveals that the path with the least resistance is north. This call to buy manifests in a red nine candlestick – signaling waning selling pressure.

Buy orders are recommended when the low of the six and seventh candles in the count is surpassed by that of the eighth and ninth bars.

AVAX/USD daily chart

Avalanche price may flaunt another buy signal if the 50-day SMA exceeds the 100-day SMA. Although this is not a typical golden cross pattern, its occurrence adds credence to the token’s bullish outlook.

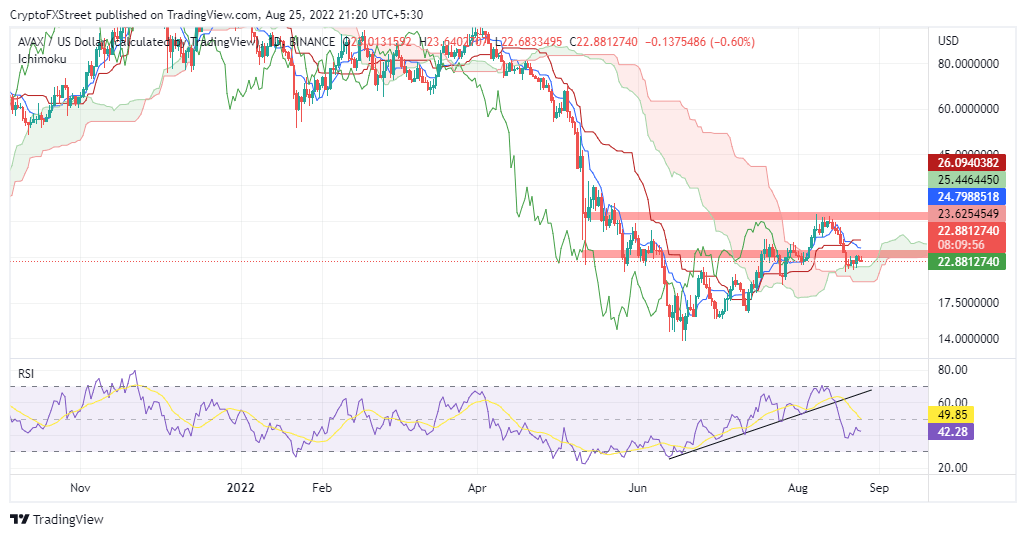

The Ichimoku cloud on the same daily chart validates the bullish narrative. As long as Avalanche price sits above this technical index, it would be very conservative to leave the target at $30.00 when $45.00 is well within reach.

AVAX/USD daily chart

On the contrary, AVAX is not out of the woods yet, considering a huge bearish divergence of the Relative Strength Index (RSI) from the price. Besides, closing the day below the supply area at $24.00 may weigh down on the bulls’ efforts to resume the uptrend and allow Avalanche price to dive south again – but this time, losses may stretch to $17.50 and $14.00, respectively.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren