Avalanche Price: Positive trading activity fails to excite a reaction from AVAX

- Avalanche network activity has skyrocketed, but the case is not reflected in AVAX price.

- The network recorded the highest number of active addresses after witnessing a tumble for most of March.

- Two important upgrades that could have boosted network traffic were rolled recently but did not influence price.

Avalanche (AVAX) network started the month on a promising note, with the chain recording the highest value in daily active addresses on a year-to-date timeframe. Notably, the numbers were up by over 70,000.

With the number of addresses surging, the transaction count on the platform rose in tandem. Data from Token Terminal shows that the transaction fees that the platform collected hit a one-month high on April 11.

Avalanche network appeal on the rise

Moreover, the Avalanche network rolled out two key upgrades expected to spark network traffic.

Evergreen Subnets

Avalanche developer, Ava Labs, unveiled the Evergreen Subnets during the first week of April, an infrastructure meant to address requirements unique to the company’s financial services.

Introducing Avalanche Evergreen Subnets

— Avalanche (@Avax) April 6, 2023

Institutions want to leverage the power of public blockchain development, interoperability and composability while enabling features historically only possible with enterprise blockchains.

Evergreen gives them the best of both worlds pic.twitter.com/EbziGmGrYY

The Evergreen Subnets help institutions pursue their blockchain and digital asset projects in private, permissioned chains with verified counterparties while maintaining communication and interoperability with other institutions.” Based on a recent tweet, the network cited the example of Intain, a debt capital markets platform.

The efficiencies unlocked by blockchain can be hard to quantify–but @intainft did just that in the latest Powering Business with Blockchain.

— Avalanche (@Avax) April 11, 2023

Take a look at how much time and money their system saves by replacing email and Excel with an #Avalanche Evergreen Subnet pic.twitter.com/5iZrAImexd

Intain increased its workflow efficiency after transitioning to the Evergreen Subnets.

Cortina Upgrade

The second development entailed the layer-1 blockchain’s Cortina Upgrade, implemented on its Fuji testnet.

Big news for #Avalanche

— PrimeXBT (@PrimeXBT) April 12, 2023

@Avax has launched its #Cortina upgrade on Testnet, which is expected to improve support for exchanges and enable faster development.

$AVAX is up 5% on the week.

Explore here:https://t.co/fVG9vfoURC#PrimeXBT #AVAX pic.twitter.com/cqVM4KctFN

The Cortina Upgrade simplifies the process for exchanges to support Avalanche’s X-Chain that sends and receives funds. The development brings a wide range of benefits, but the main one, according to Avalanche, is that it will enable faster development and more widely applicable innovation.

Head of engineering at Ava Labs, Patrick O’Grady, said that Cortina’s mainnet launch is slated for April 25, 2023.

Undoubtedly, these upgrades have played a crucial role in the increased network activity displayed on the Avalanche network of late.

Avalanche TVL hints at a possible recovery

The total value of assets held on the Avalanche network is $850.76 million based on DefiLlama data at the time of writing. This total value locked (TVL) hints at a possible recovery as it is up by around 15% from a low of 736.74 million on March 11.

The improvement catapulted Avalanche to position number seven (#7) in the list of blockchains with the highest TVL.

Avalanche price has other plans

While the network remains bullish, the Avalanche price seems to have other plans, as AVAX is still shy of gains.

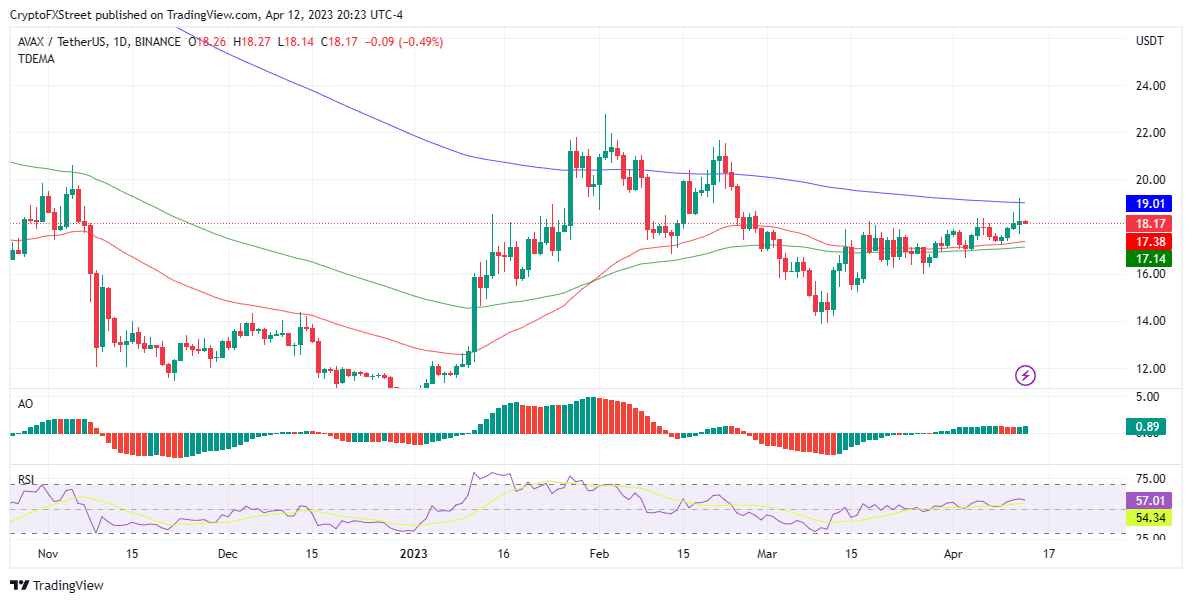

AVAX/USDT 1-day chart

At the time of writing, AVAX is auctioning for $18.17, down 0.1% in the last 24 hours but up only 1.1% in the last week. A look at the derivatives markets shows traders readying for gains in Avalanche price are less than those anticipating more losses, putting the longs to shorts ratio (taker buy/sell ratio) down to 0.59%.

Based on CoinMarketCap data, trading activity around AVAX is up almost 70%, presumably because market players are shifting to assets with less boring price actions.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.