Avalanche price makes a turn for the better

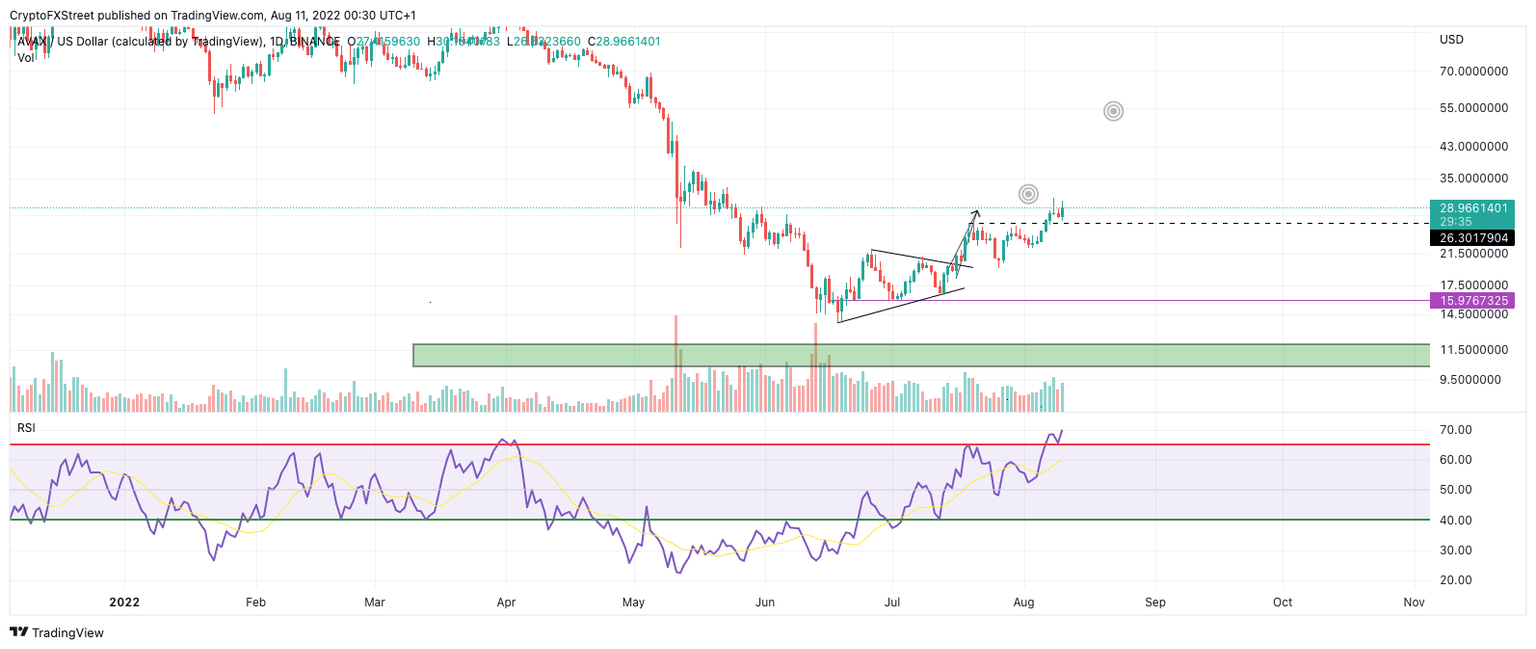

- Avalanche price shows classic ramping pattern accompanied with price ascension.

- AVAX price has breached the oversold level on the Relative Strength Index.

- If the technicals are correct, a breach of the $50 barrier could happen rapidly.

Avalanche price looks strong which may be a shock to many analysts eyes during this bear market.

Avalanche price looks impulsive

Avalanche price currently auctions at $29. The digital gaming token could be showing early stages of a journey to the moon as technicals appear rather unusually bullish. If market conditions are genuine, extreme volatility for traders is to be expected. AVAX price could become the scalpers’ playground for this month.

Avalanche price technical indicators confound the idea of an explosive rally. The Relative Strength Index has breached oversold territories while the Volume Profile Indicator produces a classical volume ramping pattern.

When combined, it appears AVAX price could be witnessing the calm before the storm stages. A second breach of $30.50 should be enough to propel the digital gaming token in an explosive manner. First target is $40, with an extended variant at $50.

AVAX/USDT

If the technicals are genuinely as bulliish as they seem. then the AVAX price should not be lured into breaching lquidity levels lying below the swing low below $22. If this bearish event occurs the AVAX prrice uptrend would be in jepordy with a decline towards $14 and possibly $10 as a possible outcome.

In the following video, our analysts deep dive into the price action of Avalanche, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.