Avalanche price crashes as almost 10 million AVAX tokens flood market in cliff unlock

- Avalanche price has dropped 15% since a rejection from the $49.96 range high, worsened by a cliff token unlock event.

- AVAX could extend the fall 14% to the $32.08 support if the 50-day SMA support capitulates.

- The price clearing the $49.96 range high would invalidate the bearish thesis.

Avalanche (AVAX) price has seen a tough second half of February with a price action characterized by lower highs and lower lows. With Bitcoin (BTC) still giving indecisive cues and the market leaning toward the downside, AVAX holders should probably brace fora more mucky rest of the week.

Also Read: Uniswap launches v2 on Arbitrum, Polygon, Optimism, Base, Binance Smart Chain and Avalanche

Avalanche network $356 million worth of AVAX to the market

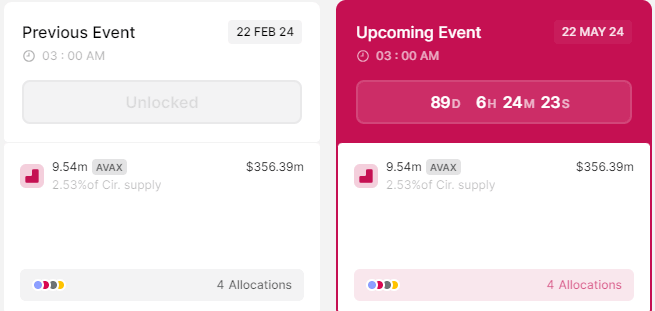

The Avalanche network unleashed 9.54 million AVAX tokens worth $356.39 million to the market on Thursday. The tokens constitute roughly 2.6% of the total supply. The event was a cliff unlock, where the tokens had been set to unlock on a schedule that is more periodic than daily, and not the traditional weekly, monthly or yearly periodicals.

AVAX token unlocks

Token unlocks are considered a bearish catalyst because of the increased supply. In the Avalanche network’s previous unlock in November 2023, investors who expected a price drop were disappointed. While they expected a dip, the price soared 5% within the first week, before skyrocketing 44% within two weeks.

If history is enough to go by, Avalanche price could pump now that the unlock is over. However, for the meantime, the odds continue to favor the downside.

Avalanche price outlook after millions of AVAX tokens flood market

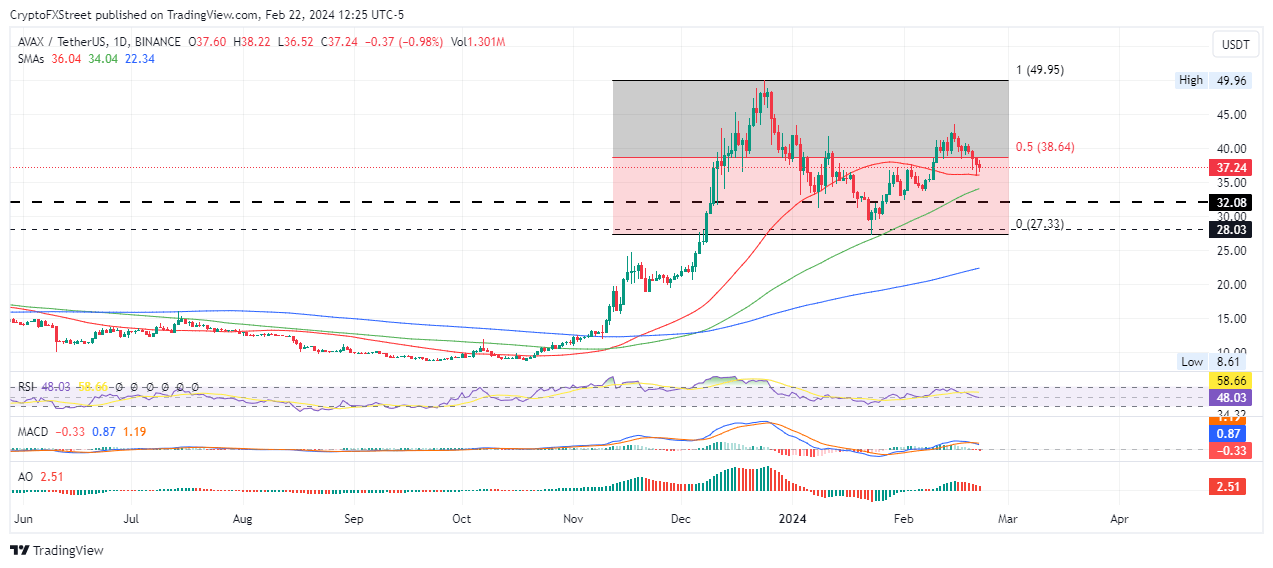

Avalanche price is sitting on support due to the 50-day Simple Moving Average (SMA) at $36.04. The Relative Strength Index (RSI) is below 50 and southbound, which points to falling momentum. The Moving Average Convergence Divergence (MACD) is also below its signal line (orange band) with histogram bars flashing red in negative territory. The histogram of the Awesome Oscillator (AO) is also flashing red, signifying a strong bearish grip on AVAX.

If the 50-day SMA gives way, Avalanche price could drop to test the 100-day SMA at $34.04. In a dire case, the slump could see AVAX price revisit the $32.08 support level, which was last tested on January 27. Such a move would constitute a 14% drop below current levels.

AVAX/USDT 1-day chart

On the other hand, if the bulls increase their buying pressure, Avalanche price could recover north, flipping the 50% Fibonacci retracement level at $38.64 into support. An extended move north could see AVAX price move past the $40.00 psychological level to reclaim the February 15 range high of $43.60, 17% above current levels.

For the bearish thesis to be invalidated, however, Avalanche price must extend the gains 35% above current levels, filling the market range at $49.96 and creating a higher high above it.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.