Avalanche Network introduces Firewood upgrade amid declining on-chain activity, AVAX holders uncertain

- Avalanche introduces Firewood as an efficient blockchain database system.

- The smart chain platform notes a decline in several key metrics like active addresses, revenue and fees generated.

- AVAX price could decline in the short term amid dismal on-chain metrics.

Avalanche Network will soon get an upgrade known as "Firewood," which is an efficient system for storage of Merkalized blockchain state. Ava Labs announced that Firewood is currently in the development stage and is not ready to be deployed yet.

Also Read: 99% of AVAX holders are in loss ahead of nearly $100 million token unlock

Avalanche network introduces Firewood

Avalanche Network has added a developer preview of Firewood on its network. Ava Labs, the creator of Avalanche blockchain, explained that the upcoming upgrade will tackle one of the most important bottlenecks – blockchain scaling.

The goal of an intelligent filing system is to efficiently organize information while enabling effective state management to help scale blockchains. However, projects like Bitcoin and Ethereum use a tree data structure or Merkleized storage on their blockchains. Firewood is designed to read Merkleized blockchain state under heavy loads.

Unlike other blockchain database management systems, Firewood is not based on generic key-value stores like LevelDB or RocksDB. Ava Labs, the company behind Avalanche, said that it will evaluate Firewood's performance in comparison to other blockchain databases in the coming months.

While the update for Firewood is still under work, it is a bullish development for the Avalanche ecosystem from a big-picture perspective. But the on-chain metrics reveal a not-so-optimistic outlook, which could add headwinds to AVAX price.

AVAX price to take a hit

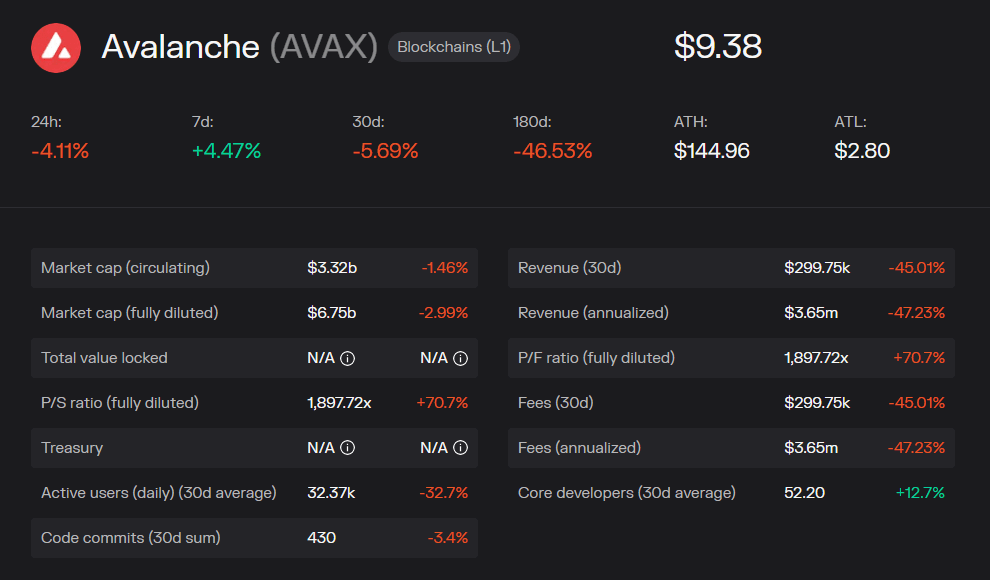

According to Token Terminal statistics, the number of addresses actively interacting with the Avalanche network has declined over the past month, indicating a capital flight. The 30-day Active Users average has dropped nearly 33%.

Additionally, its 30-day revenue has also taken a hit with the fall in activity. Revenue that AVAX generated from fees and other sources for the period is down 45%. Annualized fees for the chain stand at $3.65 million, down over 47%.

With the network’s key metrics on a slump, AVAX price, which currently trades at $9.35, is likely to suffer a further decline.

AVAX Key Metrics

Author

Shraddha Sharma

FXStreet

With an educational background in Investment Banking and Finance, Shraddha has about four years of experience as a financial journalist, covering business, markets, and cryptocurrencies.