Avalanche, Lido DAO, Space ID to unlock $126 million worth of cliff token unlocks this week

- Avalanche, Lido DAO, and Space ID are set to release up to $126 million in total unlocks this week.

- Some tokens will go to community airdrop, project development, marketing, and investor motivation.

- Investors should brace for a potential move, with the ensuing sell-off likely to send AVAX, LDO, and ID prices south.

Several tokens have unlock events scheduled for different days this week, with Avalanche, Lido DAO, and Space ID featuring among the most voluminous. On August 22, 25, and 26, the circulating supply of ID, LDO, and AVAX will increase by 18.49 million, 8.50 million, and 9.54 million tokens, respectively.

Also Read: Arbitrum will unlock $1.2B ARB in March 2024: Token unlocks

AVAX, LDO, ID to unleash $126 million in token unlocks

The circulating supply of Avalanche, Lido DAO, and Space ID is set to increase. The event will be a cliff token unlocks, where a specified amount of tokens are unlocked immediately after a specified period or vesting phase. For the Lido DAO ecosystem, the tokens will go to investors.

Space ID will allocate the tokens towards project development, comprising a community airdrop, an ecosystem fund, the foundation, and marketing. On the other hand, Avalanche will give the tokens to the strategic partners of AVAX, its team, the foundation, and for airdrop purposes.

Potential impact of cliff token unlocks

Once the cliff unlock commences, a significant amount of tokens are paid out, which increases the circulating supply of the tokens rapidly. This creates selling pressure, causing the prices of the involved tokens to fall.

As token unlocks add to the circulating supply, they are bearish in nature. The unleashed tokens come into the circulating supply, causing an increase in selling pressure that may lead to the value of existing tokens depreciating.

Before the token unlocks, early investors, developers, and other holders can sell their assets while the price is still high. Owing to the speculative nature of the crypto market, market prices tend to rise before the unlock event.

For Space ID, the tokens going toward the ecosystem fund, community airdrop, and the foundation will likely not be sold immediately for a profit. Nevertheless, the marketing and airdrop chunk will likely add to the selling headwinds for ID tokens. On the other hand, Avalanche could indicate a price slump, with tokens going to partners and the airdrop, but those allocated to the foundation and the team may be held for a while. For Lido DAO, tokens will go to investors, meaning chances of seller momentum are high, and LDO could indicate a significant price move to the downside.

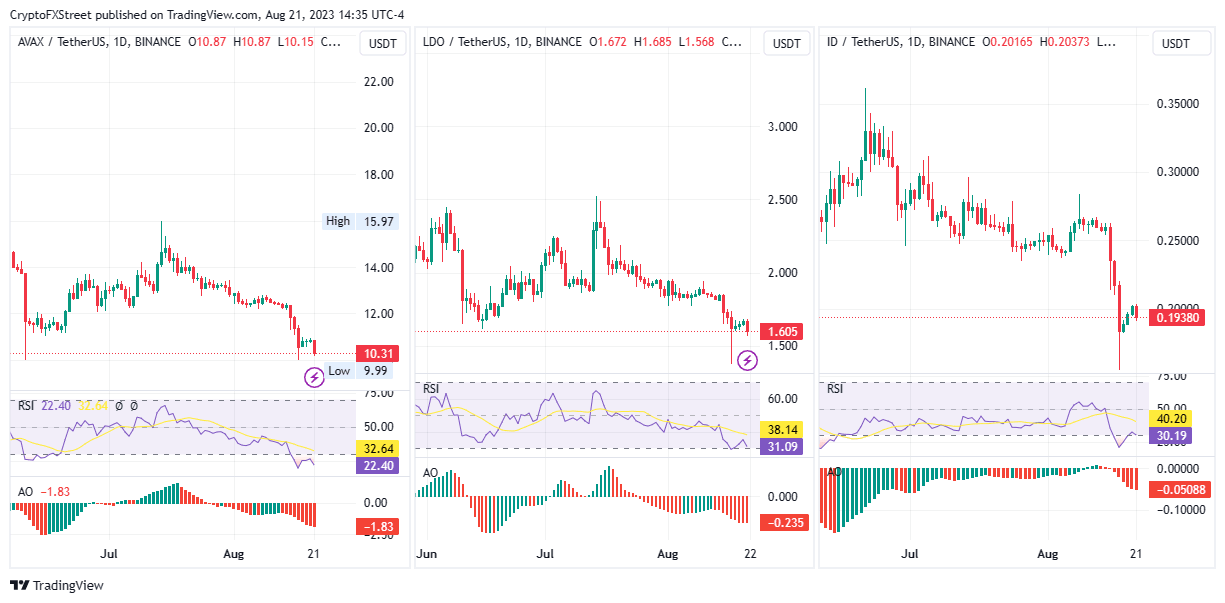

AVAX/USDT 1-day chart, LDO/USDT 1-day chart, ID/USDT 1-day chart

Generally, when tokens go towards the treasury or toward project development, the chances of these tokens being kept within the ecosystem are high as the holders are less likely to sell them for profit. Conversely, when the unlocks go to partners, advisors, and early investors, there is a high selling risk because of the significant stake risk involved.

Investors can earn with Avalanche, Lido DAO, and Space ID’s token unlocks by short selling ahead of the unlocks. This could see profit from falling prices. However, making investment decisions based on research is imperative and always advisable.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.