Avalanche Foundation’s meme coin investments are underwater, AVAX price sees 36% weekly gains

- Avalanche Foundation’s portfolio has five meme coins and the Avalanche-based assets are hit by a correction.

- Avalanche blockchain’s native token AVAX price offered 36% weekly gains.

- COQ, KIMBO, GEC and TECH are currently underwater.

Avalanche-based meme coins have found a place in the Foundation’s portfolio. The Avalanche Foundation has directly invested in AVAX ecosystem’s meme coins, Kimbo (KIMBO), Coq Inu (COQ), Gecko (GEC), Technology joke token (TECH) and Avax has no chill (NOCHILL).

While Bitcoin and the broader crypto market started recovering from its decline in the past day, Avalanche-based meme coins are in a downward trend.

Also read: Avalanche foundation snaps up KIMBO, COQ, and three other tokens as first Meme Coin investment

Avalanche Foundation sits on unrealized losses from meme coin holdings

While the crypto market has started recouping its recent losses as Bitcoin gains lost ground, making a comeback above $68,600 on Saturday. However, Avalanche-based meme coins are hit by a correction in their prices in the past day.

KIMBO, COQ, GEC, and TECH prices declined 2%, 7%, 12%, 13%, respectively, in the past 24 hours. NOCHILL price climbed nearly 11%, emerging as an outlier among the Foundation’s meme coin holdings.

The meme coins in the Foundation’s portfolio have been issued within the past few months and the daily trade volume of the tokens is in millions of dollars. While Avalanche Foundation’s announcement acted as a catalyst, driving the prices of these assets higher, post the disclosure, the meme coins are yet to recover from the market-wide correction.

AVAX price could rally to $70

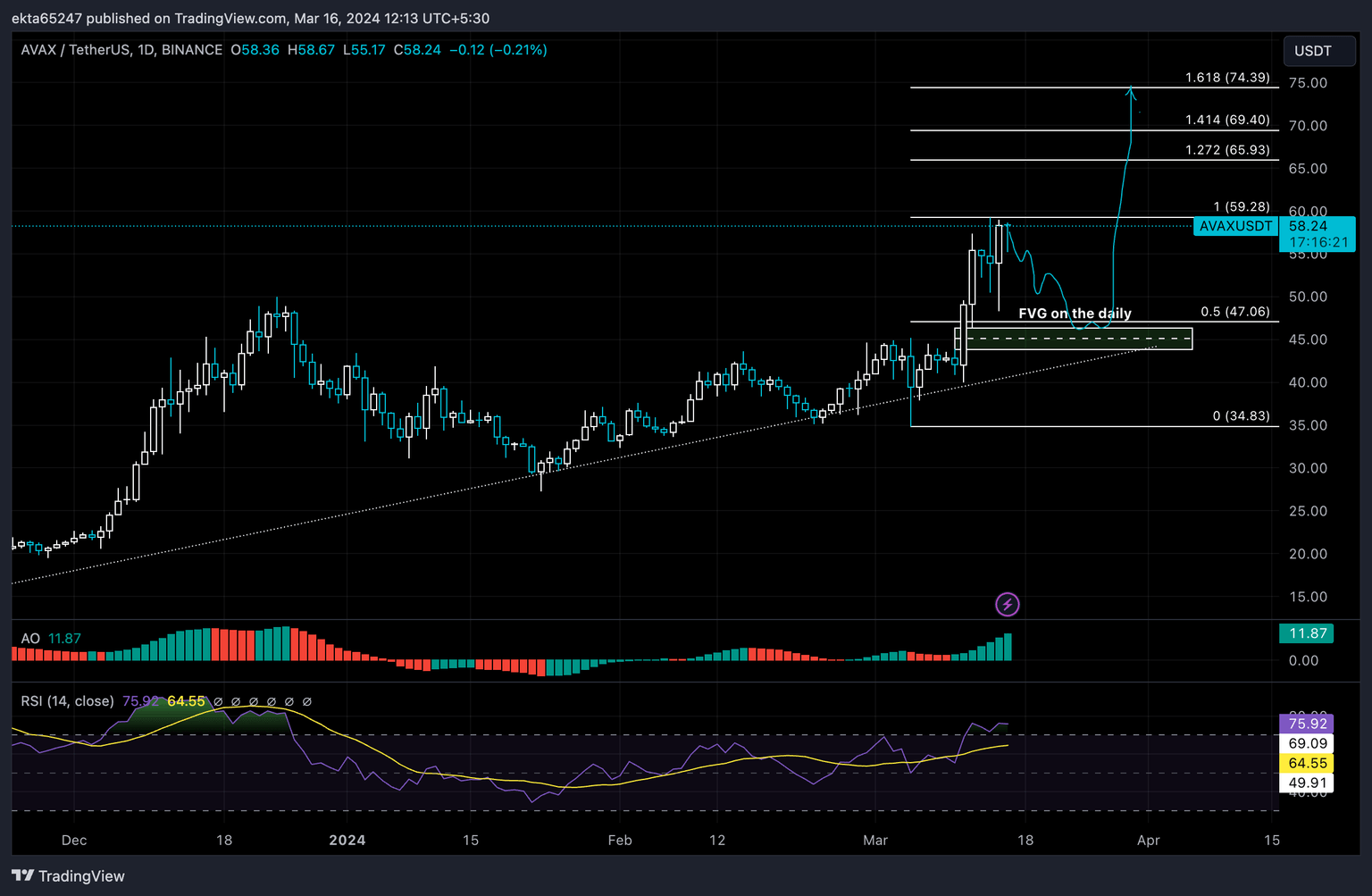

Avalanche price could rally towards $70, above 141.4% Fibonacci retracement level of its climb to its year-to-date high of $59.28. The green bars on the Awesome Oscillator (AO) shows there is positive momentum and AVAX price uptrend is intact. The Relative Strength Index (RSI) reads 75.92, the asset is overvalued or overbought, according to the indicator.

The RSI’s reading informs that there is a likelihood of a correction, AVAX price could sweep the Fair Value Gap (FVG) on the daily chart, between $43.93 and $46.34. Once AVAX fills the gap, the token could resume its climb towards the $70 target.

AVAX/USDT 1-day chart

A daily candlestick close below the lower boundary of the FVG, at $43.93, could invalidate the bullish thesis for Avalanche price.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.