Avalanche (AVAX) is paying the price for being one of the collateral assets that maintain Terra's native stablecoin TerraUSD's (UST) peg with the U.S. dollar.

Major AVAX dump ahead?

AVAX's price dropped about 30% to reach $32.50 on May 11, its lowest level since September 2021. Its massive intraday decline coincided with UST dropping to as low as 23 cents, which effectively dented its stablecoin status among traders and investors alike.

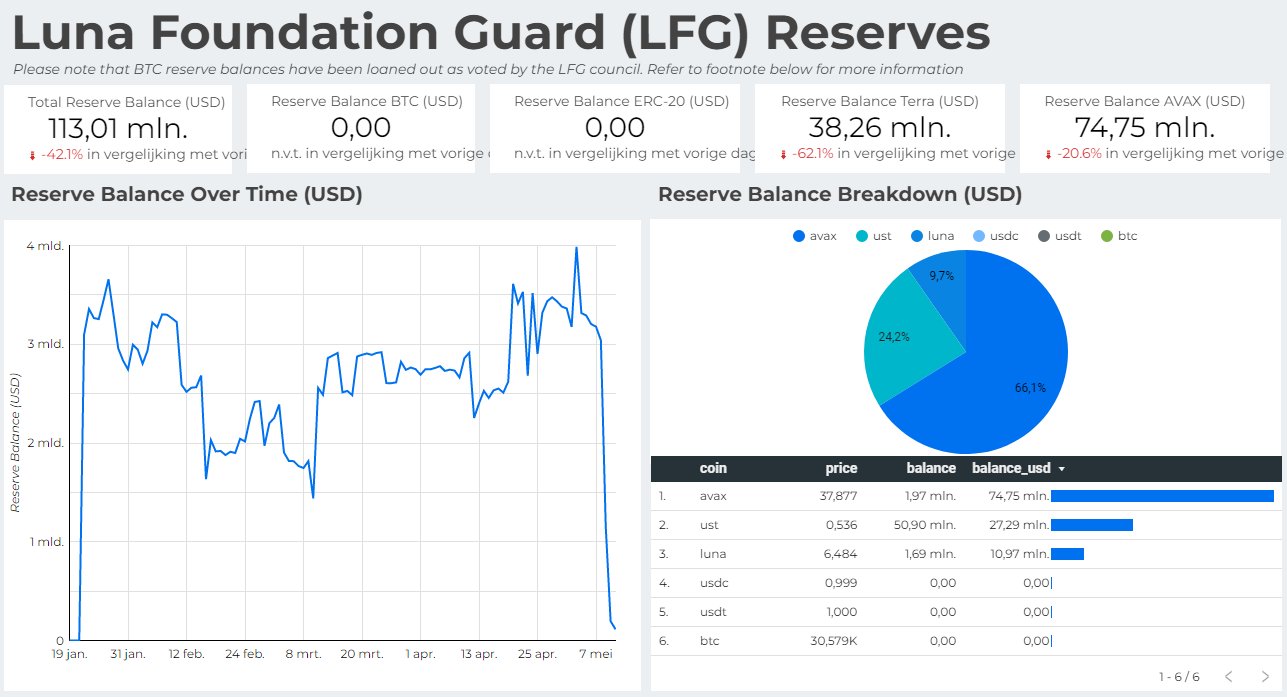

The de-peg incident happened despite Luna Foundation Guard, a Singapore-based nonprofit backed by TerraLabs, emptying its crypto reserves to prop up the UST peg. The firm currently holds 1.97 million AVAX worth nearly $74.75 million, according to data shared by analyst CrypOrca.

Luna Foundation Guard reserves. Source: CryptOrca

A similar sentiment can be witnessed in the LUNA market, another crypto LFG holds as collateral to back UST. LUNA's value dropped by 85% on May 11, its worst daily performance.

Bearish AVAX price technicals

Avalanche bulls attempted to save AVAX from falling below a key support line near $36, coinciding with the 0.238 Fib line of the Fibonacci retracement graph stretched from the $0.29-swing low to the $34.52-swing high.

Their efforts helped the token recoup almost 22% of its May 11 losses, with its price rebounding from $32.50 to over $39.50.

But a full-fledged bullish reversal appears unlikely as AVAX's upside retracement faces one strong resistance after another.

Initially, the token now eyes a run-up toward a support-turned-resistance area, marked as the accumulation zone in the chart below. The upside target coincides with the 0.618 Fib line around $67.

AVAX/USD daily price chart. Source: TradingView

A decisive close above the zone could have AVAX test its 50-day exponential moving average (50-day EMA; the red wave) near $69 and its 200-day EMA (the blue wave) around $74 as next resistances.

But AVAX also faces headwinds from a higher interest rate environment that has dampened buying sentiment across the crypto market.

This could prompt the AVAX/USD pair to retest $36 as support for a breakdown move, which risks leading the price toward $20, an important price floor from February-April 2021.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

President Trump's memecoin leads crypto unlock with incoming supply pressure of over $320 million

Official Trump, launched by President Trump, will unlock over $320 million worth of its tokens to team members next week despite the dominant risk-off sentiment across the crypto market.

Bitcoin and crypto market sees recovery as Fed official says agency ready to stabilize market if necessary

Bitcoin rallied 5% on Friday, trading just below $84,000 following Susan Collins, head of the Boston Federal Reserve, hinting that the agency could stabilize markets with "various tools" if needed.

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin holding steady at $82,584, Ethereum at $1,569, and Ripple maintaining its position above $2.00.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Crypto traders are digesting US President Donald Trump’s Liberation Day announcements last week, the tariff truce declared on Wednesday and the worsening situation with China, as the industry wraps one of its worst weeks in terms of price swings.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.