Prices

Is Bitcoin’s rally coming to an end?

Good morning Asia, here’s how the markets are beginning the East’s trading day.

Bitcoin is beginning the trading day in the red, down 0.63% to $27,805. Ether is down 2.5% to $1,741.

The big question on everyone’s mind is, of course, interest rates.

In a recent note, Goldman Sachs Chief Economist David Mericle said that the Fed will pause interest rate hikes because of stress on the banking system.

“While policymakers have responded aggressively to shore up the financial system, markets appear to be less than fully convinced that efforts to support small and midsize banks will prove sufficient,” Mericle wrote. “We think Fed officials will therefore share our view that stress in the banking system remains the most immediate concern for now.”

Delphi Digital co-founder Tom Shaughnessy says the market is giving off mixed signals. While many say the possibility of the Fed pausing rate hikes is a bullish signal for bitcoin, the reality might be something else entirely.

“The data suggests that once the Fed stops raising or pivots, that’s historically when markets sell off,” he said on a recent CoinDesk TV appearance. “I think the rally is less about the Fed pausing, and more about liquidity pressures or surpluses there.”

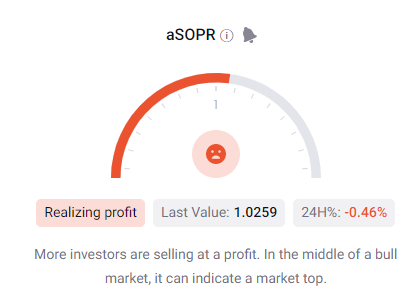

Data from CryptoQuant might back up Shaughnessy’s thesis. Its Adjusted Output Profit Ratio gauge, which tracks the profitability of HODLers, shows that more investors are selling at a profit. In the middle of a bull market, this can indicate a market top.

(CryptoQuant)

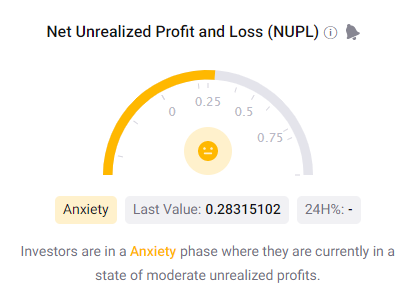

At the same time, its Net Unrealized Profit and Loss shows that investors are in an anxiety phase, where they have moderate unrealized profits.

(CryptoQuant)

All eyes are going to be on the Fed’s next announcement to see if its bullish or bearish for bitcoin.

Insights

Crypto VC funding was resilient in the bear market. It’s now powering through this mini-bull cycle

Crypto winter was a harsh and cold one for venture capital deals. A report from CoinDesk in January painted a bleak picture for VC activity: down 91% year-over-year.

But spring has sprung, and crypto is once again rallying. The macroeconomic environment has gone a little weird, and bitcoin has $30,000 in its sights.

Crypto VC funding is coming right back with it.

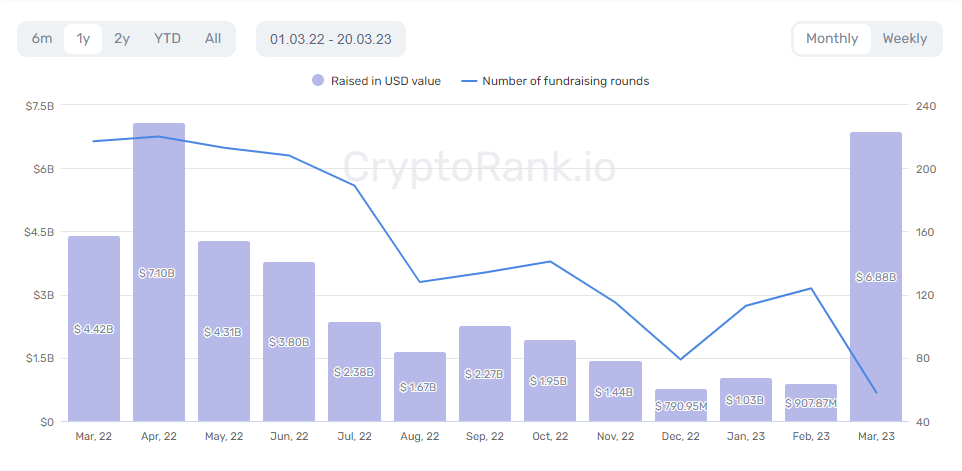

Data from CryptoRank.io shows that a rebound is taking place.

(CryptoRank.io)

“Despite the inherent volatility of the cryptocurrency market, venture capitalists remain undeterred and continue to pour significant investments into the industry, recognizing its immense potential for long-term growth,” CryptoRank’s analyst team said in a note prepared for CoinDesk.

CryptoRank’s analysts say the VC market’s confidence is reinforced by the substantial increase in the number of funding rounds observed in recent months, which the analysts say indicates the burgeoning interest and optimism within the industry.

“Many funds reported losses in 2022 and now have to reduce their investment activity,” the analysts said in their note. “Other VCs, which were more cautious in their investments last year, are now taking the opportunity to use the preserved capital.

Banking will remain a challenge

In the days before Silvergate’s collapse, bitcoin was stuck between Silvergate and China. The impending loss of crypto’s go-to bank dragged down prices, adding sell pressure, while the China narrative of Hong Kong relaxing regulations on institutional and retail trading pulled it up.

And then the Bank Term Funding Program (BTFP) happened, with a major money print from the Fed.

Risk assets are suddenly back in play.

Banking remains a challenge, but other financial institutions are stepping up to the plate, some of which are outside of the U.S. and out of reach of its regulatory regime.

For VCs, this is a separate and unique issue; they need a bank familiar with the sector. Crypto and tech startups as well as small VC funds are turned down by many banks because they are deemed as not worth the risk.

“The problem has far wider implications than the temporary depegging of stablecoins. We expect to see a decline in VC activity, which will have a knock-on effect on crypto fundraising,” the analysts wrote in their note. “SVB provided one of the most popular banking infrastructures for VC investors. Now they will have to look for new opportunities, but the pressure on crypto-friendly banks is a significant red flag.”

This might be Singapore’s time to shine. It’s understood that banks with USD rails will step up and fill the gap. DBS is thought to be a contender, given that it runs a crypto exchange. Or, it might be something entirely different.

“VC fundraising for crypto is driven by a younger generation of alternative fund managers breaking away from TradFi institutions to raise their own capital in Asia,” adds Katherine Ng, Managing Director of TZ APAC, Asia’s leading Tezos blockchain Incubator.

For now, U.S. banks still dominate the sector and have outsized influence on all regions. But it could be time for other institutions to step up.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.