-

Niche celebrities have recently launched tokens in the crypto market using the Pump Fun application on Solana.

-

Early buyers of these celebrity-backed tokens have made significant profits, with some tokens netting six-figure profits in a short time.

-

The ease of launching tokens and the subsequent profits have sparked criticism and concern within the crypto community, with some describing it as a "net negative" for the industry.

It looks like froth season yet again in crypto markets as niche celebrities latch on to the instant meme coin creation hype.

American media personality Caitlyn Jenner and rappers Iggy Azalea, Trippie Redd, and Davido have all launched tokens in the past week. They used the Pump Fun application, which recently caught fire on Solana by enabling anyone to easily issue a coin attached to an image.

But the profits haven’t been widespread. Blockchain data suggests that early groups of traders were quick to accumulate most of the supply of these tokens before the celebrities promoted them on their X profiles – earning, in some cases, quick six-figure profits.

For instance, Solana blockchain data shows a single address bought over 70% of Redd’s BANDO token shortly after it went live early Thursday. The tokens were then dispersed to 190 other wallet addresses, blockchain sleuth ZachXBT said on X.

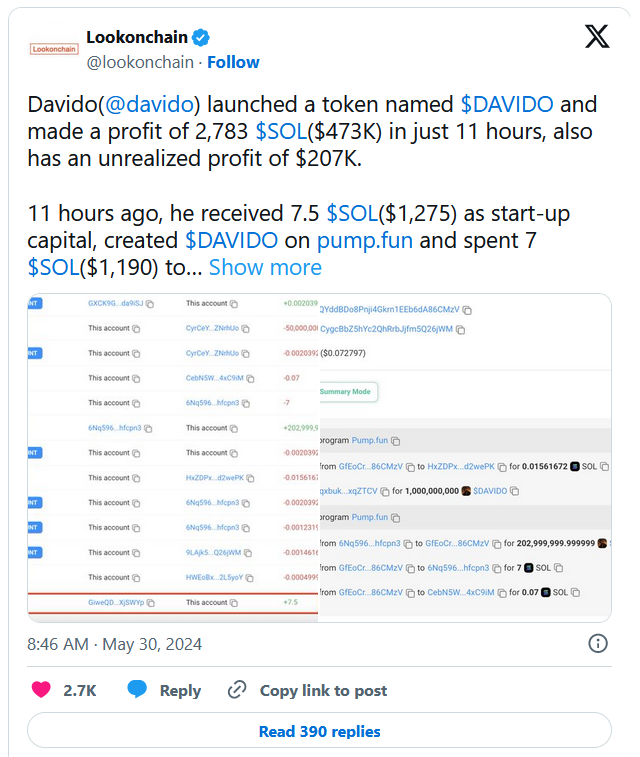

Nigerian record producer Davido’s DAVIDO token netted early buyers a profit of nearly $470,000 worth of Solana’s SOl tokens in just 11 hours, on-chain firm Lookonchain flagged, from just over $1,000 in initial capital. This analysis was done by tracking the deployer of the original token, counting how many tokens they acquired after issuance and the sales in the hours afterward.

ZachXBT flagged that Davido had previously launched and promoted “multiple scams in the past” such as RapDoge, Echoke and Racksterli, an investment ponzi scheme. DEXTools data shows prices of these tokens dropped more than 99% in the days following their online promotion.

“Their sole interest is to extract $$$ for minimal effort,” ZachXBT said in an X post. “A random meme coin shill out of nowhere does the space no good + does not prove they have a genuine interest.”

Davido’s X profile did not return a comment requesting clarity on these allegations as of Friday morning.

Iggy Azalea’s MOTHER apparently made early traders $2 million in profits, data tracking firm Bubblemaps said in an X post. Bubblemaps said 20% of the supply at issuance hours had been bought by a small bunch of wallets before Azalea posted about the token’s existence on X. The token is down 70% since Wednesday.

Easy issuance, easy money

All of these celebrity-promoted tokens were launched on Solana token generator Pump Fun. These tokens are automatically listed on the decentralized exchange Raydium after a certain trading volume is met.

DEXTools data shows most of these tokens ran to market capitalizations of as much as $25 million in the hours after issuance, racking up tens of millions in trading volumes. However, all of them have been down more than 50% since highs – a sign of selling pressure amid the hype.

JENNER tokens are down more than 80% since going live. Other recently launched celebrity tokens have fared similarly. (DEXTools)

The first of these celebrity tokens was Jenner’s JENNER meme token on Monday, which sowed confusion among market observers as its legitimacy was questioned due to past celebrity X account compromises.

Jenner’s X profile has continued to promote the token, although CoinDesk has not received confirmation of her involvement in the token despite multiple messages to her official media inquiry department.

While issuing tokens is not a harmful activity by itself, crypto market participants are criticizing how these celebrities have seemingly emerged out of the woodwork in an easy environment, making quick money from unsuspecting followers. Some have described this as a “net negative” for the industry.

Memes are hard work

Meanwhile, some meme coin developers told CoinDesk in Telegram interviews that while creating meme tokens may seem like a fun activity from the outside, they often require substantial effort to become long-term projects that win community trust.

“Successful meme coins take a lot of effort: it takes time for the culture, community, and more to develop,” Floki core team member B told CoinDesk. “Even more so if you’re focusing on fundamentals instead of just quick hype, like we try to do at Floki.”

“Many of these celebs are just banking on the hype with a pump and dump cash grab and extract as much liquidity as possible from their followers,” B added.

However, B opined there’s a way to issue personal branded meme tokens and do it right.

“Celebrities coming into crypto and participating in the ecosystem is definitely a good thing if done right. If they are really keen on launching tokens, however, they can launch social tokens around their brand and products and add value to the token for holders instead of the current trend where they launch a meme coin and allocate a portion of the supply to themselves only to proceed to dump it on unsuspecting followers almost immediately."

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Crypto fraud soars as high-risk addresses on Ethereum, TRON networks receive $278 billion

The cryptocurrency industry is growing across multiple facets, including tokenized real-world assets, futures and spot ETFs, stablecoins, Artificial Intelligence (AI), and its convergence with blockchain technology, as well as the dynamic decentralized finance (DeFi) sector.

Bitcoin eyes $100,000 amid Arizona Reserve plans, corporate demand, ETF inflows

Bitcoin price is stabilizing around $95,000 at the time of writing on Tuesday, and a breakout suggests a rally toward $100,000. The institutional and corporate demand supports a bullish thesis, as US spot ETFs recorded an inflow of $591.29 million on Monday, continuing the trend since April 17.

Meme coins to watch as Bitcoin price steadies

Bitcoin price hovers around $95,000, supported by continued spot BTC ETFs’ inflows. Trump Official is a key meme coin to watch ahead of a stakeholder dinner to be attended by President Donald Trump. Dogwifhat price is up 47% in April and looks set to post its first positive monthly returns this year.

Cardano Lace Wallet integrates Bitcoin, boosting cross-chain capabilities

Cardano co-founder Charles Hoskinson announced Monday that Bitcoin is integrated into the Lace Wallet, expanding Cardano’s ecosystem and cross-chain capabilities. This integration enables users to manage BTC alongside Cardano assets, providing support for multichain functionality.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.