As meme coins go extinct, this Ethereum sector is likely to grow massively

- Meme coins like DOGE, SHIB, WIF etc., are down double digits in the past five days.

- Ethereum-based altcoins like ENS, LDO and PENDLE have risen amid bearish market conditions.

- Investors can expect ETH-related altcoins to heat up as the spot Ethereum ETF decision nears.

The bull run has favored meme coins, be it on the Ethereum or the Solana blockchain. This phase has spawned multi-million dollar meme coins like dogwifhat (WIF), BOOK OF MEME (BOME), MAGA (TRUMP) and so on. However, due to the recent market outlook, meme coins have suffered a massive blow to the body.

Meme coins shed weight

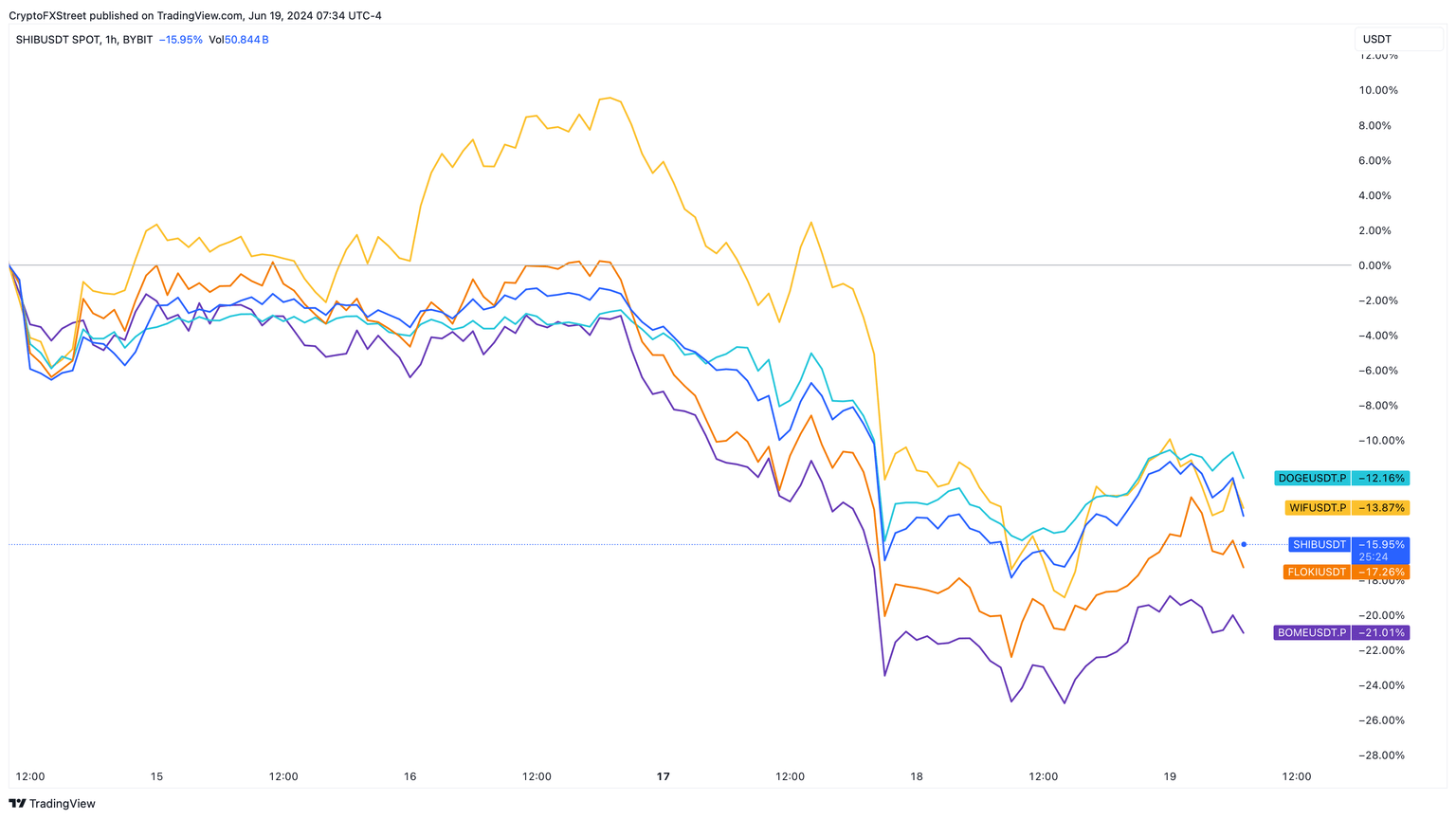

In the last five days, Dogecoin (DOGE), Shiba Inu (SHIB), and dogwifhat (WIF) have been down 13%, 15% and nearly 20%, respectively. The month-to-date performance shows these coins' performance ranges from -20% to nearly -40%, denoting the current state of the meme coin sector.

Meme coin price performance

Capital rotates into ETH-based altcoins

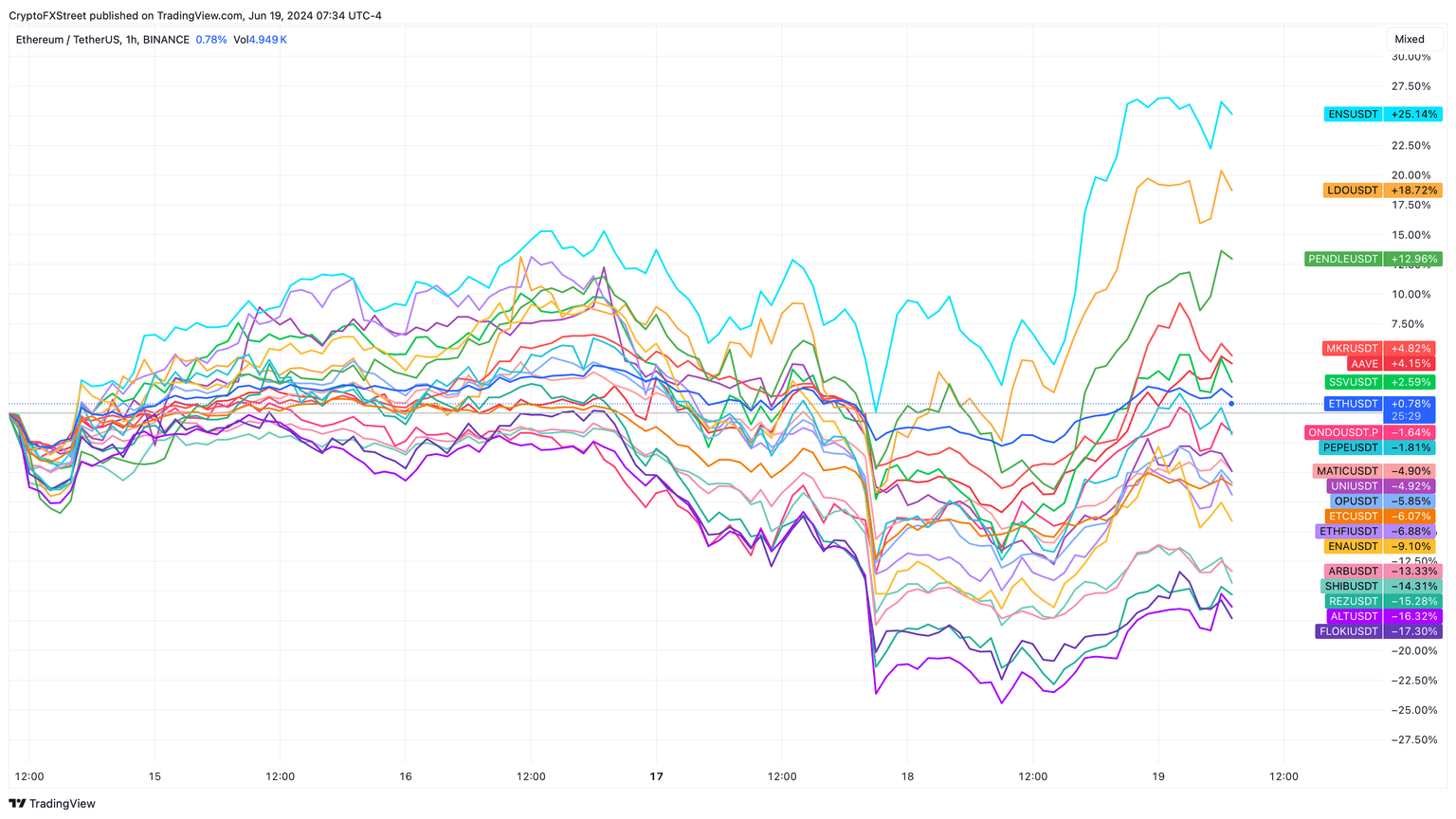

As mentioned in a previous FXStreet publication, the choppy market moves are culling not just meme coins but eager bulls as well. But one sector of altcoins has shown incredible potential to recover from the past week’s downward trend – Ethereum-based altcoins.

Ethereum Name Service (ENS) price has shot up 26% in under five days. Lido DAO (LDO) and Pendle (PENDLE) have both climbed 20% and 15% in the same period.

ETH alts performance

ENS price likely to rally another 15%

ENS price has shot up 21% in the past 48 hours and breached the $24.34 resistance level. As eager holders rush to book profits, investors can likely expect a pullback that retests the aforementioned level. Interestingly, this barrier is also engulfed by an imbalance, extending from $22.87 to $24.77.

Ideally, interested investors can accumulate ENS in this zone. The resulting recovery rally could see the ETH-based altcoin bounce 16% and tag the next key hurdle at $28.42.

ENS/USDT 4-hour chart

On the other hand, if ENS price breaches the June 18 swing low of $21.39, it would produce a lower low and invalidate the bullish thesis. Such a development could see ENS drop 12.50% to retest the June 12 swing low of $18.74.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.