As Ethereum spot ETF approval nears, these altcoins could explode

- Crypto market sentiment turns bullish as Ethereum spot ETF approval odds increase to 75%.

- Ethereum Classic, Pepe, Floki and other DeFi tokens could gain momentum as the ETH ETF approval deadline nears.

- The US SEC’s deadline to decide on VanEck and Bitwise ETH ETFs is May 23.

Ethereum (ETH) price soared on Monday after Bloomberg analyst Eric Balchunas mentioned that the US Securities and Exchange Commission (SEC) could be “doing a 180” on Ether spot Exchange-Traded Fund (ETF) decision. Since then, Balchunas and colleague James Seyffart have both upped the ETF approval odds from 25% to 75%.

Update: @JSeyff and I are increasing our odds of spot Ether ETF approval to 75% (up from 25%), hearing chatter this afternoon that SEC could be doing a 180 on this (increasingly political issue), so now everyone scrambling (like us everyone else assumed they'd be denied). See… https://t.co/gcxgYHz3om

— Eric Balchunas (@EricBalchunas) May 20, 2024

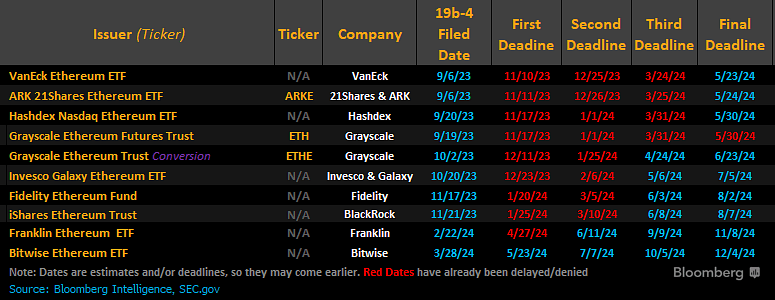

Ethereum spot ETF journey

- The US SEC's accelerated progress in approving spot ether ETFs, including requests for updated filings, reflects a potential fast-tracking of the approval process.

- The likelihood of the US SEC approving spot Ethereum ETFs has significantly increased, with analysts raising the probability to 75% from 25%.

- As a result, Ethereum price has clocked more than 20% gain since Monday.

- The notional open interest in futures tied to Ether reached a record $14.05 billion on Wednesday, signaling investor hopes for SEC approval of spot ether ETFs.

Read more: Ethereum resumes its rally as five potential issuers submit amended ETH ETF filings

According to Bloomberg Analyst James Seyffart, the US SEC’s decision on the VanEck and Bitwise Ethereum spot ETFs is due on May 23.

ETH ETF Deadline

ETH-based altcoins that could rally

It is not surprising that altcoins related to Bitcoin saw a major rally post-Bitcoin spot ETF approval. Likewise, tokens closely related to Ether could ride the ETF approval wave. Here’s a list of top altcoins that could see a significant rally in the days leading up to the Ether spot ETF approval.

- Ethereum Classic (ETC): This is a no-brainer selection. Like Bitcoin Cash and Bitcoin SV, ETC is an important altcoin of ETH’s past.

- ETH-based meme coins: Pepe (PEPE) and Floki (FLOKI) are two ERC20 meme coins and are like Ethereum’s flagship meme coins. These tokens have started to become sensitive and correlated to ETH-based developments. Coupled with the meme coin frenzy narrative, these two altcoins will likely see a massive uptick in buying pressure.

- DeFi tokens: The Decentralized Finance (DeFi) sector harbors a multitude of tokens, but we can narrow it down to DEX tokens Uniswap (UNI) and SushiSwap (SUSHI). Staking protocol-based tokens like Lido DAO (LDO) are unlikely to ride the ETF wave since there have been clear comments about some institutions not opting to stake their ETH despite the chances of approval going up from 25% to 75% in the past week.

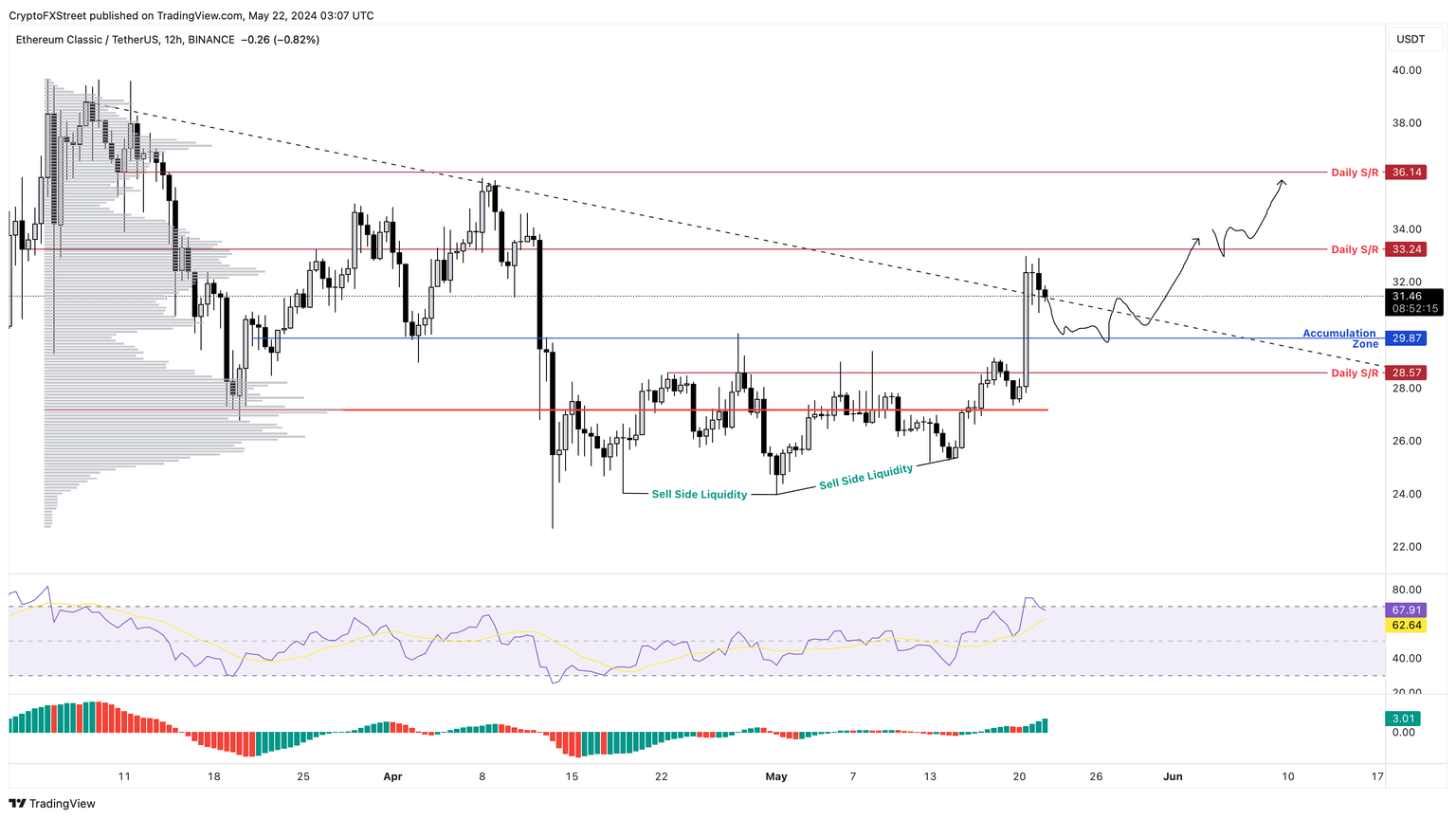

Let’s break down Ethereum Classic price, potential accumulation and take-profit levels.

Ethereum Classic price forecast

Ethereum Classic price saw a 17% daily candlestick after the positive development surrounding Ether spot ETF on Monday. This uptick pushed ETC to breach the declining trend line, as shown in the chart below, but it faced resistance around the daily resistance level of $33.24, which roughly coincides with the volume profile’s high volume node.

As the name suggests, the volume profile indicator tracks the volume traded across different price levels for a specified period. High-volume nodes are places where a large volume is traded and serve as a support or resistance level relative to the price. Low-volume nodes, on the contrary, are places where hardly any volume was traded, making them a level to watch for potential retracements and pullbacks.

Going forward, investors can expect a short-term profit-taking wave to knock the altcoin down to form a base between $29.87 and $28.57 levels. Sidelined buyers who missed the initial entry can buy ETC in this accumulation zone.

As ETC consolidates between $28.57 and roughly $30, investors can expect the range tightening to result in a breakout to the upside. This time, however, Ethereum Classic price will decisively breach the declining trend line, making its way to the daily resistance level of $33.24. This move would constitute an 11% gain from $29.87.

In a highly bullish case, Ethereum Classic price could breach $33.24 and retest the $36.14 hurdle, bringing the total gain to 20%.

ETC/USDT 12-hour chart

On the flipside, if Ethereum Classic price fails to hold above the daily support level of $28.57, it would signal that the bears are in control. Such a development will invalidate the bullish thesis and could send ETC down an additional 5% to tag the volume profile’s point of contract at $27.20. Ideally, a good accumulation zone in this case would be a sweep of $25, which would collect the sell-side liquidity.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.