Arweave Price Prediction: AR overextends, 17% correction seems likely

- Arweave price rose roughly 87% since the September 7 swing low to set up a new all-time high at $74.49.

- The buyers failed to sustain this ascent, which could lead to a 17% retracement.

- A decisive close above the all-time high at $74.49 will invalidate the bullish thesis.

Arweave price has been on a strong uptrend, but lately, things have been starting to slow down as the bullish momentum wanes. Investors can expect AR to retrace to stable support levels before the overall structure of the cryptocurrency market develops a directional bias.

Arweave price looks ready for a pullback

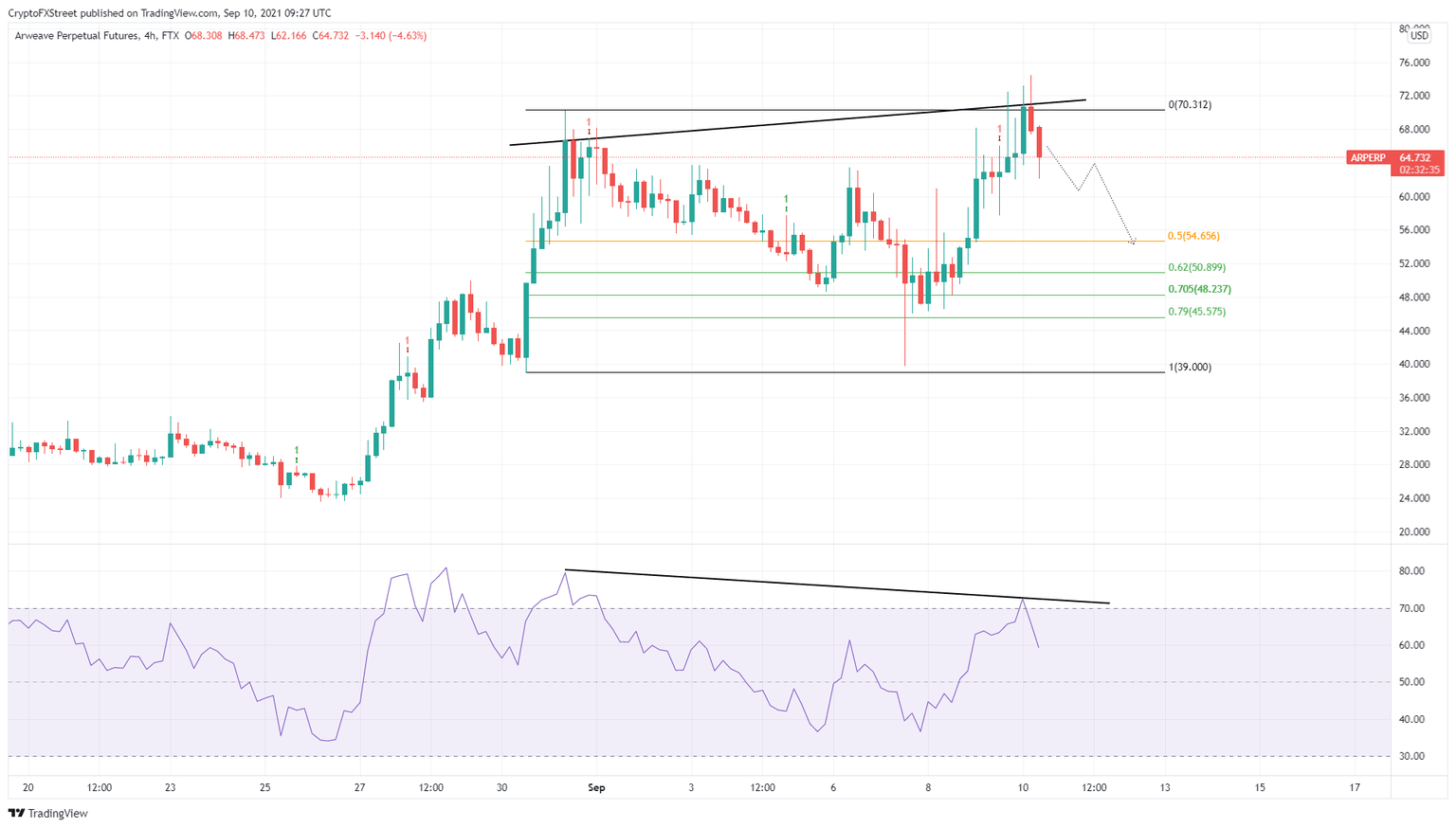

Arweave price rose roughly 80% from August 30 to August 31 to set an all-time high at $70.27. However, this ascent was undone as AR retraced quickly and consolidated. The buyers made a comeback by kick-starting another uptrend after the flash crash on September 7.

This time, Arweave price rose 87% and set up a new all-time high at $74.49, but failed to sustain this uptrend and is currently showing signs of entering a downward trend.

The Relative Strength Index (RSI) for AR became overbought on September 10, which is one of the signs that indicate the incoming pullback.

Moreover, the swing highs formed on August 31 and September 10 on the 4-hour chart between the AR price and the RSI are heading in opposite directions, indicating the formation of a bearish divergence.

This technical formation is created when the price forms a higher high and the RSI presents a lower low. The setup forecasts that Arweave price is ready to retrace lower.

In this case, market participants can expect AR to drop 17% to tag the 50% Fibonacci retracement level at $54.66.

AR/USDT 4-hour chart

On the other hand, if the buyers make a comeback, pushing Arweave price to produce a decisive 4-hour candlestick close above $70.31, it will indicate that the chances of heading higher are more.

However, if AR bulls can breach the current all-time high at $74.49 to set up a new one, it will invalidate the bullish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.