- Arkham price action has consolidated within an ascending parallel channel, signaling an impending breakdown.

- ARKM could drop nearly 40% to $0.40 in the long run amid fading Nvidia earnings euphoria.

- A break and close above the $0.89 range high would invalidate the bearish thesis.

Arkham (ARKM) price is trading with a bullish bias, consolidating above an ascending trendline to the downside. However, its upside potential is capped by another ascending trendline. The two technical formations form an ascending or rising channel.

Also Read: AI coins Render, Akash Network, Fetch.ai rally on opening of world AI Cannes Festival

Arkham price readies for a break down

Arkham (ARKM) price acting has formed an ascending channel, contained by two ascending trendlines that hint at a future convergence. This is because the lower trendline is steeper than the upper trendline, such that the lows are climbing faster than the highs. The technical formation suggests a possible break downwards.

If the technical formation plays out, the AI crypto coin could break below the lower boundary of the technical formation, potentially going as low as the $0.40 psychological level. Such a move would constitute a 40% fall below the current price action.

In a dire case, the slump could send Arkham price all the way down to the $0.05 range low.

ARKM/USDT 1-day chart

On-chain metrics to support Arkham price bearish outlook

Santiment’s daily active addresses metric has been dwindling over the past few weeks, which is bearish as there are no new addresses being created in favor of ARKM. It points to low crowd interaction, bolstering the bearish thesis.

Also, the social dominance and social volume metrics are abysmal, with the shrinking chatter around ARKM token suggesting investor focus in other projects.

ARKM Santiment: Daily active addresses, social dominance, social volume

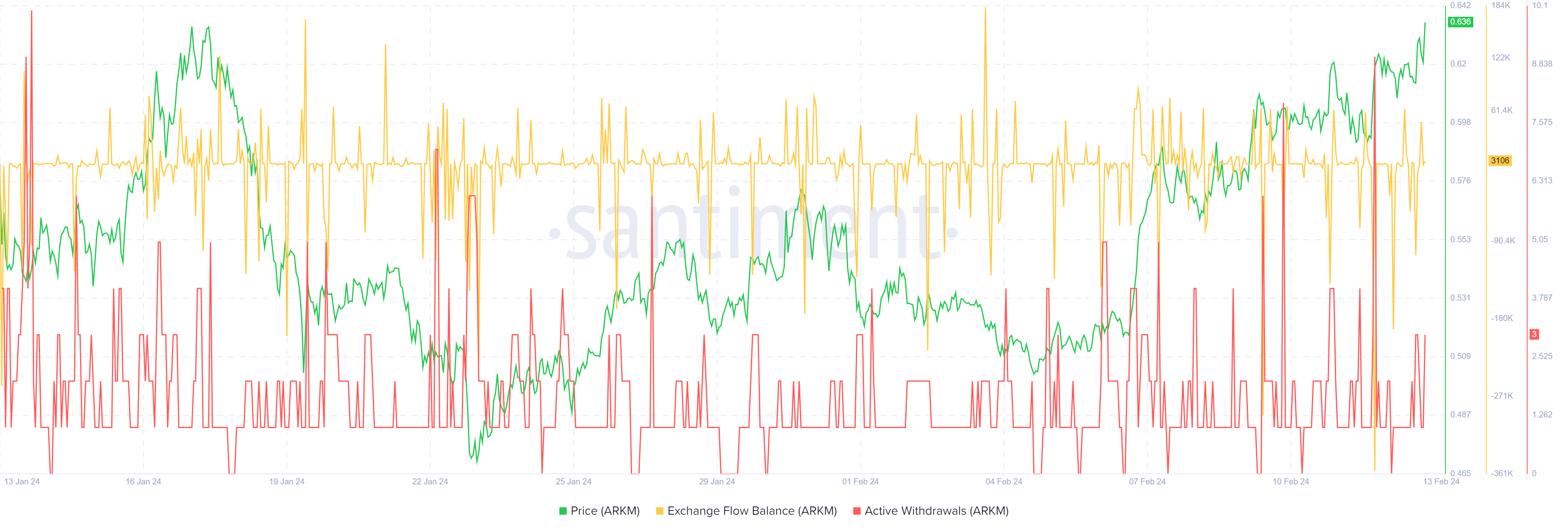

Furthermore, the exchange flow balance is positive, which means the amount of ARKM tokens that have flowed into exchanges are more than those that have left. This suggests increasing intention to sell and is reinforced by dwindling active withdrawals, as ARKM holders prefer having their holdings in exchange wallets, ready to sell.

ARKM Santiment: Exchange flow balance, Active withdrawals

On the flipside, if buyer momentum increases, the Arkham price could shatter past the upper boundary of the ascending wedge pattern to reclaim the $0.8900 level. A break and close above the blockade would invalidate the bearish thesis, setting the stage for a continuation of the intermediate trend.

In a highly bullish case, the Arkham price could extend a neck higher to the $1.0000 psychological level, around 55% above current levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Michael Saylor predicts Bitcoin to surge to $100K by year-end

MicroStrategy's executive chairman, Michael Saylor, predicts Bitcoin will hit $100,000 by the end of 2024, calling the United States (US) election outcome the most significant event for Bitcoin in the last four years.

Ripple surges to new 2024 high on XRP Robinhood listing, Gensler departure talk

Ripple price rallies almost 6% on Friday, extending the 12% increase seen on Thursday, following Robinhood’s listing of XRP on its exchange. XRP reacts positively to recent speculation about Chair Gary Gensler leaving the US Securities and Exchange Commission.

Bitcoin Weekly Forecast: New high of $100K or correction to $78K?

Bitcoin surged to a new all-time high of $93,265 in the first half of the week, followed by a slight decline in the latter half. Reports highlight that Bitcoin’s current level is still not overvalued and could target levels above $100,000 in the coming weeks.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Bitcoin: New high of $100K or correction to $78K?

Bitcoin (BTC) surged up to 16% in the first half of the week, reaching a new all-time high of $93,265, followed by a slight decline in the latter half. Reports suggest the continuation of the ongoing rally as they highlight that the current trading level is still not overvalued and that project targets are above $100K in the coming weeks.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

%20[22.03.20,%2013%20Feb,%202024]-638434519323278481.png)