- ETF specialist Eric Balchunas has indicated that Cathie Wood’s Ark Invest filed an updated version of its Spot BTC ETF.

- Among the changes, the firm articulates that the trust’s assets are not commingled with corporate or other customer assets.

- Balchunas anticipates more back and forths with SEC on certain small but important details, hence more delays.

Ark Invest, the renowned American investment management firm associated with Cathie Wood, has updated its Spot Bitcoin exchange-traded fund (ETF) filing after a recent feedback from the US Securities and Exchange Commission (SEC). It comes as several issuers continue to await the financial regulator’s decision.

Also Read: Former BlackRock director estimates Bitcoin spot ETF to be approved by April 2024

Ark Invest edits and updates Spot ETF filing

Ark Invest asset management firm has improved its Spot BTC ETF prospectus, weeks after the commission emailed issuers with comments and questions regarding their forms S-1. In the email, the financial regulator had details that they wanted addressed. According to ETF specialist Eric Balchunas, it is highly likely that the firm has answered all the commission’s concerns in its latest submission.

ARK has just filed an updated version of its spot bitcoin ETF prospectus. The SEC emailed issuers a few wks ago with comments/qs about their S-1 that they wanted addressed so is very poss ARK has answered all that in this filing. We looking thru it now.. pic.twitter.com/AlwTt82WU0

— Eric Balchunas (@EricBalchunas) October 11, 2023

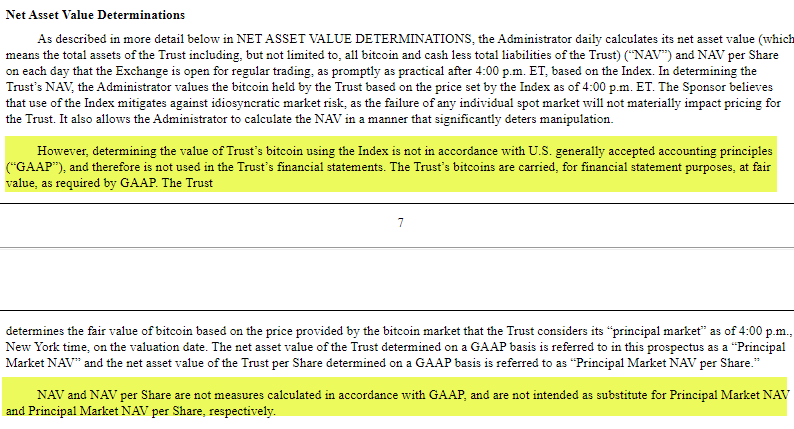

Among the changes spotted, under the Net Assets Value (NAV) Determination, the new prospectus features details on how the NAV calculation is not in accordance with GAAP accounting. The SEC had comment about this issue in its address weeks ago.

Net Asset Value Determination

Another new addition is that the filing articulates that the Trust’s assets with the Custodian are held in segregated accounts (wallets) on the Bitcoin (BTC) blockchain. With this, the assets are not commingled with corporate or other customer assets.

The subsequent pages of the form S-1 feature a lot of other material, but the new stuff is featured in different places of the first two pages. This points to ARK getting the SEC's comments dealing with them all. With the issues all responded to, it remains to the SEC to weigh whether to approve or not.

According to Balchunas, there will be a few back and forths with the SEC on small but important details about the process, which ultimately leaves the door open for more engagements before the financial regulator can finally give a green light.

Noteworthy, Ark Invest expected to receive a decision on its filing on September 26 but did not. In fact, the regulator beat the deadline by three days, giving a "notice of the designation of a longer period for commission action to determine whether to approve or disapprove a proposed rule change..."

Crypto ETF FAQs

What is an ETF?

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Is Bitcoin futures ETF approved?

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Is Bitcoin spot ETF approved?

Bitcoin spot ETF has been approved outside the US, but the SEC is yet to approve one in the country. After BlackRock filed for a Bitcoin spot ETF on June 15, the interest surrounding crypto ETFs has been renewed. Grayscale – whose application for a Bitcoin spot ETF was initially rejected by the SEC – got a victory in court, forcing the US regulator to review its proposal again. The SEC’s loss in this lawsuit has fueled hopes that a Bitcoin spot ETF might be approved by the end of the year.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.