Are whales restraining Bitcoin price from an end-year rally amid FTX contagion?

- Large-volume holders keep the pressure on Bitcoin price, stifling its recovery to $20,000.

- Only 1,938 whales hold between 1,000 and 10,000 BTC compared to 2,123 in June 2022.

- Bitcoin price erases most of its weekly progress as bulls seek support at $17,000.

Bitcoin price is wobbling to the weekend session after encountering sudden correction from gains accrued earlier in the week. The largest cryptocurrency climbed to a monthly high at $18,380 following positive investor sentiment on the future of crypto assets when the US Consumer Price Index (CPI) returned lower-than-expected figures.

On Wednesday, an expected interest rate hike of 0.5% by the Federal Open Market Committee (FOMC) was a positive signal for crypto markets, with analysts projecting that BTC will trade above $20,000 going into the New Year.

Bitcoin price plunges to $17,000 after audit firm Mazars halts work with crypto clients

Mazars, an international audit firm working with Binance and other cryptocurrency exchanges, has temporarily suspended all engagements with its crypto clients. Binance, KUCoin and Crypto.com are the exchanges affected by the firm’s decision.

A statement published by Binance on Friday confirmed the rumor that it “will not be able to work with Mazars for the moment.” Mazars report on Binance’s “proof of reserves” appeared overcollateralized. Moreover, the report, which is no longer available on the auditor’s website, failed to show any of the largest exchange’s liabilities.

Bitcoin price dropped to $17,000 after the news from Mazars reverberated across the market on Friday. Binance has been making headlines this week for the wrong reasons, including rumors that the US Justice Department is investigating the exchange and its top executives for money laundering.

It is a sensitive time in the cryptocurrency industry, especially with regulators, stakeholders and government authorities mulling over FTX’s collapse. The new CEO, John Ray III’s top priority is the recovery of assets belonging to the defunct exchange. Politicians and regulators are working to ensure consumers are protected from the actions of a few inexperienced individuals.

Bitcoin price holds crucial support, but for how long?

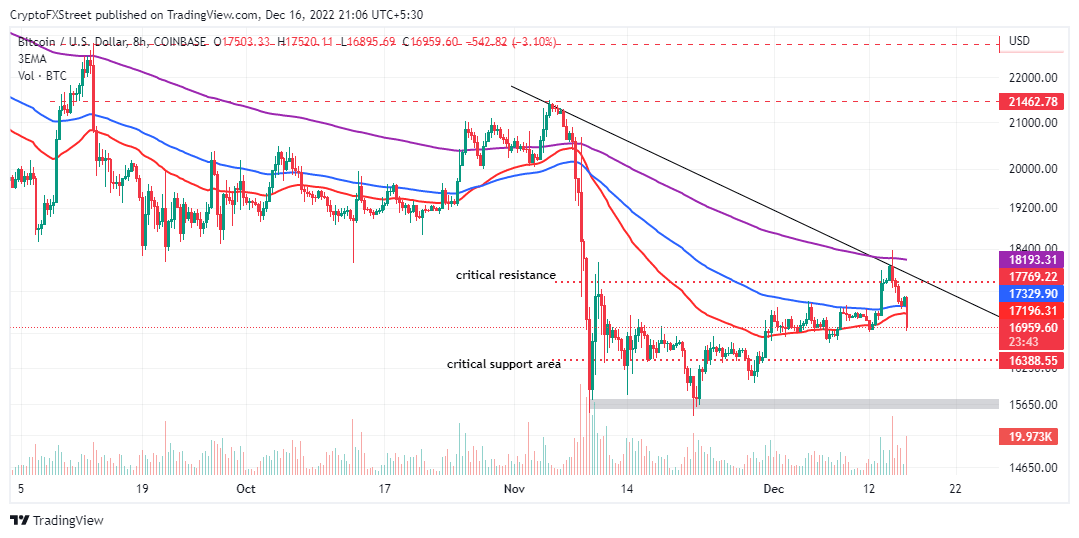

Bitcoin price attempted to break above a crucial falling trend line, as shown on the eight-hour timeframe chart below. Although this move could have pointed BTC in a northbound direction to $20,000, overhead pressure snuffed the bullish spark prematurely on Friday, leaving Bitcoin with no guards to $17,000.

BTC/USD eight-hour chart

The bellwether cryptocurrency slipped below the main moving averages like the 100-day Exponential Moving Average (EMA) (in blue) at $17,330 and the 50-day EMA (in red) at $17,196, suggesting that declines could extend further.

Support at $17,000 remains crucial to resuming the Bitcoin price uptrend. However, if bears push the price below the same level, BTC might revisit downhill levels at $16,388 and the primary support at $15,650.

Insight from Santiment highlights increased selling activities among whales with coins between 1,000 and 10,000. Currently, only 1,938 addresses call this cohort home compared to 2,123 addresses in June 2022.

Bitcoin Supply Distribution

The above chart shows Bitcoin price dropping alongside the on-chain metric, meaning whales substantially impact the trend. Therefore, an end-year rally could be a pipe dream if large-volume holders keep emptying their wallets.

On the upside, holding onto support at $17,000 may keep investors interested in BTC. If bulls push for a break above the falling trend line, as shown in the chart and succeed, Bitcoin price might quickly close the gap to $20,000.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B17.41.08%2C%252016%2520Dec%2C%25202022%5D-638068036057348037.png&w=1536&q=95)