- Ethereum Merge behind us, a phase of Bitcoin dominance has commenced and altcoins have suffered a decline in the past week.

- The current market cycle is marked by long accumulation and long consolidation phases, analysts consider this worse than a bear market.

- Ethereum price is on a steep decline, analysts have set a downside target of $1,277 for the altcoin in the ongoing bloodbath.

Successful completion of the Merge has paved the way for Ethereum’s 18% dominance. Interestingly, Ethereum, XRP and Cardano, among other altcoins, are showing signs of weakness in their price trends. Analysts believe it is the end of altcoin season and the beginning of Bitcoin’s dominance yet again.

Also read: Bitcoin price sink or swim: Largest BTC exchange inflow worries investors

Ethereum price continues decline despite successful Merge

Ethereum Merge is successfully behind us and the crypto community has turned its eyes to the Cardano Vasil hard fork. The hype surrounding the Ethereum Merge has died down, ETH price is on a steep decline. Analysts have set a bearish target of $1,250 for Ethereum’s price.

Traders should be aware of the bearish signals in Ethereum’s price trend. Though trader sentiment was bullish ahead of the Merge, the decline in ETH price has fueled a bearish sentiment among Ethereum holders.

Ethereum price decline post Merge

Analysts at the YouTube channel Bleeding Crypto identified Ethereum’s loss of support at $1,362 as a key bearish signal for the altcoin. Analysts have anticipated another drop down in Ethereum price, to support at the $1277.30 level.

ETH-USDT Perpetual Contract 12-hour chart

Analysts at FXStreet are bearish on the Ethereum price trend. For key price levels, check the video below:

Bitcoin vs. top 50 altcoins

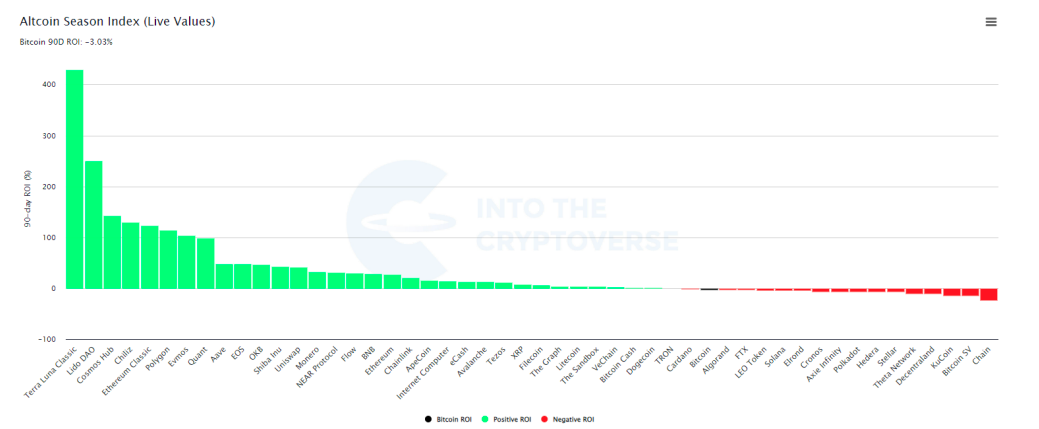

Analysts at crypto intelligence platform IntoTheCryptoverse argue that Bitcoin’s dominance is gaining ground. Ethereum Merge fueled a bullish sentiment among holders, pushing ETH dominance to 18%. Bitcoin therefore needs to outperform Ethereum and the top 50 cryptocurrencies.

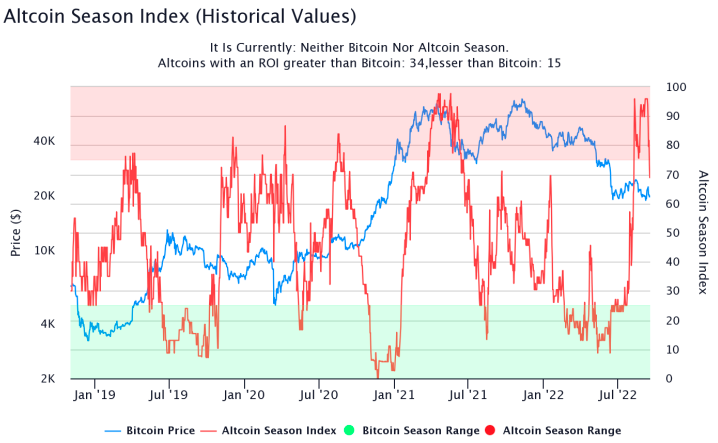

Altcoin season index is considered an indicator of altcoin price trend reversal and what to expect from cryptocurrencies into 50. The index currently reads 69, and this implies it is not Altcoin season. Analysts argue it is a bear market in the ongoing cycle and Bitcoin dominance is likely to overtake altcoins. When less than 25% altcoins have a 90-day ROI greater than Bitcoin, it is Bitcoin season. Therefore, analysts believe Bitcoin season is about to commence.

Altcoin Season Index

Ethereum, XRP and Cardano price trends show signs of weakness

After month-long altseason, a period in which 75% of the altcoins have a greater 90-day ROI than Bitcoin, altcoins have witnessed a bloodbath. Altcoins in top 30, Ethereum, XRP and Cardano have witnessed double-digit losses overnight. While there is still a high number of altcoins with a 90-day ROI greater than 100% and Luna Classic is the best performer, liquidity has started flowing into Bitcoin.

IntoTheCryptoverse’s report on altcoins reveals a change in inflow of capital. The decline below the red region in the Altseason Index reveals more altcoins have started bleeding against Bitcoin again. Analysts have identified a weakness in the Ethereum, XRP and Cardano price trend.

Altcoin Season Index

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Grayscale files S-3 form for Digital Large Cap ETF comprising Bitcoin, Ethereum, XRP, Solana, and Cardano

Grayscale, a leading digital asset manager operating the GBTC ETF, has filed the S-3 form with the United States (US) Securities and Exchange Commission (SEC) in favor of a Digital Large Cap ETF.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH, and XRP brace for volatility amid Trump’s ‘Liberation Day’

Bitcoin price faces a slight rejection around its $85,000 resistance level on Wednesday after recovering 3.16% the previous day. Ripple follows BTC as it falls below its critical level, indicating weakness and a correction on the horizon.

Top crypto news: VanEck hints at BNB ETF, Circle files S-1 application for IPO

Asset manager VanEck registered a BNB Trust in Delaware on Tuesday, marking its intention to register for an ETF product with the Securities & Exchange Commission (SEC).

Solana Price Forecast for April 2025: SOL traders risk $120 reversal as FTX begins $800M repayments on May 30

Solana price consolidated below $130 on Tuesday, facing mounting headwinds in April as investors grow wary of looming FTX sell-offs.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.