Are there any altcoins that might withstand the market fall?

Bulls could not keep the growth started at the weekend and all top 10 coins have come back to the red zone.

Top coins by CoinMarketCap

BTC/USD

Last Saturday, the Bitcoin (BTC) price recovered within the channel, and on Sunday, buyers tried to test the resistance of $36,000. However, the growth was not supported by large volumes, and the pair could not gain a foothold in the area of $36,000.

BTC/USD chart by TradingView

The price returned to the side channel this morning. If the lower border of the corridor ($34,000) does not keep the price in sideways consolidation, then the forecast for the pair to decline to support at $32,500 remains relevant.

Bitcoin is trading at $33,625 at press time.

XRP/USD

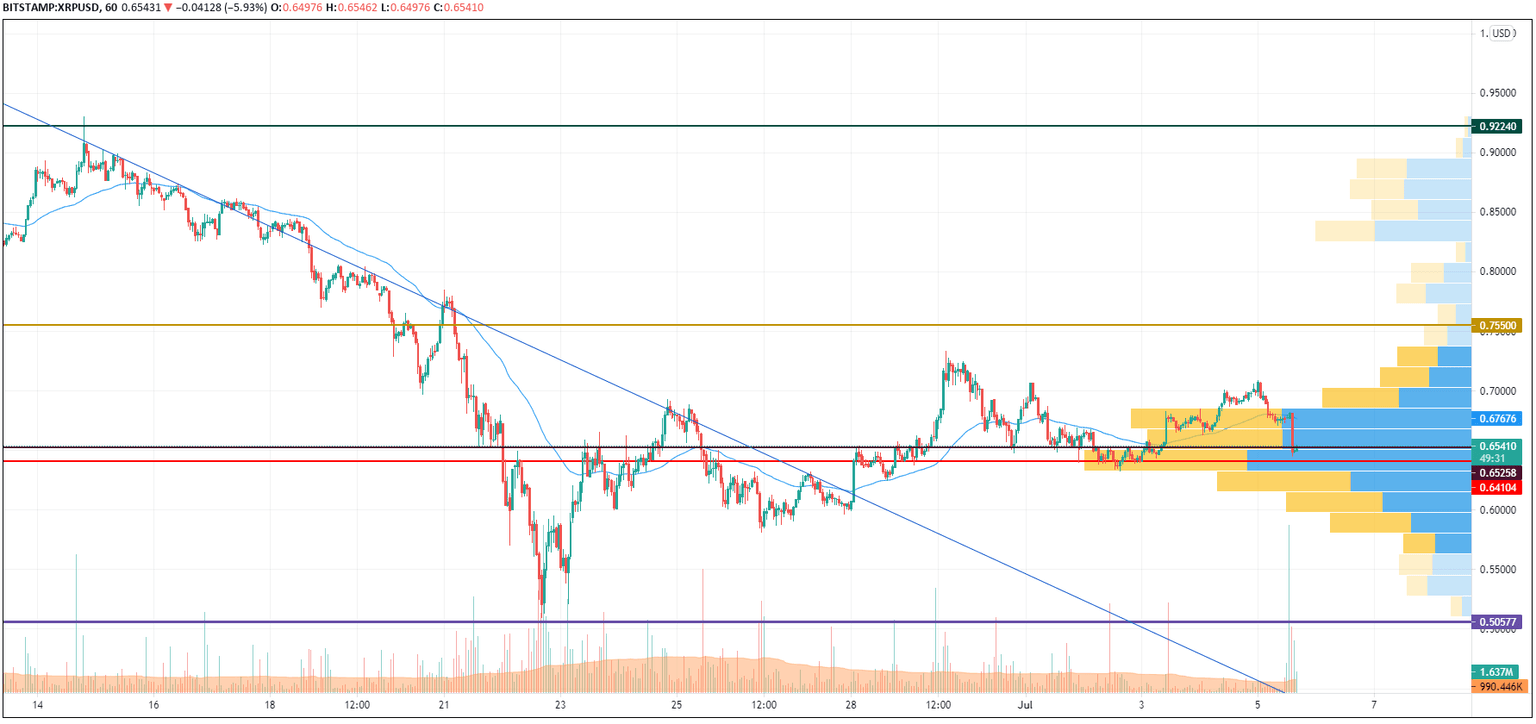

Last Saturday, buyers managed to break through the hourly EMA55, and on Sunday they broke above the $0.70 resistance. However, XRP was unable to consolidate above this level.

XRP/USD chart by TradingView

Tonight the pair returned from the maximum zone to the area of average prices and stopped the decline, but if the bears break through the support of the EMA55 moving average, the price can roll back to the POC line ($0.641).

XRP is trading at $0.6545 at press time.

LTC/USD

The rate of Litecoin (LTC) keeps falling, losing 5.53% of its price share over the last day.

LTC/USD chart byTradingView

Litecoin (LTC) has made another false breakout of the resistance at $143 which means that bulls are not ready yet to keep the rise. However, the selling trading volume is going down, confirming the weakness of bears.

In this case, the sideways trading between $143 and $130 is the more likely price action for the next few days.

Litecoin is trading at $136.57 at press time.

LINK/USD

Chainlink (LINK) has lost less than Litecoin (LTC) as its rate has decreased by 5%.

LINK/USD chart byTradingView

Chainlink (LINK) is trading similarly to Litecoin (LTC) as it is also located in the sideways range. At the moment, the altcoin is closer to the support zone than to the resistance which means that its breakout can lead to a sharp decline to $14.

LINK is trading at $18.19 at press time.

XLM/USD

Stellar (XLM) is the top loser today, going down by almost 6% since yesterday.

XLM/USD chart byTradingView

Stellar (XLM) has confirmed the ongoing bearish mood as the coin has fixed below the $0.2742 mark. In this regard, there are chances to continue to drop to the nearest level at $0.2392.

XLM is trading at $0.2536 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.