Are Solana NFT traders running into a dead end with the Cardano price?

- An influx of Solana NFT traders have been switching over to the Cardano network.

- The ADA technicals display a significant bearish strength, targeting $0.25 and lower.

- Invalidation of Cardano’s bearish thesis is a breach above $0.40.

Cardano price shows an influx of speculative risk takers as NFT trading has prompted Solana users to consider swapping SOL for ADA. Still, the technicals are pointing south in a powerful manner, making the current market conditions evermore challenging.

Cardano price is a risky bet

Cardano price is in a peculiar situation. While price swings have been ever more powerful to the downside in October, the NFT trading volume has peaked near all-time highs. In fact, so much to the point that Solana NFT traders have caught wind of mayhem. According to U Today’s Crypto News Journalist Gamza Khanzadaev, Solana users are stirring the waters on social media as many have jumped ship from Solana to ADA in hopes of better yield.

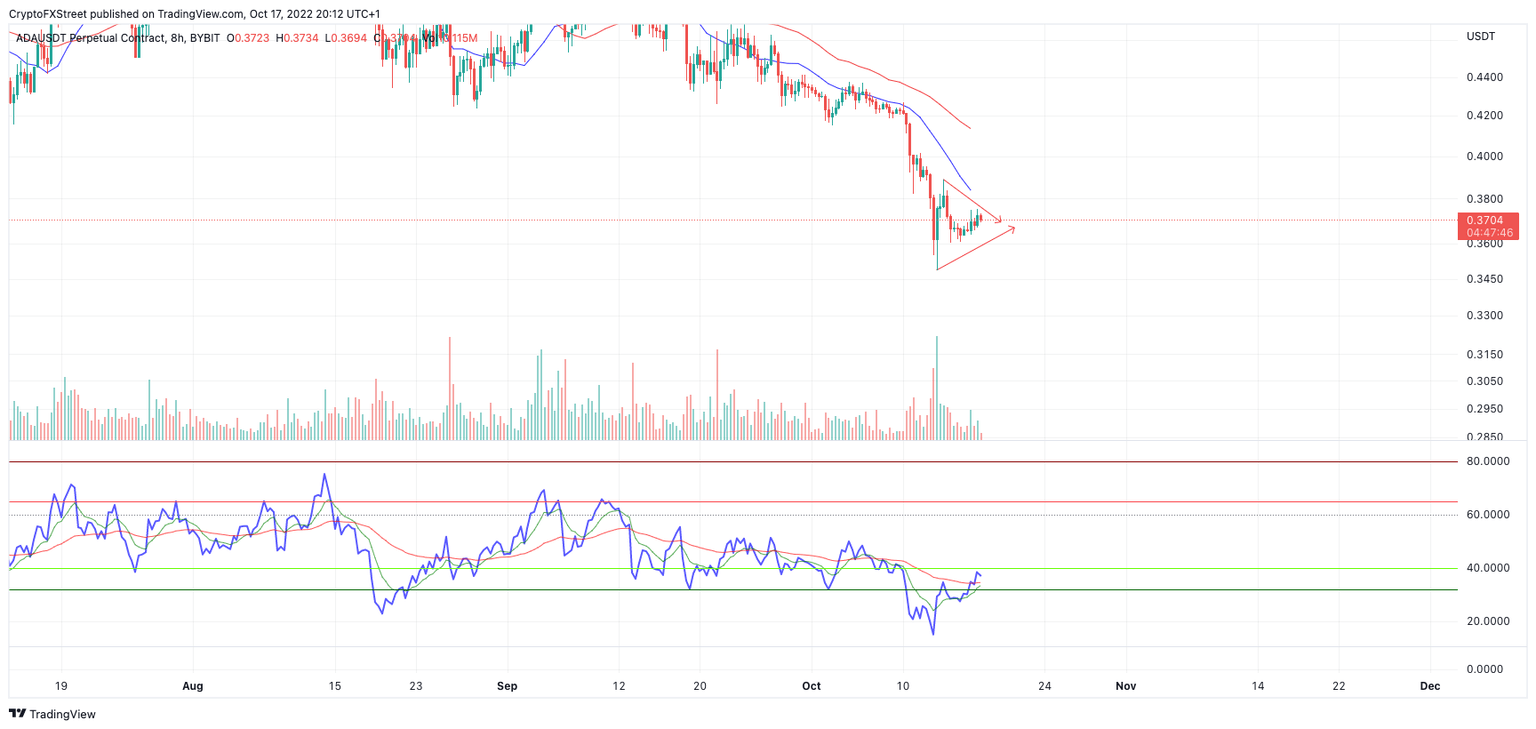

Cardano’s price currently auctions at $0.37, as a pennant-like pattern is forming on the 8-hour chart. Seeing this kind of pattern is quite concerning as pennants, based on price action theory, usually lead to sharp, rapid, and sometimes irreversible declines.

The Relative Strength Index shows bearish divergences between Monday’s highs and the initial recovery spike after the first breach of the $0.35 level. The indicator compounds the idea that a strong bearish presence is prevalent in the Cardano price action.

ADA/USDT 8-Hour Chart

A reattempt at the $0.35 lows established on October 13 could be the catalyst to a decline targeting the $0.25 liquidity zone established in 2020. A classical trade setup would place the invalidation point above the top of the pennant at $0.40.

If the invalidation level is breached, the bulls could recover some of this month's losses. A likely countertrend target would be the 8-day exponential moving average at $0.415, resulting in a 13% increase from the current Cardano price.

In the following video, our analysts deep dive into the price action of Cardano, analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.