- Arbitrum’s ARB token airdrop goes live, users could face issues in claiming the token as seen in Optimism’s OP airdrop.

- Experts on crypto Twitter have shared step-by-step procedures to claim ARB tokens without facing challenges.

- Analysts have urged caution to users, against fake Arbitrum smart contracts, and lag in the Arbitrum One chain.

The Arbitrum ARB governance token airdrop goes live marking the beginning of the Ethereum layer-2 solution’s transition into decentralization. Experts on crypto Twitter have warned airdrop participants of issues that arise in claiming ARB airdrop and shared solutions for the same.

ARB token airdrop comes at a time when Bitcoin price rally grinded to a halt after The Federal Reserve’s 25 basis point hike. This supports the thesis of an altcoin rally and ARB token holders could benefit from Arbitrum’s popularity as a layer-2 scaling solution for the Ethereum blockchain.

Also read: Arbitrum: What is the fair value for ARB as tokens bloom in pre-launch trading?

Arbitrum ARB airdrop: How to claim, issues faced and how to tackle them

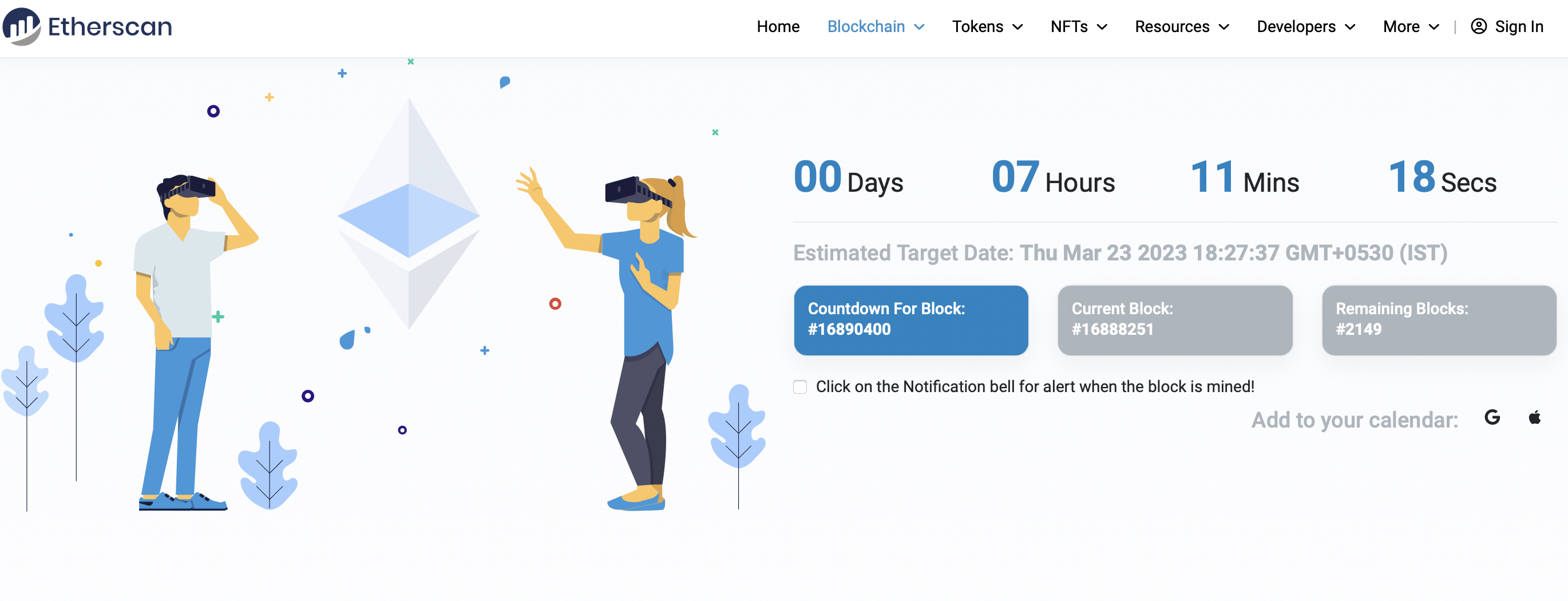

Arbitrum’s ARB token airdrop is one that the crypto community has long awaited, for its role in governance of the layer-2 chain and boost in decentralization. Users can claim Arbitrum’s ARB airdrop until September 23, 2023. Claiming on the Arbitrum One chain will start when the Ethereum chain reaches block 16890400. This is around seven hours away. Find the countdown timer on Etherscan.

Arbitrum ARB token airdrop countdown

In the process of claiming the ARB airdrop, market participants can expect to face issues as seen during Optimism’s OP token airdrop. For step-by-step instructions on claiming ARB, check the tweet thread below:

▓▓▓▓▓░ 91%$ARB is coming TOMORROW

— olimpio (@OlimpioCrypto) March 22, 2023

A quick guide on how to be prepared:

• how to claim faster

• how to LP

• how to buy/sell/snipe faster

Don't get front-run

During Optimism’s OP token airdrop, users faced a challenge in communicating and interacting with the blockchain. Remote Procedure Calls (RPCs) that allow communications with servers remotely, didn’t work as expected and users faced a lag in the process.

Most importantly, even after claiming the OP token airdrop, lag posed a challenge in transferring Optimism’s token to DEX or Centralized Exchanges. Few in the OP community sold the airdropped token at the top ($2). This highlights how important it is set up a custom RPC and claim the airdropped token at the right time.

@rektfencer and @OlimpioCrypto, two crypto experts on Twitter recommended users set up their own custom RPC to tackle this issue. Find the guide in the tweet thread below:

Smart degens always stay ahead of the curve.

— Rekt Fencer (@rektfencer) March 22, 2023

The $ARB claim is coming, and you want to be ready.

Here's a thread that'll help you prepare for the claim and sell at the highest price pic.twitter.com/wy3YFxkS0z

What to expect from the ARB token airdrop

The timing of Arbitrum’s ARB token airdrop is key to expectations of market participants. With Bitcoin price rally grinding to a halt and the US Central Bank raising interest rates by 25 basis point, altcoins are likely to gain popularity and relevance.

Typically, when Bitcoin price rally takes the backfoot, there has been a spike in altcoin prices, while investors are bullish. An alt season rally is therefore good news for Arbitrum’s ARB governance token, with the layer-2 scaling solution’s popularity in the Ethereum ecosystem and the timing of the airdrop.

Also read: Arbitrum: What is the fair value for ARB as tokens bloom in pre-launch trading?

In addition to Arbitrum, there are several other altcoin categories that could benefit from an alt season rally. Find out more about it here: Here are top three altcoin categories that are likely to pump the hardest in the 2023 alt season

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto Today: Metaplanet raises $10M to buy BTC, ETH price moves below $1,600 as Tron gains signals panic

The cryptocurrency aggregate market capitalization stabilized around $2.7 trillion on Wednesday, with Bitcoin’s $84,000 support momentarily anchoring the market against external bearish discourses.

Chainlink active addresses drop as whale selling spikes, could LINK crash below $10?

Chainlink active addresses slide dramatically to 3,200 from February’s peak of 9,400. The downtrend in network activity coincides with increasing selling activity among whales with between 10 million and 100 million LINK.

Bitcoin stabilizes around $83,000 as China opens trade talks with President Trump’s administration

Bitcoin is stabilizing around $83,500 at the time of writing on Wednesday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. A breakout of this strong level would indicate a bullish trend ahead.

Binance Chain completes $914M BNB token burn, hinting at a potential rally

Binance Chain has finalized its programmed 31st quarterly BNB token burn, potentially setting the stage for the world’s fifth-largest cryptocurrency, with a market capitalization of $81.45 billion, to rally in the coming weeks.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.