Arbitrum unlocks Layer 3 chains as Ethereum Layer 2 wars intensify

- Arbitrum developers Offchain Labs recently released Orbit, a toolkit for development of Layer 3 chains in the ARB ecosystem.

- Ethereum Layer 2 projects compete for dominance as blockchains like Polygon and BSC rolled out their version of ETH scaling solutions.

- Experts believe Optimism has an inherent advantage over Arbitrum despite the ARB’s foray into Layer 3.

Arbitrum and Optimism have long competed for dominance in the Ethereum Layer 2 ecosystem. With Offchain Lab’s release of Arbitrum Orbit, a toolkit for the development of Layer 3 chains, ARB ecosystem expects higher dominance and a large market share in the future.

Arbitrum’s launch in August 2022 stirred similar competition among Layer 2 chains and ARB gained dominance and a high market share post its launch.

Experts have weighed in on the intensifying war between scaling solutions, picking Optimism, OP stack as a clear winner with its advantages over Arbitrum.

Also read: Arbitrum boosts Layer 3 network development as Polygon, BNB Chain lag behind

FXStreet has covered Arbitrum and Ethereum Layer 2 in detail. Check these posts:

- Why do whales accumulate millions of Arbitrum?

- Ethereum ZK rollups eye Arbitrum’s market share as adoption rises

- Polygon and Arbitrum lead cryptos in on-chain activity with spike in active addresses

- After Arbitrum’s 50% rally, is Optimism (OP) next Layer 2 altcoin to explode?

The race among Ethereum Layer 2 scaling solutions is on, with Optimism and Arbitrum competing for the throne. In this post, Arbitrum, Optimism, Polygon’s ZK rollup and Binance Smart Chain’s opBNB are analyzed.

Among these developments, Arbitrum’s developers released the toolkit for Layer 3 chains, opening up new avenues for competition, cheaper transactions and faster processing.

What is Layer 3: Opportunities and challenges

Arbitrum’s Layer 2 improves the Ethereum blockchain’s speed of processing transactions, flexibility and scalability, opening doors to a wide range of DeFi protocols. Through its Layer 3 chains, Arbitrum ecosystem is working on higher levels of customizability for projects. One of the key challenges of Layer 2 protocols is limited customization in design, especially for market participants looking for lower-cost execution and privacy-preserving functionalities.

Layer 2 solutions are used for general purpose scaling and the introduction of Layer 3 adds privacy, empowering Layer 2s. While Layer 2 solutions can achieve scalability and lower transaction costs, their privacy and transaction speed can be enhanced further. This is what Layer 3 chains help users achieve.

Is Layer 3 a game changer?

Layer 3 has three objectives, customized functionality, scaling and validiums (lower-grade security than rollups and they are highly underrated according to Ethereum creator Vitalik Buterin). Through these three visions, Layer 3 can emerge as a game changer in the scaling ecosystem.

Currently, traders have to pick between a fixed confirmation time or cost tradeoffs. The introduction of Layer 3 chains eliminates the tradeoff between time and cost. This makes it likely that Layer 3 chains bring a paradigm shift in the scaling ecosystem.

Vitalik Buterin, Ethereum co-founder, said in a recent blog post,

If we're entering a world with lots of customized validiums and application-specific environments, then many of them will do much less than 5 TPS. Hence, tradeoffs between confirmation time and cost start to become a very big deal. And indeed, the 'layer 3' paradigm does solve this.

Ethereum’s Layer 2 solutions battle for dominance

While Ethereum is natively working on scaling its blockchain network, the release of Layer 2 scaling solutions has simplified the task and shared the altcoin’s workload. Solutions like Arbitrum and Optimism are known to roll up hundreds of transactions in one and reduce the traffic directed to the mainnet.

Layer 2 solutions, therefore, significantly slash transaction processing time and associated fees.

The competition among Layer 2 chains has intensified in 2023 with Polygon’s ZKL2 release and BSC’s opBNB testnet.

Comparing the top Layer 2 chains on DeFi intelligence tracker DeFiLlama reveals the following insights:

- Arbitrum leads with 70.78% of dominance in terms of TVL.

- Optimism follows with 22.04%.

- Polygon’s zkEVM is at 0.73%.

TVL comparison between Ethereum Layer 2 chains

The top three Layer 2 chains compared here reveal Arbitrum’s dominance in the scaling solution ecosystem. However, this does not mean that the protocol is the winner of the Layer 2 race.

BitGet’s managing director, Gracy Chen, told FXStreet that the competition between chains primarily revolves around capturing developer resources. This can be achieved through open solutions and standardized tools.

Arbitrum provides a solid foundation for introducing new projects, especially in the gaming and social sectors. Op Stack holds an advantage in terms of early entry and collaboration (Base, OpBNB). In summary, both share a similar direction in terms of ecosystem strategy, but differ in specific technological details and current development status.

Chen explains that both the Layer 2 solutions reflect the intense competition in the ecosystem.

When comparing other projects, it is evident that Polygon and BNB Chain strongly focus on gaming and social projects. The release of Arbitrum’s Layer 3 has therefore intensified competition among all the blockchains, and it comes down to user acquisition, developer engagement, and TVL accumulation in the long term.

Arbitrum vs. Optimism wars

The competition between different Layer 2 solutions means more options for market participants to process transactions at lower costs and faster finality. In terms of the scope of adoption and dominance, Optimism’s partnerships with BNB Chain and Coinbase are likely to drive more users to the chain in the long term.

Arbitrum’s developers Offchain Labs are gearing up for intensifying competition with the release of Orbit, a toolkit for launching Layer 3 chains in the ecosystem. Andrew Kuznetsov, co-founder and CTO of Islamic Coin, told FXStreet that Arbitrum Orbit and OP Stack Superchain have a stark contrast.

Kuznetsov believes it will be fascinating to observe how these protocols compete and how Optimism responds to Offchain Labs’ innovation.

Kuznetsov said,

The Arbitrum Orbit comes with a plethora of unique advantages, mostly centered around faster transaction speeds and extremely low fees. The launch of the new tech tool will change the game. Probably, it will force other L1 and L2 players to double down on their efforts to catch up — and users will get the most considerable benefit from these innovations.

When Arbitrum and Optimism are compared side by side,

Daily transactions year till date on Arbitrum as of July 12

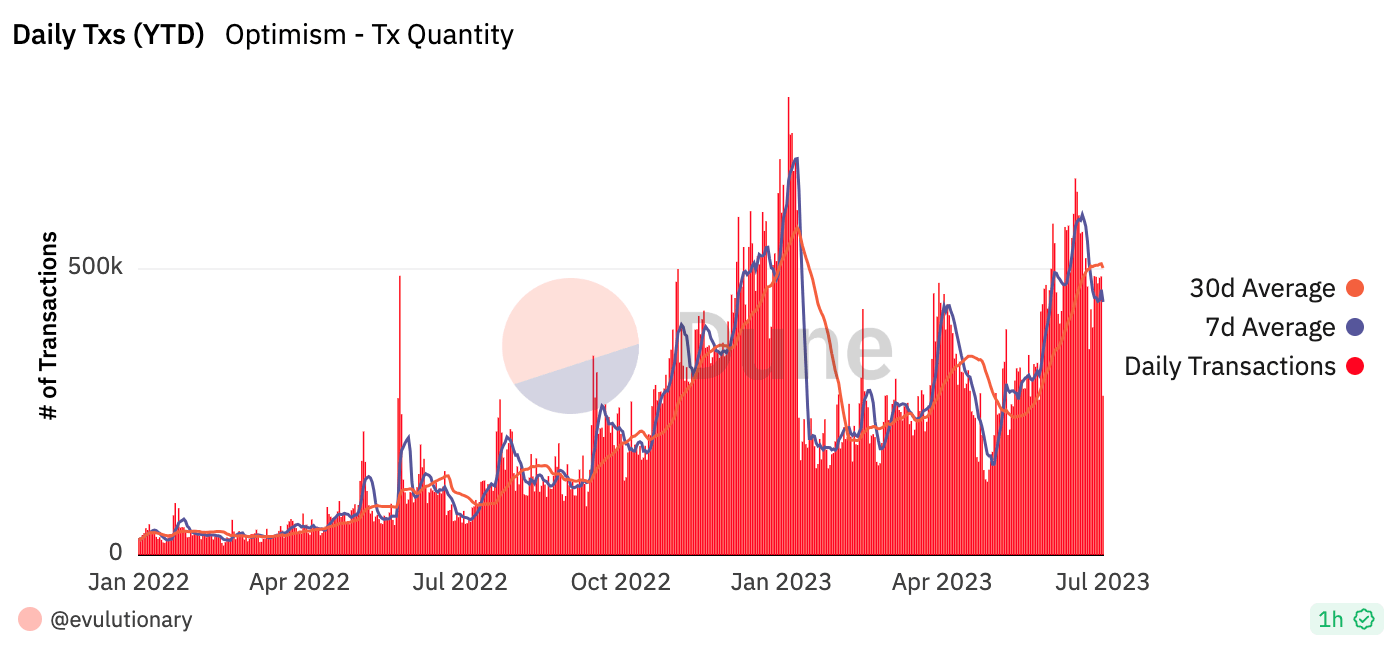

Daily transactions year till date on Optimism as of July 12

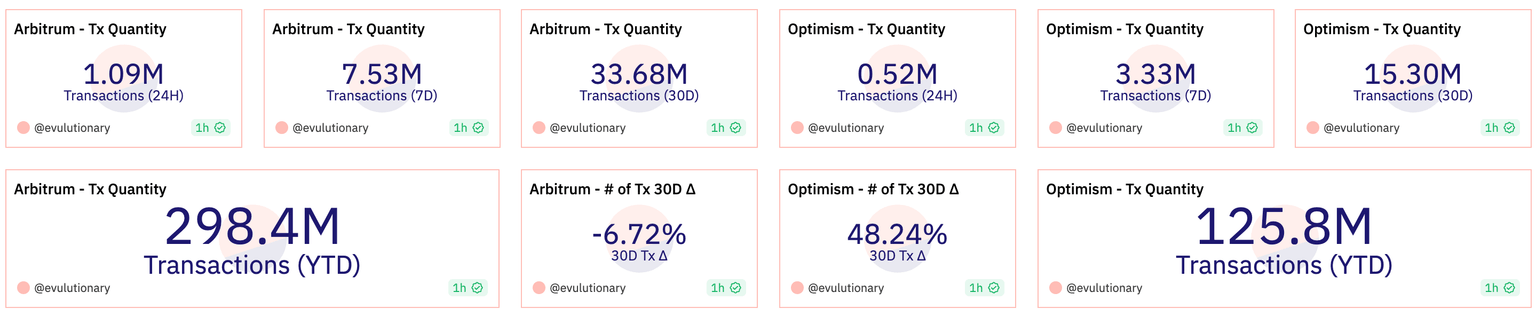

Arbitrum has an average of 1.09 million daily transactions against Optimism’s 520,000. Interestingly, transaction fees on Arbitrum are 0.1 Gwei against Optimism’s 0.036 Gwei. Despite the massive difference in transaction costs, users prefer Arbitrum for its network effect, driving its adoption higher.

Arbitrum has added a total of 8.32 million addresses since its launch. For Optimism, the number is 3.77 million. Data from Dune Analytics sheds light on address activity:

Arbitrum vs Optimism transaction statistics

In the race to the largest TVL, Layer 3 is icing on the cake

The emergence of Layer 3 solutions expands the scope and potential of the blockchain and this has opened up more avenues for competition. Robert Quartly-Janeiro, Chief Strategy Officer of Bitrue exchange, told FXStreet,

Arbitrum Orbit’s launch for Layer 3 chains balances between decentralization, security, and stability and introduces an extra dimension of differentiation. Competition among Polygon, BNB Chain, and Arbitrum may, as a result, drive further improvement, advancement, and value proposition, eventually benefiting users and driving the broader adoption of decentralized applications.

Arbitrum’s foray into Layer 3 establishes the ecosystem’s dominance in the Layer 2 space, however, it remains to be seen how soon Optimism and other blockchains will catch up.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.