- Arbitrum price has recorded a massive recovery, governed by a rounding bottom pattern.

- The move has seen ARB TVL record a seven-month high at $2.439 billion, suggesting growing interest in the L2 token.

- However, with the ADX beginning to slope and the RSI at 81, the altcoin could top out soon amid buyer exhaustion.

- A break and close above the $2.200 psychological level would invalidate the bearish thesis.

Arbitrum (ARB) stands among the top performers in the market on Wednesday, sidestepping the broader market crash led by Bitcoin (BTC) price to pump hard. The Ethereum-based Layer 2 (L2) token has shown strength, distancing itself from panic selling amid rumors that the US Securities and Exchange Commission (SEC) would reject spot BTC exchange-traded funds (ETFs) in January.

Also Read: Bitcoin open interest hits $19 billion as Jim Cramer declares BTC ‘indestructible’

Arbitrum TVL hits seven-month high

Arbitrum (ARB) price surged 10% during the early hours of the New York trading session, with a 130% rise in trading volume. This points to increasing investors’ attention and interest in ARB tokens. The Total Value Locked (TVL) of Arbitrum recording a seven-month high of $2.439 billion accentuates this outlook. A rise in TVL points to increasing liquidity in the protocol, growing popularity, and usability.

ARB TVL

Nevertheless, Arbitrum price shows signs of topping out soon as the technicals hint at a possible exhaustion after a 160% surge beginning in October 2023.

Arbitrum price likely to top out soon

After a 160% recovery, Arbitrum price shows signs of exhaustion even as the price action has been governed by a rounding bottom pattern. This technical formation, found at the end of extended downward trends, follows a series of price movements that graphically form the “U” shape. It signifies a reversal in a long-term price movement.

The position of the Relative Strength Index (RSI) at 81 shows that ARB is already massively overbought, suggesting a possible pullback. The outlook of this momentum indicator, coupled with the hinted deviation of the Average Directional Index (ADX) indicator at 35, shows that the bulls are approaching an exhaustion point.

In this regard, a daily candlestick close below the immediate support at $1.8225 could provoke profit booking, likely sending Arbitrum price to the $1.4676 level. In the dire case, the slump could see the L2 token find support around $1.4000 or lower at the $1.2000 psychological level.

ARB/USDT 1-day chart

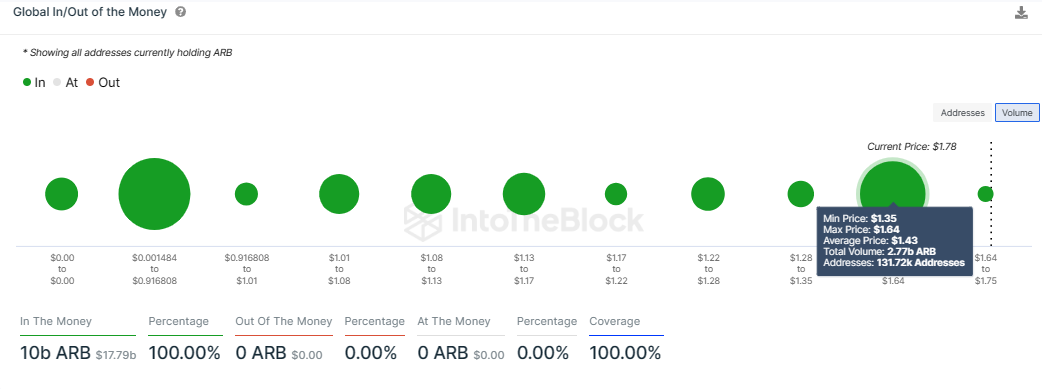

On-chain metrics: GIOM

Based on data from IntoTheBlock’s Global In/Out of the Money (GIOM) metric, if Arbitrum price drops, it could find support between the $1.3500 and $1.6400 range, where approximately 131,720 addresses currently hold 2.77 billion ARB tokens purchased at an average price of $1.43. This area coincides with where traders bought the dip.

Conversely, after a bullish rejection from the lower wick following a stark crash, it appears the bulls stand in readiness to buy any correction. The ensuing buyer momentum could see Arbitrum price extend north, reclaiming the $2.0272 range high before a possible neck higher to the $2.2000 psychological level. A daily candlestick close above this level would invalidate the bearish postulation, setting the pace for a move to the $2.4000 psychological level. Such a move would constitute a 20% climb above current levels.

ARB GIOM

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches like Arbitrum’s ARB airdrop and Optimism OP influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence risk assets like Bitcoin, mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs. This has been observed in Bitcoin and Litecoin.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Litecoin Price Prediction: LTC tries to retake $100 resistance as miners halt sell-off

Litecoin price grazed 105 mark on Monday, rebounding 22% from the one-month low of $87 recorded during last week’s market crash. On-chain data shows sell pressure among LTC miners has subsided. Is the bottom in?

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin price struggles around $95,000 after erasing gains from Friday’s relief rally over the weekend. Bitcoin’s weekly price chart posts the first major decline since President-elect Donald Trump’s win in November.

SEC Commissioner Hester Pierce sheds light on Ethereum ETF staking under new administration

In a Friday interview with Coinage, SEC Commissioner Hester Peirce discussed her optimism about upcoming regulatory changes as the agency transitions to new leadership under President Trump’s pick for new Chair, Paul Atkins.

Bitcoin dives 3% from its recent all-time high, is this the cycle top?

Bitcoin investors panicked after the Fed's hawkish rate cut decision, hitting the market with high selling pressure. Bitcoin's four-year market cycle pattern indicates that the recent correction could be temporary.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.