Arbitrum price sets the stage for 30% recovery rally

- Arbitrum price is slowing its descent as it trades around $0.973.

- A bullish divergence coupled with on-chain metrics suggests a potential reversal.

- Investors can expect ARB to rally 30% and tag $1.281.

- A decisive daily candlestick close below $0.855 will invalidate the bullish thesis.

Arbitrum (ARB) price is showing signals that suggest the downtrend could be coming to an end. If this development is coupled with improving Bitcoin price outlook, then ARB could be due for a quick move to the upside.

Arbitrum price ready to reverse the downtrend

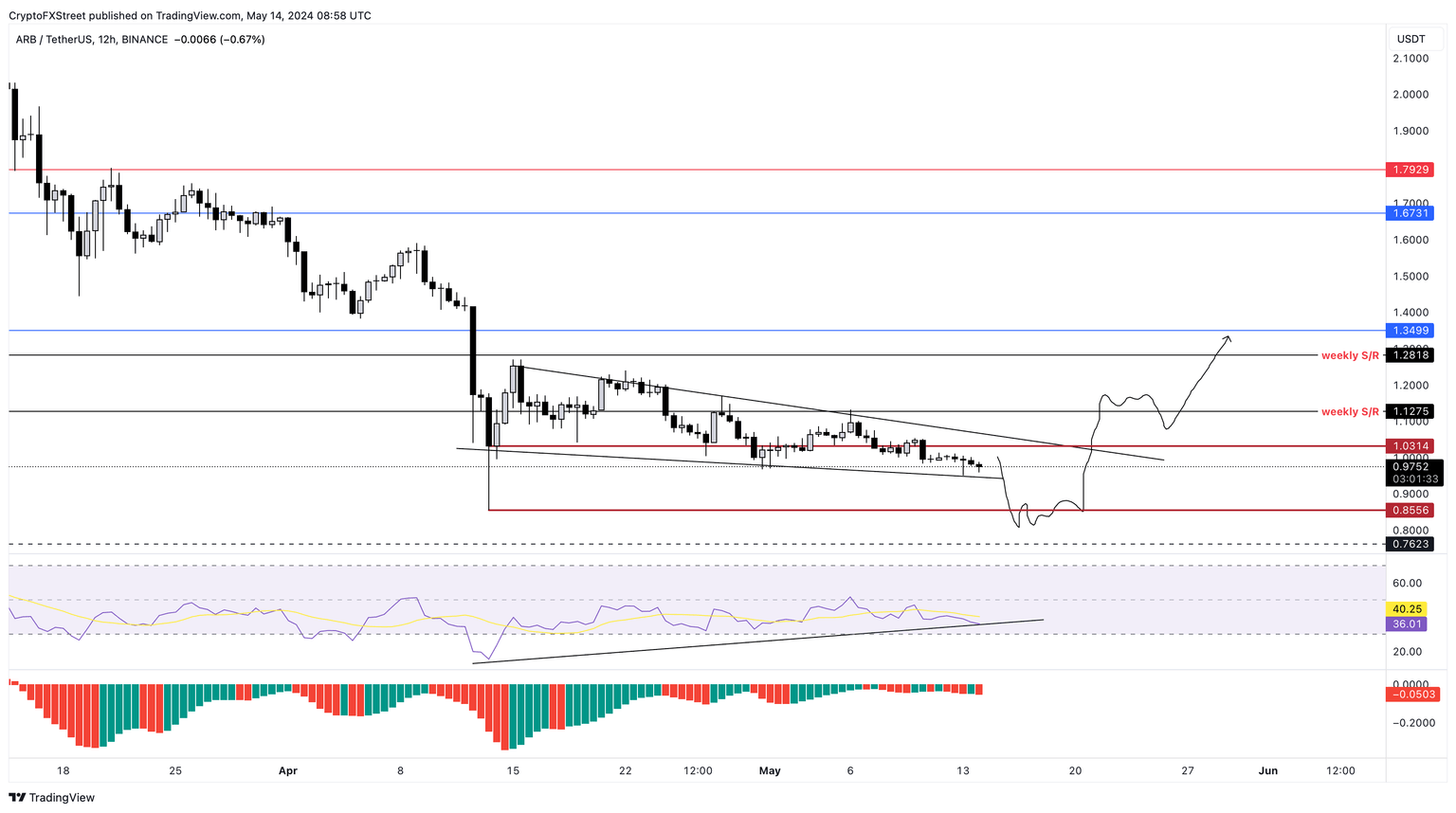

Arbitrum price created a swing low and a potential bottom at $0.855. Since then, ARB has set up three key distinctive lower lows. But interestingly, the Relative Strength Index (RSI) and Awesome Oscillator (AO) have both created higher lows for the same period. This non-conformity is termed bullish divergence, meaning ARB is due for a quick rally.

However, the uptick in Arbitrum price might come after a flush, i.e., a sweep of the $0.855 level to collect sell-side liquidity. Typically, a reversal is often coupled with such a movement, where a huge chunk of early investors are liquidated. Hence, bulls need to wait for this flush and a potential recovery above $1.031 before betting heavily on ARB.

In such a case, Arbitrum price could eye a retest of the $1.127 and $1.281 resistance levels.

ARB/USDT 12-hour chart

Supporting this bullish outlook in Arbitrum price is the uptick in Santiment’s Network Growth metric. This index is used to track the new addresses created on the Arbitrum blockchain. On May 12, Network Growth shot up to 9,399 from 4,836 the day before.

ARB Network Growth

Furthermore, the 30-day Market Value to Realized Value (MVRV) ratio is used to track the average profit/loss of investors who purchased ARB in the past month. This metric has recovered from -35% on April 13 to near zero as of this writing. This uptick or bounce suggests that short-term holders capitulated, and the offloaded ARB tokens were likely bought by long-term holders.

ARB 30-day MVRV

All in all, the outlook for Arbitrum price looks optimistically bullish and could shift to a strong uptrend by this week or the start of a new one. However, if the Bitcoin (BTC) price fails to retain its ongoing consolidation and drops lower, it could wrongfully impact Arbitrum price. In such a case, if ARB produces a daily candlestick close to $0.855 it would lead to a lower low and invalidate the bullish thesis.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%2520%5B14.29.46%2C%252014%2520May%2C%25202024%5D-638512849010662968.png&w=1536&q=95)

%2520%5B14.31.23%2C%252014%2520May%2C%25202024%5D-638512849369330611.png&w=1536&q=95)