Arbitrum price readies for one of the biggest token unlocks of 2024

- Arbitrum network will unleash 1.11 billion tokens on March 16 in a cliff unlock.

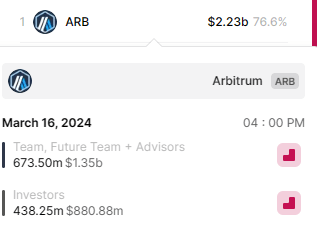

- The unlock will comprise 76.62% of the network’s circulating supply, worth $2.31 billion.

- Token allocations go to the team, advisors and investors who are likely to cash in for early gains.

Arbitrum (ARB) price has recorded a lot of volatility since the onset of 2024, trading within a range while the broader market rallied. With all eyes peeled to the Ethereum Layer 2 (L2) token for the anticipated ETH beta plays situation, ARB holders should brace for even more volatility as the network plans one of the biggest unlocks in 2024.

Also Read: Arbitrum Arcade launch could fuel narrative for crypto gaming tokens

Arbitrum price to experience even more volatility

Arbitrum price remains within the $1.7307 to $2.2017 range as part of a horizontal consolidation in an otherwise volatile market. The ongoing correction came as whales dumped their L2 holdings ahead of the Dencun Hard Fork scheduled for Wednesday. While this could be a potential buy the dip situation, investors should probably exercise caution as more ARB tokens are due to flood markets this week.

On March 16, the Arbitrum ecosystem will unlock 1.11 billion ARB tokens to the market, constituting 76.62% of the network’s circulating supply and worth $2.31 billion at current rates. Allocations will go to investors and even more to the team, future team, and project advisors, with the former expected to book profits for the 438.25 million ARB tokens coming their way on Saturday.

ARB unlocks

To make it even worse, after Saturday, every 16th of the month, more unlocks will happen over the next 4 years. This could lead to major price action for the ARB token.

▫️ Ethereum's scaling solution @arbitrum is set to release a massive 1.1 billion $ARB tokens from its cliff unlock next March, which could lead to major price action. According to TokenUnlocks, this could be one of the biggest unlocks in crypto history. https://t.co/YfJQnL1jTw

— Brain BoX (@brainboxintel) August 16, 2023

At the time of writing, Arbitrum price is trading for $2.0476, with a budding recovery rally. Amid growing overhead pressure, momentum is dropping, indicated by the overall trajectory falling Relative Strength Index (RSI). The Awesome Oscillator (AO) histogram bars are also flashing red as the bears align in the ARB market.

Arbitrum price could test the $1.7307 bottom of the market range before the next leg up, with a breach of this position likely to extend the losses by creating a lower low.

ARB/USDT 1-day chart

Conversely, a resurgence by the bulls could see Arbitrum price push north, shattering the $2.2017 blockade as part of a bold move north. A decisive flip of this roadblock into support could see ARB price reclaim the $2.4250 range high, levels last seen on January 11, when spot Bitcoin exchange-traded funds (ETFs) hit the market.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.