- Arbitrum network will unleash 92.65 million tokens to the market on Tuesday, worth nearly $107 million.

- ARB could dip 10% to $1.00 as investors, among other token recipients, are likely to cash in for quick gains.

- A flip of $1.73 roadblock into support would invalidate the bearish thesis.

Token unlocks are considered bearish catalysts, particularly when recipients are likely to cash in for a quick profit. The event, which adds tokens to the project’s circulating supply without increasing demand, leaves an effective imbalance in favor of supply. The Arbitrum network is among the projects lined up for cliff token unlocks this week, meaning traders must brace for volatility.

Arbitrum cliff token unlocks

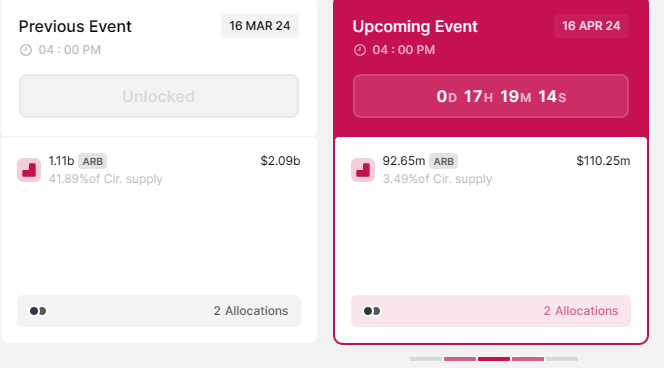

The Arbitrum network will unlock 92.65 million ARB tokens worth approximately $107 million and composing 3.49% of the network’s circulating supply. The event, slated for April 16, will see the tokens allocated to the Arbitrum team, the future team, and future advisors and investors.

ARB token unlocks schedule

The last unlocks happened on March 16, where 1.11 billion ARB tokens comprising 41.89% of the circulating supply were allocated to the team, future team and advisors, and investors. The unlock saw Arbitrum price drop by over 10%. If history repeats, the Ethereum Layer 2 (L2) token could register similar losses.

Arbitrum price outlook ahead of ARB unlocks event

Arbitrum price attempted a recovery on Sunday after bottoming out around $0.85 on Saturday. However, the recovery proved premature as the L2 token now suffers robust resistance from the north. As traders flee the market to escape being caught in exit liquidity, Arbitrum price risks further downside.

The likely play is a retest of the $1.00 psychological level, which would mark a 10% downswing. In a dire case, however, the WIF price could descend to the Saturday bottom at $0.8556. This would constitute a 25% fall below current levels.

ARB/USDT 1-day chart

On the other hand, increased buying pressure could facilitate a strong move north, sending the ARB price above the 200-day SMA at $1.45. However, for the bearish thesis to be invalidated, the price must break and close above $1.73.

A breach of the aforementioned level, which coincides with the 50-day SMA at $1.71, would encourage more buyers, sending ARB price above the forecasted target.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bulls target $100,000 BTC, $2,000 ETH, and $3 XRP

Bitcoin (BTC) is stabilizing around $95,000 at the time of writing on Wednesday, and a breakout suggests gains toward $100,000. Ethereum (ETH) and Ripple (XRP) followed BTC’s footsteps and hovered around their key levels.

Tether mints 3 billion USDT on Ethereum and TRON as markets stabilize

Tether ramps up its minting activity amid surging demand for stablecoins, often signaling heightened trading and liquidity needs. The issuer of the leading stablecoin by market capitalization has minted 2 billion USDT on Ethereum and an additional 1 billion USDT on the TRON network.

SEC delays decision on Franklin Templeton’s spot XRP ETF to June 2025

The Securities and Exchange Commission (SEC) has postponed its decision on Franklin Templeton’s spot XRP ETF, extending the review period to June 17, 2025. XRP traded at approximately $2.24 at press time, rising 7% over the past week, according to CoinGecko.

Trump Media announces new token launch and native crypto wallet in latest Shareholder letter

Trump Media unveils plans to launch a utility token and crypto wallet to monetize Truth Social and expand its streaming services. Markets react with a 10% drawdown on the Solana-hosted official TRUMP memecoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.