- Arbitrum price fall led the crypto market crash as the altcoin marked fresh all-time lows for the third time this month.

- Naturally, almost all of ARB’s 619k investors are presently underwater, with losses extending to 62% from the all-time high.

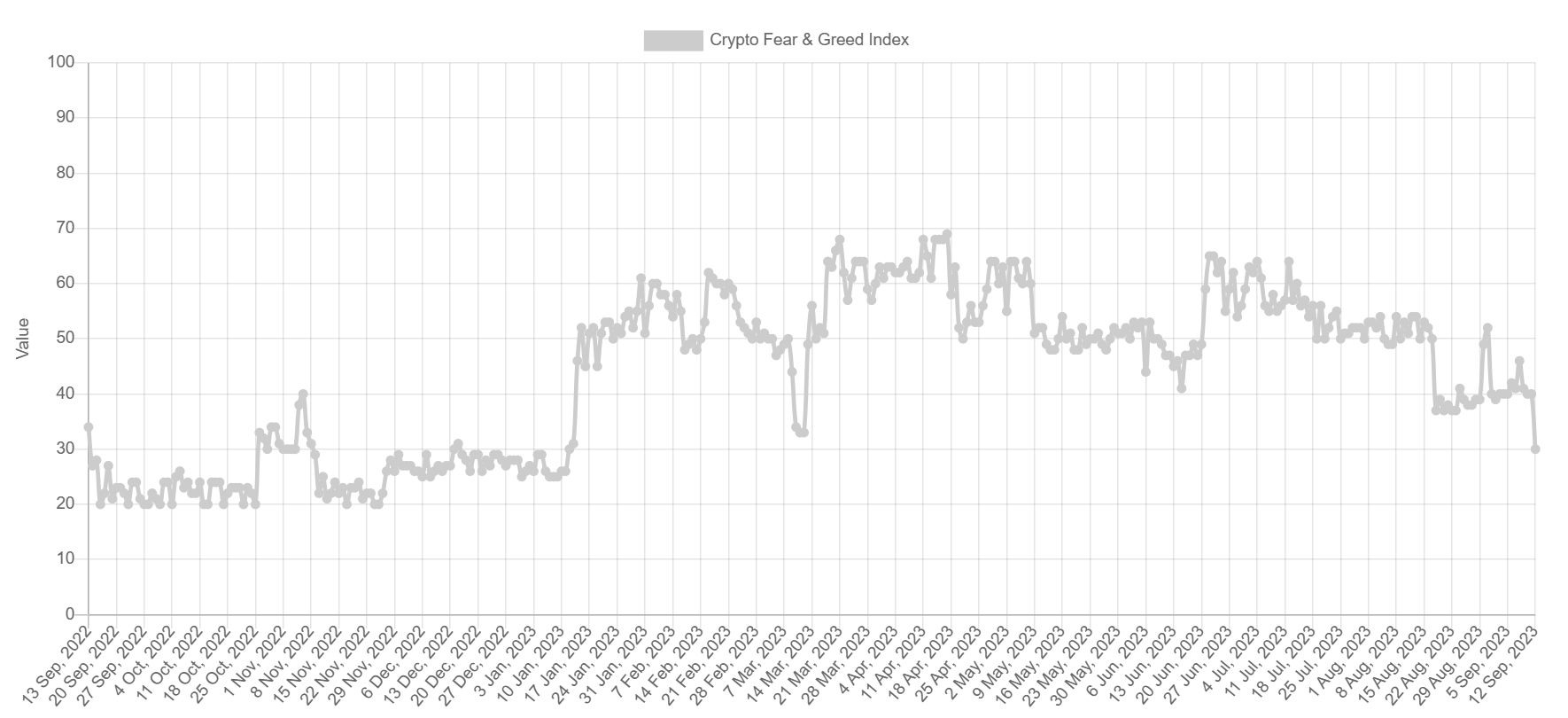

- At the time of writing, the crypto market’s fear is the most intense it has been in nearly eight months.

Arbitrum price faced the brunt of the bears as the cryptocurrency took the most damage. The resultant value of the altcoin has left its investors with severe losses that could take a while to recover.

Arbitrum price forms new lows

Arbitrum price trading at $0.76 has established fresh all-time lows, marking a new low for the third time since the beginning of this month. Falling by 10%, the altcoin became a target of the bears after whales began dumping millions of dollars worth of ARB in the past 24 hours. This included a trading company, Wintermute Trading, which deposited over 4.35 million ARB into Binance.

The recovery target for Arbitrum price now stands at reclaiming the resistance level marked at $0.94, which has been tested as support multiple times in the past three months. This is crucial in bringing the value of the altcoin back above $1.

ARB/USD 1-day chart

A recovery would also encourage ARB holders to keep their hopes of profits up, which have been certainly destroyed following the recent crash.

ARB holders' losses match price action

According to data analysis firm IntoTheBlock, almost everyone holding an amount of ARB is facing losses as the altcoin is forming all-time lows. Those who bought around the all-time high price of $1.69 are suffering the most, with a loss percentage of 62% based on unrealized losses.

Arbitrum investors at a loss

Till now, this has not driven selling in the market, nor has it caused a mass exit of investors as the total addresses with a balance remain unchanged. However, if the altcoin does not witness a recovery soon, a sell-off from investors may not take long.

As it is, the fear in the crypto market is alarmingly high. According to the Crypto Fear and Greed Index, the intensity of fear in the hearts of investors is the highest it has been in eight months since January this year, surpassing even the mid-August crash.

Crypto Fear and Greed Index

If this sentiment further intensifies, it could lead to more offloading of assets than accumulation, which generally is the sentiment of investors. People would pull away from buying at cheaper prices and instead offset their losses as much as they could by dumping their holdings.

Thus, investors looking to scoop ARB right now are advised to watch the market for further drawdown to prevent unprecedented losses.

Read more - Total Crypto market cap falls below $1 trillion as whales dump Bitcoin and Ethereum

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP Price Prediction: Bearish technicals, on-chain indicators signal 68% potential crash

XRP faces increasing bearish sentiment from macro, micro and fundamental factors in April. Weak on-chain indicators ranging from network growth, total supply and active addresses reinforce an impending crash.

Bitcoin Price Forecast: Tariff volatility sweeps over $200 billion from crypto markets

Bitcoin price hovers around $83,000 on Thursday after it failed to close above the $85,000 resistance level the previous day. Volatility fueled by Trump’s tariffs swept $200 billion from total market capitalization, liquidating over $178 million in BTC.

SOL is the winner as Solana chain turns into battleground for meme coin launchpad and DEX

Solana (SOL) gains nearly 2% in the last 24 hours and trades at 118.28 at the time of writing on Thursday. A Decentralized Exchange (DEX) and a meme coin launchpad built on the Solana blockchain have waged a war for users and compete for the trade volume on the chain.

Shibarium, built for the Shiba Inu blockchain, reaches 1 billion in transactions in 18 months after its launch

Shibarium, a Layer-2 blockchain for the Shiba Inu ecosystem, reaches 1 billion transactions 18 months after its launch. This milestone reflects growing adoption and Shibarium’s robust performance.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.