Arbitrum price could trim losses with new Offchain Labs launch, while Bitcoin traders wait and watch

- Arbitrum developers at Offchain Labs announced a dispute protocol that boosts ARB decentralization.

- Bitcoin traders are in watch-and-wait mode as the DeFi crisis unravels and Ethereum Layer 2 projects like Arbitrum continue building.

- ARB price is likely to resume its upward trend, similar to the period following the release of Orbit toolkit.

Arbitrum developers, Offchain Labs, rolled out a new dispute protocol for the Ethereum Layer 2 scaling solution. Previous releases by the developer have fueled a recovery in ARB price.

Bitcoin price sustained below the $30,000 level as BTC holders and traders watch the events in DeFi and Ethereum Layer 2 projects unfold. The Curve Finance founder continues shoring up liquidity for CRV, selling the token to influencers and DeFi leaders through OTC deals.

Also read: Shiba Inu gears up to compete with DeFi tokens, unveils plans for digital ID verification

Arbitrum decentralization gets a boost from Offchain Labs

Arbitrum protocol has $2.584 billion locked in different assets, based on data from DeFiLlama. The Ethereum Layer 2 got a boost in its decentralization with the new dispute protocol launched by Offchain Labs.

Offchain Labs announced BOLD (Bounded Liquidity Delay), a dispute protocol that can enable permissionless validation for Arbitrum chains. BOLD is expected to guarantee safety and liveness of their chain, minimize latency to settle states and prevent dishonest parties from raising the cost for honest ones.

After months in dev, we’re announcing BOLD (Bounded Liquidity Delay), a new dispute protocol that enables permissionless validation for Arbitrum chains, potentially removing the need for permissioned validation, dramatically improving decentralization. https://t.co/SHegVRGqXf

— Offchain Labs (@OffchainLabs) August 3, 2023

Offchain Labs developers have worked on the project for months, with the objective of removing the need for permissioned validation, dramatically improving decentralization.

The development could catalyze ARB price recovery as seen with previous releases by Offchain Labs.

ARB price gears up for recovery

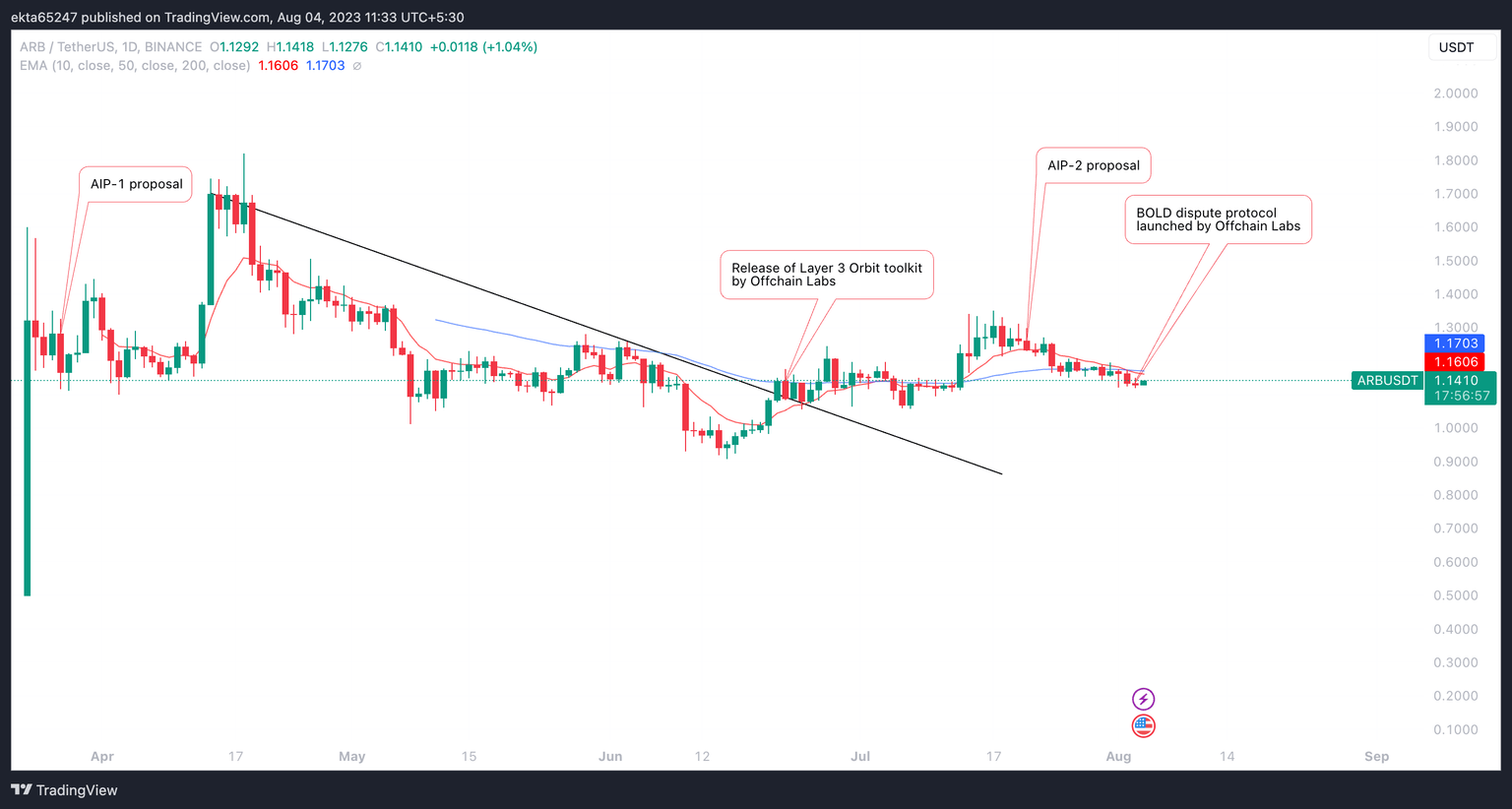

As seen in the price chart below, ARB price rallied 17.5% following the release of the Orbit toolkit for development of Layer 3 chains. A similar reaction is expected from ARB price following BOLD’s launch.

ARB/USDT price chart

Arbitrum is trading at $1.1420 on Binance at the time of writing.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.