- Arbitrum DAO approved an eight-week pilot M&A program after 99% support for the proposal.

- Key on-chain metric hints that Arbitrum is still in buy zone despite 7.5% rise.

- Arbitrum could see a rally soon following an increase in its MVRV.

Arbitrum's (ARB) on-chain metrics showed signs of a rally on Friday following news that the Arbitrum DAO approved an eight-week M&A pilot proposal on Wednesday.

Also read: Arbitrum price sets the stage for 30% recovery rally

Arbitrum approves M&A proposal

The Arbitrum DAO showed massive support for the eight-week M&A pilot phase proposal, with over 99% of DAO members voting for it.

According to the proposal, the eight-week M&A pilot would focus on in-depth data-driven research and discussion to provide Arbitrum's DAO with robust information on whether to approve or deny "further operationalization of the M&A unit and its funding requirements."

"The overarching aim is to utilize M&A as a key growth driver for the Arbitrum ecosystem and to help the DAO expand non-organically through acquisition opportunities that are not accessible to competing ecosystems, thereby critically enhancing Arbitrum DAO's capital allocation methods," stated the proposal.

The M&A move from Arbitrum DAO follows the recent approval from the individual communities of AI tokens FET, OCEAN, and AGIX to merge as one with a new token, ASI.

Read more: Injective to launch Layer 3 chain on Arbitrum, INJ falls 4%

ARB's on-chain metrics show signs of potential rally

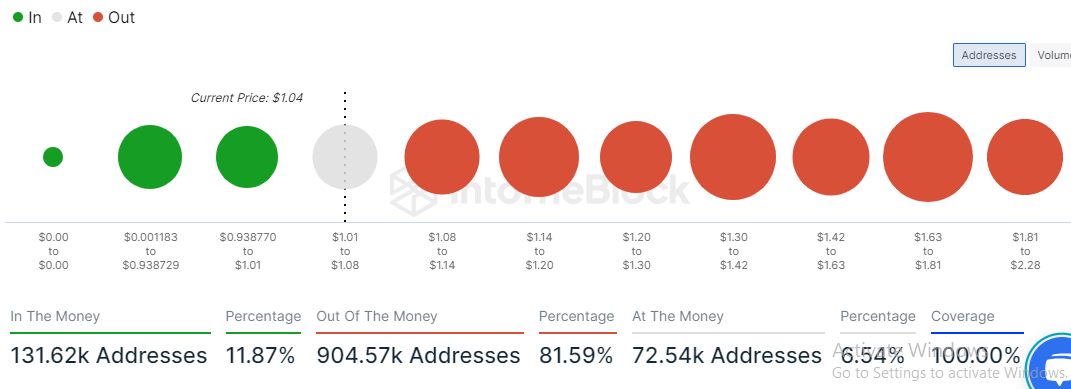

ARB posted an impressive 7.5% gain on Friday, following a generally positive outlook across the crypto market. However, despite the recent gain, data from IntoTheBlock shows that 79.6% of ARB addresses are still out-of-the-money, with only 20.11% -in-the-money and 0.29% at-the-money.

A high percentage of in-the-money addresses signifies potential profit-taking from investors, and vice versa for out-of-the-money addresses.

Global In/Out of the Money

As a result, ARB investors are likely to hold onto their assets in anticipation of a tangible price appreciation that would see them being in the money.

A further look into other metrics shows addresses holding 55% of ARB's circulating supply are out of the money. This may be because of the 1.1 billion ARB — 41% of its current circulating supply — token unlock on March 16. The unlock largely affected ARB's price growth, correlating with a steep decline that saw ARB drop 103% within two months from $1.83 to $0.93 on May 15.

Also read: Arbitrum price dips post massive token unlock, mass sell-off drives ARB decline

While prices have slightly recovered to $1.03, these metrics show ARB is still in the buy zone for investors looking to open a position in the Ethereum Layer 2 altcoin. However, investors should exercise caution, considering whales hold about 45% of the token's total supply.

There has also been equal activity from bulls and bears in the past seven days, with 146 bulls and 146 bears indicating uncertainty. However, recent price movement tilts toward the direction of bulls, indicating signs of a potential rally.

ARB's market value to realize value (MVRV) ratio also confirms the rally signs with a 6.54% growth in the past 24 hours. A bearish change in the general crypto market sentiment would invalidate this thesis.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Monero Price Forecast: XMR soars over 19% amid rising demand for privacy coins

Monero (XMR) price is extending its gains by 19% at the time of writing on Monday, following a 9.33% rally the previous week. On-chain metrics support this price surge, with XMR’s open interest reaching its highest level since December 20.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC and ETH stabilize while XRP shows strength

Bitcoin (BTC) and Ethereum (ETH) prices are stabilizing at around $93,500 and $1,770 at the time of writing on Monday, following a rally of over 10% and 12% the previous week. Ripple (XRP) price also rallied 8.3% and closed above its key resistance level last week, indicating an uptrend ahead.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.