Arbitrum airdrop flops, but ARB still makes it to a commendable all-time high. Here’s what happened

- Users could not claim ARB tokens for the first hour after the airdrop launch.

- Twitter users criticized Arbitrum for not performing a stress test.

- ARB still managed to hit almost double-digit gains once normalcy was restored.

The token launch for Arbitrum was quite bumpy, to say the least after users could not claim their airdrop tokens for the first one hour post-launch. The turn of events was very disappointing, given that users had been waiting for a week for the highly-advertised ARB airdrop.

Arbitrum off to a rough start

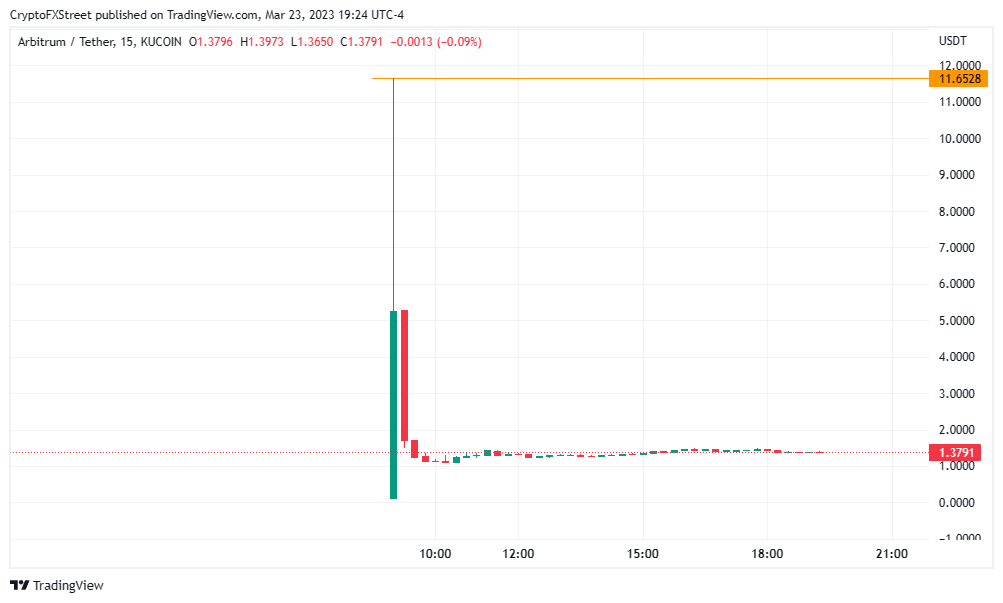

To begin with, when claiming commenced, the Arbitrum Foundation website crashed and remained offline for at least an hour. Upon return, most users could not claim their tokens citing high gas fees. Some users still managed to claim it through alternative methods like Arbiscan. During the first two hours, the market witnessed a massive sell-off of the token, with its price declining from over $10.29 to lows of $1 on the Kucoin exchange.

At Kucoin, the token recorded an intra-day high of $11.65 but dropped to $1.50 within minutes. At the time of writing, the token was trading at $1.37.

Only one address successfully sold ARB at $10.29 through the ARB/USDC pool on Uniswap. This address bagged $64,340 for 6,250 tokens. Several others were able to sell for $4.50 before Arbitrum price plummeted below $1.50 at record speed. This happened as more sellers flocked to the scene.

As a result, Arbitrum users were frustrated beyond words, indicated by the extremity of criticism and backlash that community members have given to the network.

Man I love Arbitrum...

But this has been an embarrassingly bad experience, how can you launch the most hyped airdrop Crypto has had an not be prepared for the traffic??? pic.twitter.com/l7bfAVScsJ

— Q (@0xFlips) March 23, 2023

While different users cited different challenges, one particular concern stood out involving users getting their tokens but not being able to move them.

got my tokens, cant move my tokens

F+

— Jebus.eth (@jebus911) March 23, 2023

As a result, some users gave it an ‘F’ grade for the epic fail, and other community members offered possible solutions to what the network needed for a seamless user experience. Another group claimed it was a strategic move by Arbitrum to heighten gas fees so that they could add a priority fee.

arbitrum getting an F+ on its first stress test

— Jebus.eth (@jebus911) March 23, 2023

Overall, the situation was embarrassingly bad, given Arbitrum launched the most hyped airdrop the crypto industry has seen in a long time but came out as unprepared for the traffic, which most call a ‘stress test.’

Arbitrum acknowledges the problem as ARB records a notable ATH

Notably, airdrops in the crypto sector are crucial to decentralizing the concerned network and rewarding early users for participating. After acknowledging the reason why its debut was a flop, Arbitrum issued an apology on Twitter. Based on the announcement, the network acknowledged the problem but it did not reveal the root cause..

We understand there has been difficulty connecting to the foundation site and claiming tokens.

These issues are now resolved, and claiming is well underway.

We greatly appreciate everyone's patience throughout these times of exceptionally high traffic.

Please read pic.twitter.com/pdIyI2bumW

— Arbitrum (,) (@arbitrum) March 23, 2023

Speculation about what the value of ARB would be upon launch had been rearing several days before the main event, with some saying the token could hit $6. Better still, others hoped it would explode to $10 and qualify as the most valuable blockchain in the world.

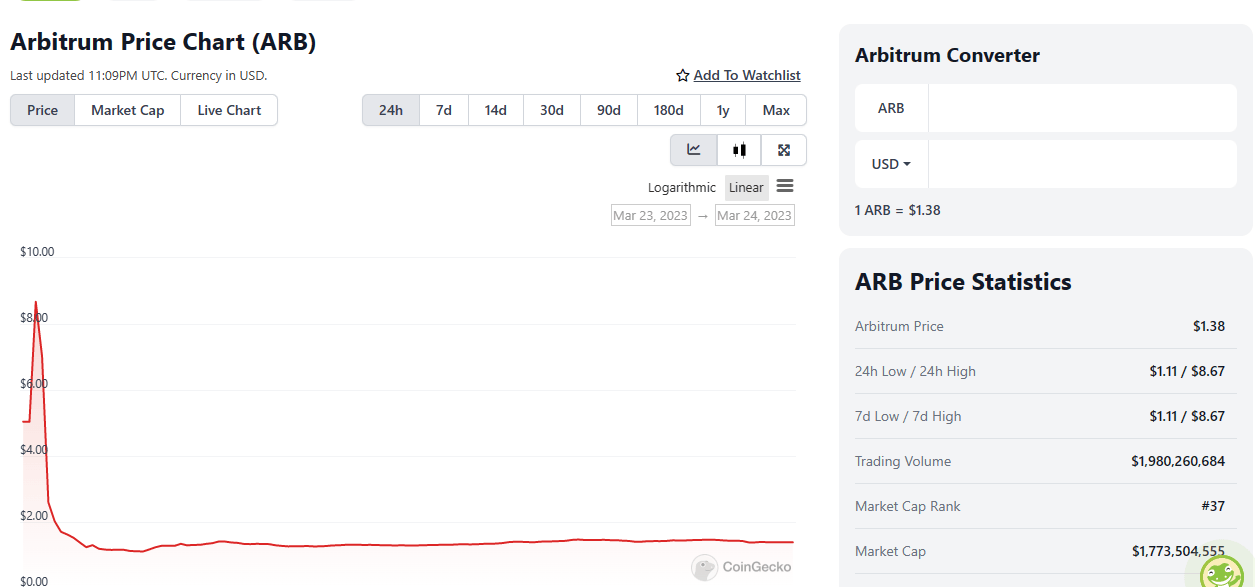

Close enough! According to Coingecko, the ARB token managed to record an all-time high (ATH) of $8.67, which was 33% higher than had been predicted.

Nevertheless, as was expected, it took barely an hour before the highly-advertised Layer 2 (L2) token dropped to the $1-$2 price range. At the time of writing, ARB is auctioning for $1.43 with indications of volatility as it went down as low as $1.11 in one instance.

Source: Coingecko

Notably, 63% of ARB has already been claimed, and if the remaining tokens are claimed and sold, the Arbitrum price could plunge further. This should be expected, given that eligible token holders will now flock to the website to claim their ARB as network traffic continues to subside.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.