- Aptos holders gear up for 4.5 million APT token unlock scheduled on Wednesday.

- APT holders are likely front-running the event and it could turn out to be a sell-the-news for the asset following 7% gains overnight.

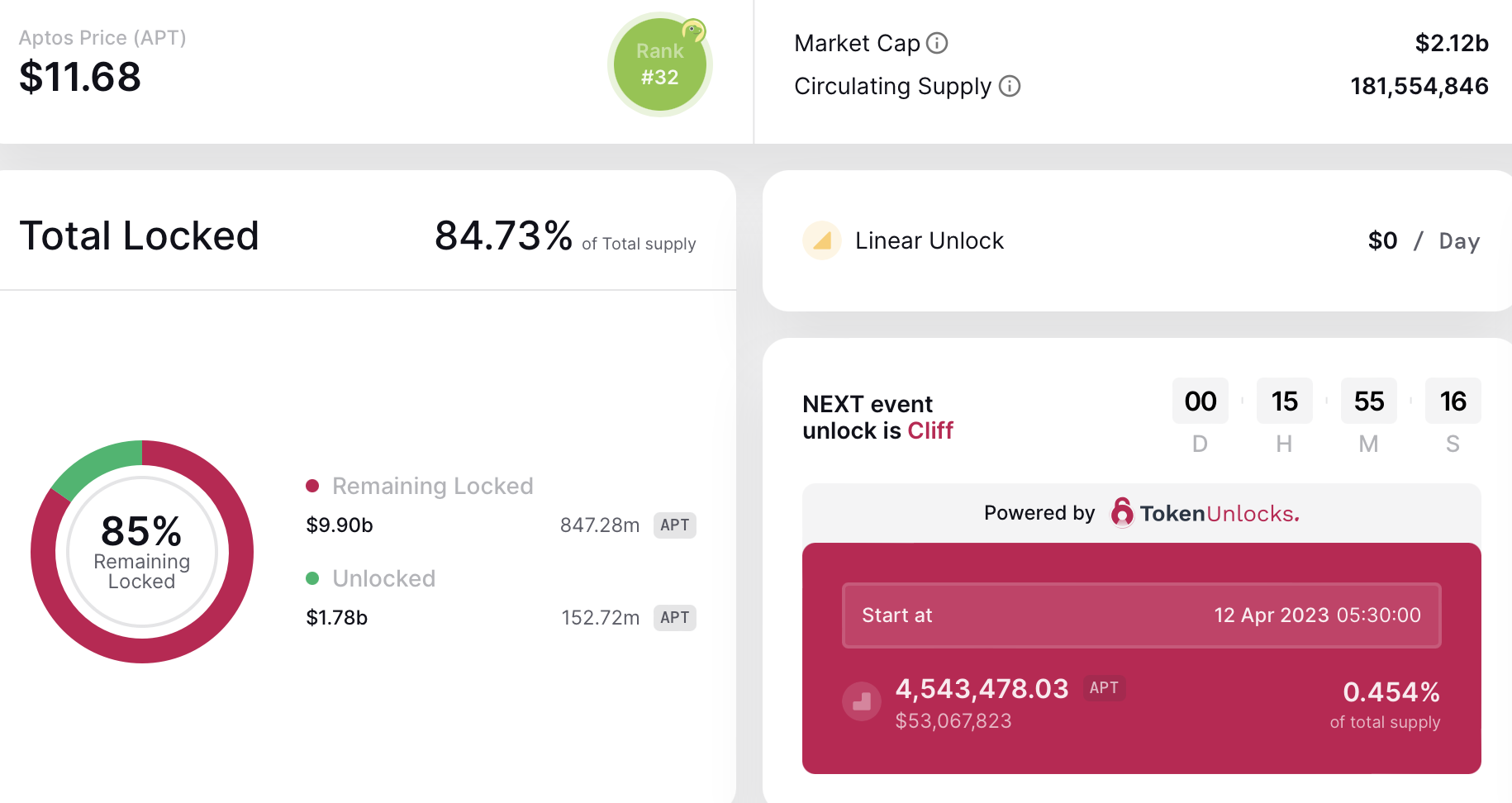

- The token unlock will introduce APT tokens upward of $53 million to the circulating supply of the asset.

Aptos, a web3 blockchain yielded 7% gains for holders overnight. APT holders are likely preparing for the unlock of $53 million worth of the token on Wednesday. The APT token unlock could increase selling pressure and the ongoing price rally implies holders are front-running the event.

Also read: Ethereum holders brace for selling pressure on Ethereum after run up to $1,900

Aptos token unlock slated to occur on Wednesday

Aptos holders brace for impact ahead of 4,543,478 APT token unlock worth upwards of $53 million. The unlock is scheduled for Wednesday, April 12. A token unlock is typically a bearish event for the asset.

APT price yielded nearly 7% overnight gains for holders, ahead of the scheduled token unlock. This makes it likely that APT has “set a trap” for bulls and the unlock of nearly 0.45% of the total supply of the web3 token might increase the selling pressure and result in a correction.

APT holders can therefore expect a correction in Aptos price post the token unlock and the current rally is likely traders front-running the event.

APT scheduled token unlock

The unlocked APT tokens will be distributed to the community and the foundation. The community will receive 3,210,145 APT tokens, nearly 0.32% of the total supply and the foundation will receive 1,333,333 APT, 0.13%.

Where is APT price headed

APT price is in a multi-month downtrend and in descending parallel channel as noted in the APT/USDT four-hour price chart below. The descending channel pattern is considered bullish only when price penetrates the upper trendline.

APT price is therefore at a critical point, testing the upper trendline of the channel at $11.73 as resistance.

APT/USDT 4h price chart

If APT continues its climb, the next resistance is at 23.6% Fibonacci Retracement at $12.25. However, with the upcoming token unlock, selling pressure is expected to increase and APT price could nosedive to support at $10.63. The $10.63 level has acted as support for Aptos, barring mid-March when APT witnessed a correction below this level.

The Relative Strength Index (RSI), a momentum indicator reveals a bullish divergence on the four-hour price chart, but is likely that the divergence has played out and the token unlock negatively influences APT price.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Polygon joins forces with WSPN to expand stablecoin adoption

WSPN, a stablecoin infrastructure company based in Singapore, has teamed up with Polygon Labs to make its stablecoin, WUSD, more useful in payment and decentralized finance.

Coinbase envisages listing of more meme coins amid regulatory optimism

Donald Trump's expected return to the White House creates excitement in the cryptocurrency sector, especially at Coinbase, the largest US-based crypto exchange. The platform is optimistic that the new administration will focus on regulatory clarity, which could lead to more token listings, including popular meme coins.

Cardano's ADA leaps to 2.5-year high of 90 cents as whale holdings exceed $12B

As Bitcoin (BTC) gets closer to the $100,000 mark for the first time — it crossed $99,000 earlier Friday — capital is rotating into alternative cryptocurrencies, creating a buzz in the broader crypto market.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: Rally expected to continue as BTC nears $100K

Bitcoin (BTC) reached a new all-time high of $99,419, just inches away from the $100K milestone and has rallied over 9% so far this week. This bullish momentum was supported by the rising Bitcoin spot Exchange Traded Funds (ETF), which accounted for over $2.8 billion inflow until Thursday. BlackRock and Grayscale’s recent launch of the Bitcoin ETF options also fueled the rally this week.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.